Berkshire Hathaway 2000 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

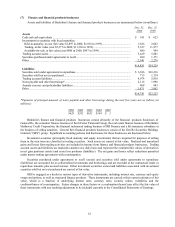

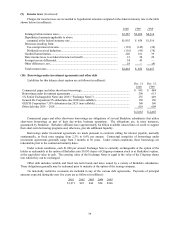

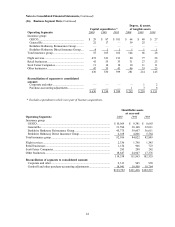

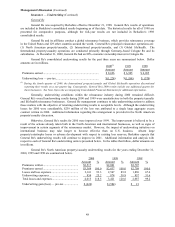

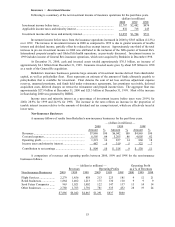

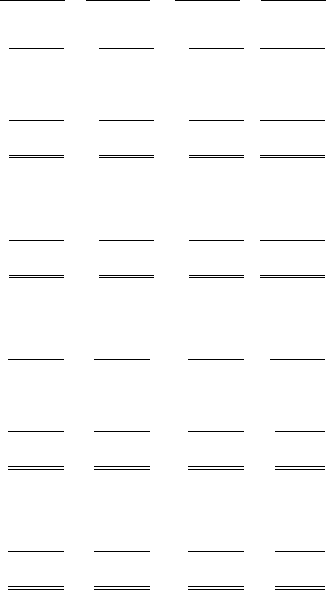

(17) Quarterly data

A summary of revenues and earnings by quarter for each of the last two years is presented in the following

table. This information is unaudited. Dollars are in millions, except per share amounts.

1st 2nd 3rd 4th

2000 Quarter Quarter Quarter Quarter

Revenues ........................................................................................... $6,474 $6,553 $8,426 $12,523

Earnings:

Excluding realized investment gain.................................................. $ 354 $ 245 $ 301 $ 36

Realized investment gain * .............................................................. 453 395 496 1,048

Net earnings.................................................................................... $ 807 $ 640 $ 797 $ 1,084

Earnings per equivalent Class A common share:

Excluding realized investment gain.................................................. $ 233 $ 161 $ 197 $ 23

Realized investment gain * .............................................................. 298 260 326 687

Net earnings.................................................................................... $ 531 $ 421 $ 523 $ 710

1999

Revenues............................................................................................ $5,446 $5,461 $7,051 $6,070

Earnings:

Excluding realized investment gain .................................................. $ 294 $ 299 $ 156 $ (78)

Realized investment gain *............................................................... 247 273 264 102

Net earnings .................................................................................... $ 541 $ 572 $ 420 $ 24

Earnings per equivalent Class A common share:

Excluding realized investment gain .................................................. $ 194 $ 197 $ 103 $ (52)

Realized investment gain *............................................................... 162 179 173 69

Net earnings .................................................................................... $ 356 $ 376 $ 276 $ 17

*The amount of realized gain for any given period has no predictive value and variations in amount from period

to period have no practical analytical value particularly in view of the unrealized appreciation now existing in

Berkshire’s consolidated investment portfolio.

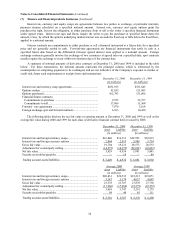

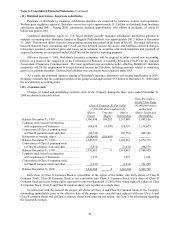

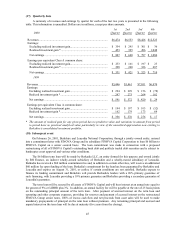

(18) Subsequent event

On February 26, 2001, Berkshire and Leucadia National Corporation, through a jointly owned entity, entered

into a commitment letter with FINOVA Group and its subsidiary FINOVA Capital Corporation to loan $6 billion to

FINOVA Capital on a senior secured basis. The loan commitment was made in connection with a proposed

restructuring of all of FINOVA Capital’s outstanding bank debt and publicly traded debt securities and is subject to

bankruptcy court approval and various other conditions.

The $6 billion term loan will be made by Berkadia LLC, an entity formed for this purpose and owned jointly

by BH Finance, an indirect wholly-owned subsidiary of Berkshire and a wholly-owned subsidiary of Leucadia.

Berkadia has received a $60 million commitment fee and, in addition to certain other fees, will receive an additional

$60 million fee upon funding of the loan. Berkadia’s commitment for the loan has been guaranteed by Berkshire and

Leucadia and expires on August 31, 2001, or earlier, if certain conditions are not satisfied. Berkadia expects to

finance its funding commitment and Berkshire will provide Berkadia’s lenders with a 90% primary guarantee of

such financing, with Leucadia providing a 10% primary guarantee and Berkshire providing a secondary guarantee of

Leucadia’s guarantee.

The term loan will be secured by all assets of FINOVA Capital and will bear interest at an annual rate equal to

the greater of 9% or LIBOR plus 3%. In addition, an annual facility fee will be payable at the rate of 25 basis points

on the outstanding principal amount of the term loan. After payment of accrued interest on the term loan and

operating and other corporate expenses, providing for reserves and payment of accrued interest on the restructured

FINOVA Group senior notes, 100% of excess cash flow and net proceeds from asset sales will be used to make

mandatory prepayments of principal on the term loan without premium. Any remaining principal and accrued and

unpaid interest on the term loan will be due at maturity (five years from the closing).