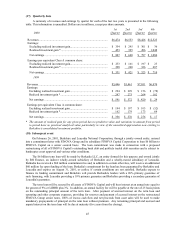

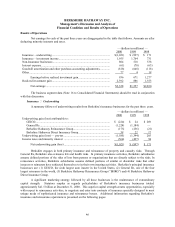

Berkshire Hathaway 2000 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

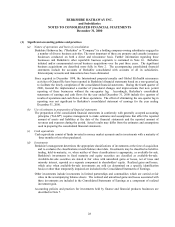

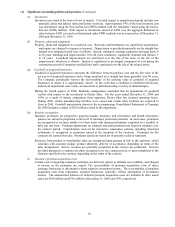

Notes to Consolidated Financial Statements (Continued)

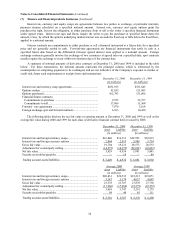

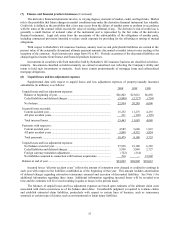

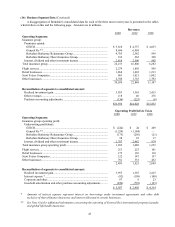

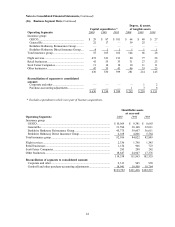

(7) Finance and financial products businesses (Continued)

Interest rate, currency and equity swaps are agreements between two parties to exchange, at particular intervals,

payment streams calculated on a specified notional amount. Interest rate, currency and equity options grant the

purchaser the right, but not the obligation, to either purchase from or sell to the writer a specified financial instrument

under agreed terms. Interest rate caps and floors require the writer to pay the purchaser at specified future dates the

amount, if any, by which the option’s underlying market interest rate exceeds the fixed cap or falls below the fixed floor,

applied to a notional amount.

Futures contracts are commitments to either purchase or sell a financial instrument at a future date for a specified

price and are generally settled in cash. Forward-rate agreements are financial instruments that settle in cash at a

specified future date based on the differential between agreed interest rates applied to a notional amount. Foreign

exchange contracts generally involve the exchange of two currencies at agreed rates on a specified date; spot contracts

usually require the exchange to occur within two business days of the contract date.

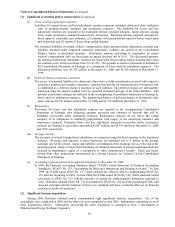

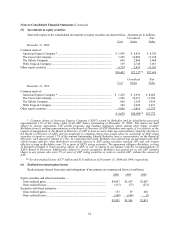

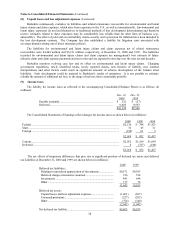

A summary of notional amounts of derivative contracts at December 31, 2000 and 1999 is included in the table

below. For these transactions, the notional amount represents the principal volume, which is referenced by the

counterparties in computing payments to be exchanged, and are not indicative of the Company’s exposure to market or

credit risk, future cash requirements or receipts from such transactions.

December 31, 2000 December 31, 1999

(in millions) (in millions)

Interest rate and currency swap agreements ................................... $651,913 $531,645

Options written ............................................................................ 91,655 121,683

Options purchased........................................................................ 102,743 151,006

Financial futures contracts:

Commitments to purchase.......................................................... 9,535 32,377

Commitments to sell.................................................................. 17,069 11,368

Forward - rate agreements ............................................................ 7,070 5,164

Foreign exchange spot and forward contracts ................................ 6,163 10,430

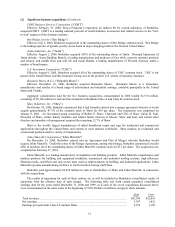

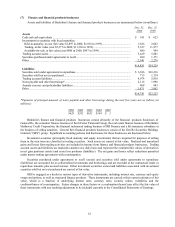

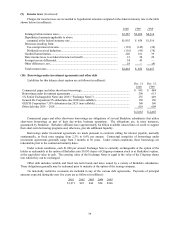

The following tables disclose the net fair value or carrying amount at December 31, 2000 and 1999 as well as the

average fair value during 2000 and 1999 for each class of derivative financial contract held or issued by GRS.

December 31, 2000 December 31, 1999

Asset Liability Asset Liability

(in millions) (in millions)

Interest rate and foreign currency swaps........................................ $16,840 $16,312 $22,593 $22,819

Interest rate and foreign currency options...................................... 2,864 2,919 5,980 5,714

Gross fair value............................................................................ 19,704 19,231 28,573 28,533

Adjustment for counterparty netting.............................................. (14,275)(14,275)(22,692)(22,692)

Net fair value ............................................................................... 5,429 4,956 5,881 5,841

Security receivables/payables ....................................................... — 18 — 89

Trading account assets/liabilities................................................... $ 5,429 $ 4,974 $ 5,881 $ 5,930

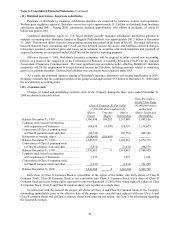

Average 2000 Average 1999

Asset Liability Asset Liability

(in millions) (in millions)

Interest rate and foreign currency swaps........................................ $20,431 $20,533 $23,213 $23,071

Interest rate and foreign currency options...................................... 3,147 3,174 4,657 4,687

Gross fair value............................................................................ 23,578 23,707 27,870 27,758

Adjustment for counterparty netting.............................................. (17,960)(17,960)(22,579)(22,579)

Net fair value ............................................................................... 5,618 5,747 5,291 5,179

Security receivables/payables ....................................................... 98 40 85 111

Trading account assets/liabilities................................................... $ 5,716 $ 5,787 $ 5,376 $ 5,290