Barnes and Noble 2006 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2006 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

through the Company’s distribution network, reduced

sales of lower margin music and increased sales volume

leveraging fi xed occupancy costs in the Barnes & Noble

stores, off set by the deep discounted selling price on

J. K. Rowling’s Harry Potter and the Half-Blood Prince.

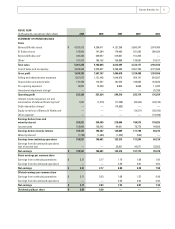

Selling and Administrative Expenses

Selling and administrative expenses increased .

million, or ., to . billion in fi scal from

. billion in fi scal . As a percentage of sales,

selling and administrative expenses increased to .

in fi scal from . in fi scal . This increase

was primarily due to a . million charge related to the

impairment of certain store assets, charges associated

with litigation of approximately . million and .

million related to stock compensation costs associated

with the issuance of restricted stock.

Depreciation and Amortization

Depreciation and amortization decreased . million,

or ., to . million in fi scal from .

million in fi scal . This decrease was primarily

due to lower amortization of the Barnes & Noble.com

customer lists and relationships, and certain Barnes &

Noble store assets becoming fully depreciated.

Pre-Opening Expenses

Pre-opening expenses increased . million, or .,

in fi scal to . million from . million in

fi scal . The increase in pre-opening expenses was

primarily due to the timing of new Barnes & Noble stores

opened during fi scal and those to be opened during

the beginning of fi scal .

Operating Profi t

The Company’s consolidated operating profi t increased

. million, or ., to . million in fi scal

from . million in fi scal . This increase was

primarily due to the matters discussed above.

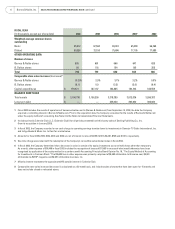

Interest Expense, Net and Amortization of Deferred

Financing Fees

Interest expense, net of interest income, and amortiza-

tion of deferred fi nancing fees, decreased . million,

or ., to . million in fi scal from .

million in fi scal . The decrease was primarily due

to reduced average borrowings, the repayment of the

Company’s prior outstanding million term loan

and interest income increasing . million, or .,

to . million in fi scal from . million in fi scal

.

Debt Redemption Charge

The Company completed the redemption of its .

million outstanding . convertible subordinated

notes due in the second quarter of fi scal . The

write-off of the unamortized portion of the deferred

fi nancing fees from the issuance of the notes and the

redemption premium resulted in a charge of .

million. The debt redemption charge of . million in

fi scal was comprised of an . million redemp-

tion premium and the write-off of . million of

unamortized deferred fi nancing fees from the issuance

of the notes.

Income Taxes

Barnes & Noble’s eff ective tax rate in fi scal

decreased to . compared with . during

fi scal . The decrease in the eff ective tax rate was

primarily due to adjustments in fi scal related to

prior year taxes.

Minority Interest

Minority interest was . million in fi scal com-

pared with . million in fi scal , and relates to the

approximate outside interest in Calendar Club.

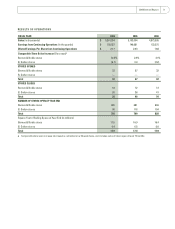

Income From Discontinued Operations

On October , , the Board of Directors of the

Company approved an overall plan for the complete dis-

position of all of the Company’s Class B common stock

in GameStop, the Company’s former video game operat-

ing segment. The plan was completed in November

with the distribution to the Company’s stockholders

of the GameStop Class B common stock. As a result,

GameStop is no longer a subsidiary of the Company

and, accordingly, the Company is presenting all histori-

cal results of operations of GameStop as discontinued

operations.

14 Barnes & Noble, Inc. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS continued