Barnes and Noble 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

Table of contents

-

Page 1

-

Page 2

-

Page 3

... Balance Sheet Consolidated Statements of Changes in Shareholders' Equity Consolidated Statements of Cash Flows Notes to Consolidated Financial Statements Report of Independent Registered Public Accounting Firm Reports of Management Shareholder Information Corporate Information Barnes & Noble...

-

Page 4

...competitor, remarkable growth in sales of NOOK products, a strong title line-up, and growth in non-book categories such as Toys & Games. And, of course, excellent execution by our booksellers continued to delight our customers and kept them coming back. Our digital business continued to grow rapidly...

-

Page 5

... digital business. Since Barnes & Noble revolutionized bookselling with the superstore concept, change has been part of our makeup. Our ability to remake ourselves and the book industry time and again to exceed our customers' expectations has been a growth strategy, not a survival tactic. In 2012...

-

Page 6

... 30, 2009 upon the closing of the acquisition of Barnes & Noble College Booksellers, Inc. (B&N College) by Barnes & Noble, Inc. (the Acquisition), gives the Company and B&N College the same ï¬scal year. The change was intended to better align the Company's ï¬scal year with the business cycles of...

-

Page 7

2012 Annual Report

5

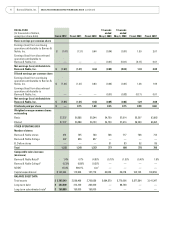

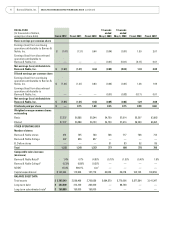

FISCAL YEAR

(In thousands of dollars, except per share data)

STATEMENT OF OPERATIONS DATA

Fiscal 2012

Fiscal 2011

13 weeks 13 weeks ended ended Fiscal 2010 May 2, 2009 May 3, 2008

Fiscal 2008

Fiscal 2007

Sales Barnes & Noble Retail Barnes & Noble Collegea NOOK ...

-

Page 8

...614 57,614

55,207 56,529

63,662 66,221

Number of stores Barnes & Noble stores Barnes & Noble College B. Dalton stores Total Comparable sales increase (decrease) Barnes & Noble Retailg Barnes & Noble Collegeh NOOKi Capital expendituresj

BALANCE SHEET DATA

691 647 - 1,338

705 636 - 1,341

720 637...

-

Page 9

2012 Annual Report

7

a B&N College results are included since the Acquisition on September 30, 2009. b Represents sales from NOOK to Barnes & Noble Retail and Barnes & Noble College that were sold through to the end user. c Includes pre-opening expenses. d Amounts for ï¬scal 2012, ï¬scal 2011, ...

-

Page 10

... customers a full suite of textbook options-new, used, digital and rental. The Company previously licensed the "Barnes & Noble" trade name from B&N College under certain agreements. The Acquisition gave the Company exclusive ownership of its trade name. To address dynamic changes in the book selling...

-

Page 11

... hardware and software companies and retail partners. The Company has a multi-channel marketing strategy that deploys various merchandising programs and promotional activities to drive traffic to both its stores and website. At the center of this program is the Company's website, barnesandnoble.com...

-

Page 12

..., all Barnes & Noble stores provide customers with access to the millions of books available to online shoppers at barnesandnoble.com while offering an option to have the book sent to the store or shipped directly to the customer. At the center of this eCommerce program is the Company's website...

-

Page 13

...partners, as well as B&N Retail and B&N College. NOOK produces a number of different eReaders, including NOOK Tablet™, NOOK Color™, NOOK Simple Touch™ and NOOK Simple Touch with GlowLight™. These devices are designed in Palo Alto, California. Barnes & Noble's NOOK eReading software provides...

-

Page 14

... all eReader device revenue deferred in accordance with ASC 605-25 Revenue Recognition, Multiple Element Arrangements, and does not include sales from closed or relocated stores. Additionally, for textbook rentals, comparable store sales reï¬,ects the retail selling price of a new or used textbook...

-

Page 15

... market price point. On November 7, 2011, Barnes & Noble launched NOOK Tabletâ„¢, the Company's fastest and lightest tablet with the best in entertainment. On February 21, 2012, Barnes & Noble launched NOOK Tabletâ„¢ - 8GB, a new addition to the highly rated NOOK Tabletâ„¢ line. On April 12, 2012...

-

Page 16

..., trade book and college bookstores businesses with its electronic and Internet offerings, using retail stores in attractive geographic markets to promote and sell digital devices and content. Customers can see, feel and experiment with the NOOK® in the Company's stores. Although the stores will...

-

Page 17

...NOOK's top line increase due to higher sales to third party distribution channels. In ï¬scal 2012, the Company closed 12 Barnes & Noble stores, bringing its total number of Barnes & Noble stores to 91 with 18.0 million square feet. In ï¬scal 2012, the Company added 32 B&N College stores and closed...

-

Page 18

16

Barnes & Noble, Inc.

MANAGEMENT 'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPER ATIONS continued

• NOOK selling and administrative expenses decreased as a percentage of sales to 1.9% in ï¬scal 2012 from 5.2% in ï¬scal 2011. This decrease was primarily attributable to ...

-

Page 19

...trade books. B&N Retail also includes its eCommerce business and thirdparty sales of Sterling Publishing Co., Inc. • B&N College sales increased $922.5 million, or 113.3%, to $1.78 billion during ï¬scal 2011 from $833. million during ï¬scal 2010. This increase in sales was due to the Acquisition...

-

Page 20

...to 23.7% in ï¬scal 2011 from 22.0% in ï¬scal 2010 due to improved store productivity. • B&N College selling and administrative expenses, included since the Acquisition on September 30, 2009, decreased as a percentage of sales to 15.2% in ï¬scal 2011 from 18.7% in ï¬scal 2010. This decrease was...

-

Page 21

2012 Annual Report

19

Income Taxes

52 weeks ended Dollars in thousands Income Taxes April 30, Effective 2011 Rate $ (48,652) 39.7% May 1, Effective 2010 Rate $ 8,365 18.6%

when college students generally purchase textbooks for the upcoming semesters. The NOOK business, like that of many ...

-

Page 22

... ability to include eligible real estate, accounts receivable and accrued interest, at the election of the Company, at Base Rate or LIBO Rate, plus, in each case, an Applicable Margin (each term as deï¬ned in the 2011 Amended Credit Agreement). In addition, the Company has the option to request an...

-

Page 23

...scal 2012, ï¬scal 2011 and ï¬scal 2010, respectively. Capital expenditures planned for ï¬scal 2013 primarily relate to the Company's digital initiatives, buildout of its Palo Alto facilities, new stores, maintenance of existing stores and system enhancements for the retail and college stores. The...

-

Page 24

... under store leases for insurance, taxes and other maintenance costs, which obligations totaled approximately 16% of the minimum rent payments under those leases. b Represents commitment fees related to the Company's 2012 Amended Credit Facility and interest obligations on the Seller Notes issued in...

-

Page 25

... eBookstore. The majority of the Company's eBook sales are sold under the agency model. The Barnes & Noble Member Program offers members greater discounts and other beneï¬ts for products and services, as well as exclusive offers and promotions via e-mail or direct mail for an annual fee of $25.00...

-

Page 26

24

Barnes & Noble, Inc.

MANAGEMENT 'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPER ATIONS continued

be material. A 10% change in actual non-returnable inventory would have affected net earnings by approximately $0.9 million in ï¬scal 2012. The Company also estimates and ...

-

Page 27

... declines in sales continue. A 10% decrease in Sterling sales trends would have resulted in a $5.2 million impairment charge on the Company's results of operations in ï¬scal 2012.

Gift Cards

The Company sells gift cards which can be used in its stores or on Barnes & Noble.com. The Company does not...

-

Page 28

... rate would not have had a material impact to the Company's results of operations in ï¬scal 2012.

Recent Accounting Pronouncements

In June 2011, the Financial Accounting Standards Board (FASB) issued ASU 2011-05, Presentation of Comprehensive Income (ASU 2011-05). ASU 2011-05 eliminates the option...

-

Page 29

2012 Annual Report

27

in labor costs, possible increases in shipping rates or interruptions in shipping service, effects of competition, possible risks that inventory in channels of distribution may be larger than able to be sold, possible risk that returns from consumers or channels of ...

-

Page 30

28

Barnes & Noble, Inc.

C O N SOLIDATED STATEMEN TS OF OPERAT I O N S

(In thousands, except per share data) Sales Cost of sales and occupancy Gross proï¬t Selling and administrative expenses Depreciation and amortization Operating proï¬t (loss) Interest income (expense), net and amortization of ...

-

Page 31

...

Current liabilities: Accounts payable Accrued liabilities Gift card liabilities Total current liabilities Long-term debt Deferred taxes Other long-term liabilities Redeemable Preferred Shares; $.001 par value; 5,000 shares authorized; 204 and zero shares issued, respectively Shareholders' equity...

-

Page 32

...2, 2009 Net earnings (loss) Minimum pension liability, net of tax Exercise of 313 common stock options Stock options and restricted stock tax beneï¬ts Stock-based compensation expense Sale of Calendar Club Cash dividend paid to stockholders Treasury stock acquired, 137 shares Balance at May 1, 2010...

-

Page 33

... T Y

Barnes & Noble, Inc. Shareholders' Equity

COMMON STOCK ADDITIONAL PAID-IN CAPITAL ACCUMULATED OTHER COMPREHENSIVE GAINS (LOSSES) RETAINED EARNINGS TREASURY STOCK AT COST

(In thousands) Balance at April 30, 2011 Net loss Minimum pension liability, net of tax Exercise of 92 common stock options...

-

Page 34

... Fictionwise earn-out payments Purchase of non-controlling interest Acquisition of Barnes & Noble College Booksellers, Inc. (net of cash acquired) Acquisition of Tikatok Inc. (net of cash acquired) Net cash ï¬,ows used in investing activities

CASH FLOWS FROM FINANCING ACTIVITIES:

- (127,779) (3,568...

-

Page 35

... ACTIVITY:

$ 28,298 $ $ $ $ 1,615 - - - - $ 3,963

45,604 (41,681) 1,513 1,213 300 - -

12,305 31,461 1,416,134 1,227,945 188,189 250,000 -

Notes payable on Acquisition of B&N College Accrued dividend on redeemable preferred shares

See accompanying notes to consolidated ï¬nancial statements...

-

Page 36

... & games, music and movies direct to customers through its bookstores or on Barnes & Noble. com. The acquisition of B&N College (see Note 12) has allowed the Company to expand into sales of textbooks and course-related materials, emblematic apparel and gifts, trade books, computer products, school...

-

Page 37

... College's textbook and trade book inventories are valued using the LIFO method, where the related reserve was not material to the recorded amount of the Company's inventories or results of operations. Market is determined based on the estimated net realizable value, which is generally the selling...

-

Page 38

... relate to the tangible product's essential software and other separable elements, the Company allocates revenue to all deliverables using the relative selling-price method. Under this method, revenue is allocated at the time of sale to all deliverables based on their relative selling price using...

-

Page 39

...scal 2012, ï¬scal 2011, and ï¬scal 2010, respectively. The Company receives payments and credits from vendors pursuant to co-operative advertising and other programs, including payments for product placement in stores, catalogs and online. In accordance with ASC 05-50-25-10, Customer's Accounting...

-

Page 40

... sells gift cards which can be used in its stores or on Barnes & Noble.com. The Company does not charge administrative or dormancy fees on gift cards and gift cards have no expiration dates. Upon the purchase of a gift card, a liability is established for its cash value. Revenue associated with gift...

-

Page 41

...ed percentage of eligible inventories and accounts receivable and accrued interest, at the election of the Company, at Base Rate or LIBO Rate, plus, in each case, an Applicable Margin (each term as deï¬ned in the 2011 Amended Credit Agreement). In addition, the Company has the option to request an...

-

Page 42

...TO CONSOLIDATED FINANCIAL STATEMENTS continued

under the 2009 Credit Agreement were limited to a speciï¬ed percentage of eligible inventories and accounts receivable and accrued interest, at the election of the Company, at Base Rate or LIBO Rate, plus, in each case, an Applicable Margin (each term...

-

Page 43

... Company's stock option activity:

WEIGHTED AVERAGE REMAINING CONTRACTUAL TERM

WEIGHTED NUMBER OF AVERAGE SHARES EXERCISE (in thousands) PRICE

AGGREGATE INTRINSIC VALUE (in thousands)

Balance, May 2, 2009 Granted Exercised Forfeited Balance, May 1, 2010 Exercised Forfeited Balance, April 30, 2011...

-

Page 44

42

Barnes & Noble, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

As of April 28, 2012, there was $20,382 of total unrecognized compensation expense related to unvested stock options granted under the Company's share-based compensation plans. That expense is expected to be recognized ...

-

Page 45

2012 Annual Report

43

Company had the following long-term liabilities at April 28, 2012, April 30, 2011 and May 1, 2010:

April 28, 2012 Deferred Rent Junior Seller Note (see Note 14 and Note 19) Other Total long-term liabilities $ 220,875 150,000 34,190 $ 405,065 April 30, 2011 271,451 150,000 27,...

-

Page 46

... costs are reviewed annually. Pension expense was $1,970, $2,558 and $1,951 for ï¬scal 2012, ï¬scal 2011 and ï¬scal 2010, respectively.

The Company maintains a deï¬ned contribution plan (the Savings Plan) for the beneï¬t of substantially all employees. Total Company contributions charged...

-

Page 47

2012 Annual Report

45

9.

I N CO M E TA XE S

The Company ï¬les a consolidated federal return with all subsidiaries owned 80% or more. Federal and state income tax provisions (beneï¬ts) for ï¬scal 2012, ï¬scal 2011 and ï¬scal 2010 are as follows:

Fiscal 2012 Current: Federal State Total ...

-

Page 48

46

Barnes & Noble, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

As of April 28, 2012, the Company had $17,032 of unrecognized tax beneï¬ts, all of which, if recognized, would affect the Company's effective tax rate. A reconciliation of the beginning and ending amount of ...

-

Page 49

... Borders Group, Inc. Chapter 11 Bankruptcy for $12,528 including acquisition related fees. These intellectual property assets include a customer list, trade names and URLs. The Company accounted for the transaction as an asset purchase, and these assets are included on its consolidated balance sheet...

-

Page 50

... expansion of the digital business. As part of the commercial agreement, NewCo and Microsoft would share in the revenues, net of certain items, from digital content purchased from NewCo by customers using the NewCo Windows 8 applications or through certain Microsoft products and services that may be...

-

Page 51

... part of the transaction, the Company acquired the Barnes & Noble trade name that had been owned by B&N College and licensed to the Company. On September 30, 2009, in connection with the closing of the Acquisition described above, the Company issued the Sellers (i) a senior subordinated note in the...

-

Page 52

..., Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

Acquired intangible assets consisted primarily of the trade name and customer relationships.

Trade Name

The Company previously licensed the "Barnes & Noble" trade name from B&N College under certain agreements. The Acquisition gave the...

-

Page 53

... other long-term liabilities in the accompanying balance sheets.

This segment includes 91 bookstores as of April 28, 2012, primarily under the Barnes & Noble Booksellers trade name. The 91 Barnes & Noble stores generally offer a NOOK® department/Boutique/Counter, a comprehensive trade book title...

-

Page 54

...

a Includes only the ï¬nancial information of B&N College since the date of the Acquisition on September 30, 2009. b Includes tangible books, music, movies, rentals and newsstand. c Includes NOOK, related accessories, eContent and warranties.

Sales by Product Line Mediab Digitalc Otherd Total

52...

-

Page 55

... against the Company's directors. The complaints generally allege breach of ï¬duciary duty, waste of corporate assets and unjust enrichment in connection with the Company's entry into a deï¬nitive agreement to purchase Barnes & Noble College Booksellers, which was announced on August 10, 2009 (the...

-

Page 56

... and derivatively, on behalf of the Company. The complaint generally alleges breaches of ï¬duciary duties, waste and unjust enrichment in connection with the Company's acquisition of Barnes & Noble College Booksellers, the adoption of the Shareholder Rights Plan, and other unspeciï¬ed instances of...

-

Page 57

...customers who used credit cards as payment. The Summons and Complaint have not been served on the Company.

Kevin Khoa Nguyen, an individual, on behalf of himself and all others similarly situated v. Barnes & Noble, Inc.

On June , 2011, Barnes & Noble, Inc. ï¬led a complaint against LSI Corporation...

-

Page 58

... to a Stock Purchase Agreement dated as of August 7, 2009 among the Company and the Sellers. As part of the Acquisition, the Company acquired the Barnes & Noble trade name that had been owned by B&N College and licensed to the Company (described below). The purchase price paid to the Sellers was $59...

-

Page 59

... to which MBS purchases books from B&N College, which have no resale value for a ï¬,at rate per box. Total sales to MBS under this program were $3 2 and $227 for ï¬scal 2012 and ï¬scal 2011, respectively. The Company purchases new and used textbooks at market prices directly from MBS. Total...

-

Page 60

....com, Barnes & Noble.com was granted the right to sell college textbooks over the Internet using the "Barnes & Noble" name. Pursuant to the Textbook License Agreement, Barnes & Noble.com paid Textbooks.com a royalty on revenues (net of product returns, applicable sales tax and excluding shipping and...

-

Page 61

.... GameStop pays a license fee to the Company in an amount equal to 7% of the gross sales of such departments, which totaled $871, $989 and $1,0 1 during ï¬scal 2012, ï¬scal 2011 and ï¬scal 2010, respectively. GameStop sold new and used video games and consoles on the Barnes & Noble.com website up...

-

Page 62

60

Barnes & Noble, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

On August 18, 2011, the Company entered into an investment agreement between the Company and Liberty GIC, Inc. (Liberty), a subsidiary of Liberty Media Corporation (Liberty Media), pursuant to which the Company issued ...

-

Page 63

... Annual Report

61

21. SE L E CT E D Q UA R T E R LY FIN A NC IA L IN FO R MATION (UN AUDITED)

A summary of quarterly ï¬nancial information for ï¬scal 2012 and ï¬scal 2011 is as follows:

Fiscal 2012 Quarter Ended On or About Sales Gross proï¬t Net earnings (loss) attributable to Barnes & Noble...

-

Page 64

...N T I N G FI R M

Board of Directors and Stockholders Barnes & Noble, Inc. New York, New York We have audited the accompanying consolidated balance sheets of Barnes & Noble, Inc., as of April 28, 2012 and April 30, 2011 and the related consolidated statements of operations, comprehensive income (loss...

-

Page 65

...nancial reporting as of April 28, 2012, based on the COSO criteria. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Barnes & Noble, Inc. as of April 28, 2012 and April 30, 2011 and the related...

-

Page 66

... Public Company Accounting Oversight Board. The report of BDO USA, LLP accompanies the Consolidated Financial Statements.

The management of Barnes & Noble, Inc. is responsible for establishing and maintaining adequate internal control over ï¬nancial reporting, as such term is deï¬ned in Exchange...

-

Page 67

...rights and are held by members of the Board of Directors and the Company's employees. The Company's most recent quarterly dividend of $0.25 per common share was paid in December 2010. Effective February 22, 2011 the Company suspended the payment of its quarterly cash dividend to common shareholders...

-

Page 68

...C O RPOR ATE INFORMATION

Corporate Headquarters: Stock Performance Chart

Barnes & Noble, Inc. 122 Fifth Avenue New York, New York 10011 (212) 33-3300

Common Stock:

New York Stock Exchange, Symbol: BKS

Transfer Agent and Registrar:

Computershare 280 Washington Boulevard Jersey City, NJ 07310-1900...

-

Page 69

... for Real TOP 1 0 PAPERBACK F ICTION The Help TOP 1 0 JUVEN IL E The Hunger Games

Stephen King Scribner

A Dance with Dragons

Walter Isaacson Simon & Schuster

Killing Lincoln

Todd Burpo Thomas Nelson

The Immortal Life of Henrietta Lacks

Kathryn Stockett Penguin Group

Fifty Shades of Grey

Suzanne...

-

Page 70

68

Barnes & Noble, Inc.

AWA R D W I N N E R S

TOP 10 NOOK BOOKS The Hunger Games S LE E P E R S Fifty Shades of Grey T HE PUL ITZER P R IZE Malcom X: A Life of Reinvention THE N ATION AL BOOK CRITICS CIRCL E AWARDS Binocular Vision THE MAN BOOKER PRIZE F OR F IC TI ON The Sense of an Ending

...

-

Page 71

-

Page 72