Berkshire Hathaway 2000 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.29

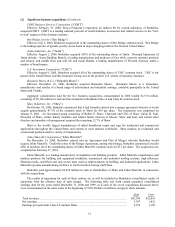

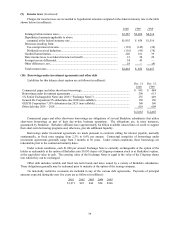

(1) Significant accounting policies and practices (Continued)

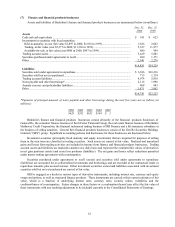

(e) Inventories

Inventories are stated at the lower of cost or market. Cost with respect to manufactured goods includes raw

materials, direct and indirect labor and factory overhead. Approximately 54% of the total inventory cost

was determined using the first-in-first-out (FIFO) method with the remainder valued using the last-in-

first-out (LIFO) method. With respect to inventories carried at LIFO cost, the aggregate difference in

value between LIFO cost and cost determined under FIFO methods was not material as of December 31,

2000 and December 31, 1999.

(f) Property, plant and equipment

Property, plant and equipment is recorded at cost. Renewals and betterments are capitalized; maintenance

and repairs are charged to expense as incurred. Depreciation is provided principally on the straight-line

method over estimated useful lives as follows: aircraft, simulators, training equipment and spare parts, 4

to 20 years; buildings and improvements, 10 to 40 years; machinery, equipment, furniture and fixtures, 3

to 10 years. Leasehold improvements are amortized over the life of the lease or the life of the

improvement, whichever is shorter. Interest is capitalized as an integral component of cost during the

construction period of simulators and facilities and is amortized over the life of the related assets.

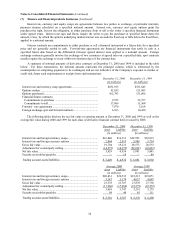

(g) Goodwill of acquired businesses

Goodwill of acquired businesses represents the difference between purchase cost and the fair value of the

net assets of acquired businesses and is being amortized on a straight line basis generally over 40 years.

The Company periodically reviews the recoverability of the carrying value of goodwill of acquired

businesses to ensure it is appropriately valued. In the event that a condition is identified which may

indicate an impairment issue exists, an assessment is performed using a variety of methodologies.

During the fourth quarter of 2000, Berkshire management concluded that an impairment of goodwill

existed with respect to the investment in Dexter Shoe. For the years ended December 31, 2000 and

1999, as a result of intense competition from importers, Dexter Shoe has incurred operating losses.

During 2000, certain manufacturing facilities were closed and certain other facilities are expected to

close in 2001. Goodwill amortization shown in the accompanying Consolidated Statements of Earnings

for 2000 includes a charge of $219 million related to the impairment.

(h) Revenue recognition

Insurance premiums for prospective property/casualty insurance and reinsurance and health reinsurance

policies are earned in proportion to the level of insurance protection provided. In most cases, premiums

are recognized as revenues ratably over their terms with unearned premiums computed on a monthly or

daily pro rata basis. Premium adjustments on contracts and audit premiums are based on estimates over

the contract period. Consideration received for retroactive reinsurance policies, including structured

settlements, is recognized as premiums earned at the inception of the contracts. Premiums for life

contracts are earned when due. Premiums earned are stated net of amounts ceded to reinsurers.

Revenues from product or merchandise sales are recognized upon passage of title to the customer, which

coincides with customer pickup, product shipment, delivery or acceptance, depending on terms of the

sales arrangement. Service revenues are generally recognized as the services are performed. Services

provided pursuant to a contract are either recognized over the contract period, or upon completion of the

elements specified in the contract, depending on the terms of the contract.

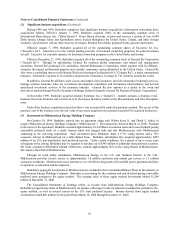

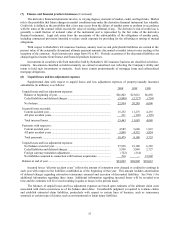

(i) Insurance premium acquisition costs

Certain costs of acquiring insurance premiums are deferred, subject to ultimate recoverability, and charged

to income as the premiums are earned. The recoverability of premium acquisition costs of direct

insurance businesses is determined without regard to investment income. The recoverability of premium

acquisition costs from reinsurance assumed businesses, generally, reflects anticipation of investment

income. The unamortized balances of deferred premium acquisition costs are included in other assets

and were $916 million and $791 million at December 31, 2000 and 1999, respectively.