Berkshire Hathaway 2000 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

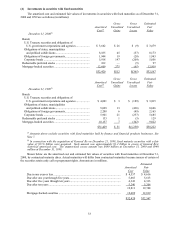

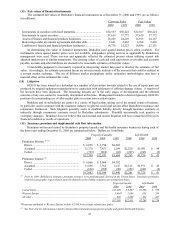

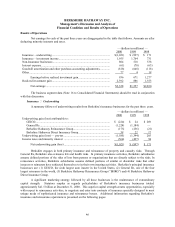

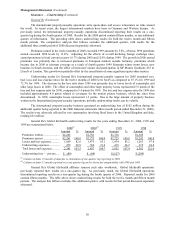

(16) Business Segment Data (Continued)

A disaggregation of Berkshire’s consolidated data for each of the three most recent years is presented in the tables

which follow on this and the following page. Amounts are in millions.

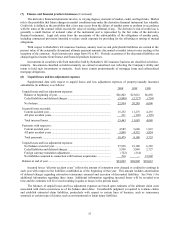

Revenues

2000 1999 1998

Operating Segments:

Insurance group:

Premiums earned:

GEICO................................................................................................ $ 5,610 $ 4,757 $ 4,033

General Re **...................................................................................... 8,696 6,905 —

Berkshire Hathaway Reinsurance Group .............................................. 4,705 2,382 939

Berkshire Hathaway Direct Insurance Group........................................ 332 262 328

Interest, dividend and other investment income....................................... 2,810 2,500 982

Total insurance group................................................................................ 22,153 16,806 6,282

Flight services........................................................................................... 2,279 1,856 858

Retail businesses ....................................................................................... 1,864 1,402 1,213

Scott Fetzer Companies............................................................................. 963 1,021 1,002

Other businesses ....................................................................................... 2,780 1,763 1,792

30,039 22,848 11,147

Reconciliation of segments to consolidated amount:

Realized investment gain........................................................................ 3,955 1,365 2,415

Other revenues ....................................................................................... 118 40 276

Purchase-accounting adjustments............................................................ (136) (225) (6)

$33,976 $24,028 $13,832

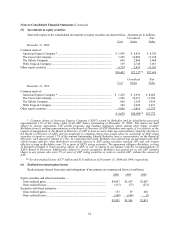

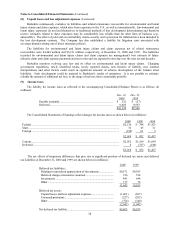

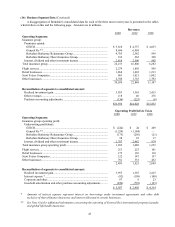

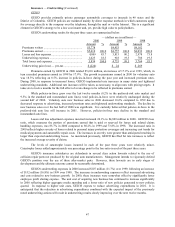

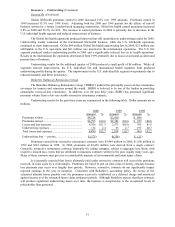

Operating Profit before Taxes

2000 1999 1998

Operating Segments:

Insurance group operating profit:

Underwriting profit(loss):

GEICO................................................................................................ $ (224) $ 24 $ 269

General Re **...................................................................................... (1,224) (1,184) —

Berkshire Hathaway Reinsurance Group .............................................. (175) (256) (21)

Berkshire Hathaway Direct Insurance Group........................................ 38 22 17

Interest, dividend and other investment income....................................... 2,787 2,482 974

Total insurance group operating profit ....................................................... 1,202 1,088 1,239

Flight services........................................................................................... 213 225 181

Retail businesses ....................................................................................... 175 130 110

Scott Fetzer Companies............................................................................. 122 147 137

Other businesses ....................................................................................... 781 335 432

2,493 1,925 2,099

Reconciliation of segments to consolidated amount:

Realized investment gain........................................................................ 3,955 1,365 2,415

Interest expense *................................................................................... (92) (109) (100)

Corporate and other................................................................................ 87 8 23

Goodwill amortization and other purchase-accounting adjustments ......... (856) (739) (123)

$ 5,587 $ 2,450 $ 4,314

*Amounts of interest expense represent interest on borrowings under investment agreements and other debt

exclusive of that of finance businesses and interest allocated to certain businesses.

** See Note 1(a) for additional information concerning the reporting of General Re’s international property/casualty

and global life/health businesses.