Berkshire Hathaway 2001 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.17

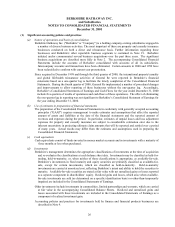

Charitable Contributions

Berkshire follows a highly unusual policy in respect to charitable contributions but its one that Charlie

and I believe is both rational and fair to owners.

First, we let our operating subsidiaries make their own charitable decisions, requesting only that the

owners/managers who once ran these as independent companies make all donations to their personal charities from

their own funds, instead of using company money. When our managers are using company funds, we trust them to

make gifts in a manner that delivers commensurate tangible or intangible benefits to the operations they manage.

Last year contributions from Berkshire subsidiaries totaled $19.2 million.

At the parent company level, we make no contributions except those designated by shareholders. We do

not match contributions made by directors or employees, nor do we give to the favorite charities of the Buffetts or

the Mungers. However, prior to our purchasing them, a few of our subsidiaries had employee-match programs and

we feel fine about their continuing them: Its not our style to tamper with successful business cultures.

To implement our owners’ charitable desires, each year we notify registered holders of A shares (As

represent 86.6% of our equity capital) of a per-share amount that they can instruct us to contribute to as many as

three charities. Shareholders name the charity; Berkshire writes the check. Any organization that qualifies under

the Internal Revenue Code can be designated by shareholders. Last year Berkshire made contributions of $16.7

million at the direction of 5,700 shareholders, who named 3,550 charities as recipients. Since we started this

program, our shareholders gifts have totaled $181 million.

Most public corporations eschew gifts to religious institutions. These, however, are favorite charities of

our shareholders, who last year named 437 churches and synagogues to receive gifts. Additionally, 790 schools

were recipients. A few of our larger shareholders, including Charlie and me, designate their personal foundations to

get gifts, so that those entities can, in turn, disburse their funds widely.

I get a few letters every week criticizing Berkshire for contributing to Planned Parenthood. These letters

are usually prompted by an organization that wishes to see boycotts of Berkshire products. The letters are

invariably polite and sincere, but their writers are unaware of a key point: Its not Berkshire, but rather its owners

who are making charitable decisions and these owners are about as diverse in their opinions as you can imagine.

For example, they are probably on both sides of the abortion issue in roughly the same proportion as the American

population. Well follow their instructions, whether they designate Planned Parenthood or Metro Right to Life, just

as long as the charity possesses 501(c)(3) status. Its as if we paid a dividend, which the shareholder then donated.

Our form of disbursement, however, is more tax-efficient.

In neither the purchase of goods nor the hiring of personnel, do we ever consider the religious views, the

gender, the race or the sexual orientation of the persons we are dealing with. It would not only be wrong to do so, it

would be idiotic. We need all of the talent we can find, and we have learned that able and trustworthy managers,

employees and suppliers come from a very wide spectrum of humanity.

* * * * * * * * * * *

To participate in our future charitable contribution programs, you must own Class A shares that are

registered in the name of the actual owner, not the nominee name of a broker, bank or depository. Shares not so

registered on August 31, 2002 will be ineligible for the 2002 program. When you get the contributions form from

us, return it promptly. Designations received after the due date will not be honored.