Barnes and Noble 2012 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2012 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Barnes & Noble’s strategy is to:

• continue to invest in the digital business to fuel NOOK

and content sales;

• use its infrastructure to deliver digital content to cus-

tomers wirelessly and online;

• utilize the strong Barnes & Noble brand and retail foot-

print to attract customers to its multi-channel platform;

and

• expand its distribution channels through strategic

partnerships with world-class hardware and software

companies and retail partners.

The Company has a multi-channel marketing strategy that

deploys various merchandising programs and promotional

activities to drive traffi c to both its stores and website.

At the center of this program is the Company’s website,

barnesandnoble.com.

On April , , the Company entered into an investment

agreement among the Company, Morrison Investment

Holdings, Inc. (Morrison), and Microsoft Corporation

(Microsoft) pursuant to which the Company will form a

Delaware limited liability company (NewCo), and transfer

to NewCo the Company’s digital device, digital content

and college bookstore businesses and NewCo will sell to

Morrison, and Morrison will purchase, million con-

vertible preferred membership interests in NewCo for an

aggregate purchase price of . million. Concurrently

with its entry into this agreement, the Company has also

entered into a commercial agreement with Microsoft,

pursuant to which, among other things, NewCo will develop

and distribute a Windows application for e-reading and

digital content purchases, and an intellectual property

license and settlement agreement with Microsoft and

Microsoft Licensing GP.

As part of the partnership with Microsoft described above,

the Company, through NewCo, plans to launch the NOOK

digital bookstore in countries within months, putting

NOOK.com websites onto the screens of tens of millions

of Windows users. Once the NOOK digital bookstore is

launched, customers in these countries will have access to

one of the world’s largest marketplaces of digital copy-

right content and reading technologies, enabling them to

buy and consume books, magazines and other forms of

content on the world’s best mobile platforms, including

Windows™, IOS™, and Android™. The Company is also

exploring opportunities to give consumers outside of the

U.S. access to its award-winning NOOK portfolio of reading

products through potential distribution partnerships yet

to be announced. While there can be no assurances, the

Company intends to have one or more distribution agree-

ments in place to sell NOOK™ devices in certain countries

outside the U.S. prior to the holiday season.

On August , , the Company entered into an invest-

ment agreement between the Company and Liberty GIC,

Inc. (Liberty) pursuant to which the Company issued and

sold to Liberty, and Liberty purchased, , shares of

the Company’s Series J Preferred Stock, par value .

per share (Preferred Stock), for an aggregate purchase

price of . million in a private placement exempt

from the registration requirements of the Act. The

shares of Preferred Stock will be convertible, at the option

of the holders, into shares of Common Stock representing

. of the Common Stock outstanding as of August ,

, (after giving pro forma eff ect to the issuance of the

Preferred Stock), based on the initial conversion rate. The

initial conversion rate refl ects an initial conversion price

of . and is subject to adjustment in certain circum-

stances. The initial dividend rate for the Preferred Stock is

equal to . per annum of the initial liquidation prefer-

ence of the Preferred Stock to be paid quarterly and subject

to adjustment in certain circumstances.

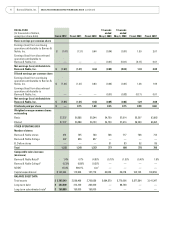

SEGMENTS

Prior to year-end, the Company reported an operating

segment titled B&N.com, which included both the NOOK

digital business and eCommerce operations. Due to the

increased focus on the digital business and the Company’s

recently developed ability to review the digital business

separate from its eCommerce business, the Company

performed an evaluation on the eff ect of its impact on

the identifi cation of operating segments. The assessment

considered the way the business is managed (focusing on

the fi nancial information distributed) and the manner in

which the chief operating decision maker interacts with

other members of management. As a result of this assess-

ment, during the fourth quarter of fi scal the Company

has determined that the segment previously referred to

B&N.com is no longer applicable and has created a new

segment titled NOOK to report upon its digital business,

moving the eCommerce business (i.e., sales of physical

merchandise over the Internet) into the B&N Retail seg-

ment. Also as a result of this assessment, certain corporate

offi ce and other costs have been allocated to all three seg-

ments. The Company’s three operating segments are: B&N

Retail, B&N College and NOOK.

2012 Annual Report 9