Barnes and Noble 2006 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2006 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

outstanding term loan of . million was repaid.

Letters of credit issued under the Prior Facility, which

totaled approximately . million as of June , ,

were transferred to become letters of credit under the

New Facility.

On June , , the Company completed the redemp-

tion of its . million outstanding . convert-

ible subordinated notes due . Holders of the notes

converted a total of . million principal amount of

the notes into , shares of common stock of the

Company, plus cash in lieu of fractional shares, at a

price of . per share. The Company redeemed the

balance of . million principal amount of the notes

at an aggregate redemption price, together with accrued

interest and redemption premium, of . million.

The write-off of the unamortized portion of the deferred

fi nancing fees from the issuance of the notes and the

redemption premium resulted in a charge of .

million.

Selected information related to the Company’s term

loan, convertible subordinated notes and the Amended

New, New and Prior Facilities:

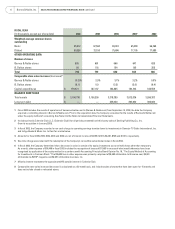

FISCAL YEAR 2006 2005 2004

Revolving credit facility $ — — —

Term loan — — 245,000

Balance at end of year $ — — 245,000

Average balance

outstanding during the year $ 23,337 121,915 276,043

Maximum borrowings

outstanding during the year $ 91,800 245,000 392,700

Weighted average interest

rate during the yeara15.40% 6.91% 5.25%

Interest rate at end of year — — 3.78%

a The fi scal 2006 interest rate is higher than prior periods due to the

lower average borrowings and the fi xed nature of the amortization

of the deferred fi nancing fees and commitment fees. Excluding the

deferred fi nancing fees and the commitment fees in fi scal 2006, the

weighted average interest rate was 7.70%.

Fees expensed with respect to the unused portion of

the Amended New, New and Prior Facilities totaled

. million, . million and . million, during fi scal

, and , respectively.

The amounts outstanding under the Amended New,

New and Prior Facilities, if any, have been classifi ed

as long-term debt based on the Company’s ability to

continually maintain principal amounts outstanding.

The Company has no agreements to maintain

compensating balances.

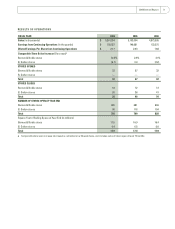

Capital Investment

Capital expenditures totaled . million, .

million and . million during fi scal ,

and , respectively. Capital expenditures in fi scal

, primarily for the opening of to new Barnes

& Noble stores, the maintenance of existing stores and

system enhancements for the retail stores and the web-

site, are projected to be in the range of . million to

. million, although commitment to many of such

expenditures has not yet been made.

Based on current operating levels and the store

expansion planned for the next fi scal year, management

believes cash and cash equivalents on hand, cash fl ows

generated from operating activities, short-term vendor

fi nancing and borrowing capacity under the Amended

New Facility will be suffi cient to meet the Company’s

working capital and debt service requirements, and

support the development of its short- and long-term

strategies for at least the next months.

In fi scal , the Board of Directors of the Company

authorized a common stock repurchase program for

the purchase of up to . million of the Company’s

common stock. The Company completed this .

million repurchase program during the fi rst quarter of

fi scal . On March , , the Company’s Board

of Directors authorized an additional share repurchase

program of up to . million of the Company’s com-

mon stock. The Company completed this . million

repurchase program during the third quarter of fi scal

. On September , , the Company’s Board of

Directors authorized a new share repurchase program of

up to . million of the Company’s common stock.

16 Barnes & Noble, Inc. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS continued