Barnes and Noble 2006 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2006 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

At the end of fi scal , the Company operated

B. Dalton bookstores in states and the District of

Columbia. B. Dalton bookstores employ merchandising

strategies that target the mainstream consumer book

market, off ering a wide range of bestsellers and general-

interest titles. Most B. Dalton bookstores range in size

from , to , square feet, and while they are

appropriate to the size of adjacent mall tenants, the

opening of book superstores in nearby locations

continues to have a signifi cant adverse impact on

B. Dalton bookstores.

The Company is continuing its controlled descent in

the number of its smaller format B. Dalton bookstores

in response to declining sales attributable primarily

to book superstore competition. Part of the Company’s

strategy has been to close underperforming stores,

which has resulted in the closing of B. Dalton

bookstores since .

On September , , the Company completed its

acquisition of all of Bertelsmann AG’s (Bertelsmann)

interest in Barnes & Noble.com. As a result of the

acquisition, the Company increased its economic interest

in Barnes & Noble.com from approximately to

approximately . On May , , the Company

completed a merger (the Merger) pursuant to which

Barnes & Noble.com became a wholly owned subsidiary

of the Company.

The Company has a multi-channel marketing strategy

that deploys various merchandising programs and

promotional activities to drive traffi c to both its stores

and website. At the center of this program is Barnes &

Noble.com, which receives over million customer

visits annually, ranking it among the top e-commerce

sites in terms of traffi c, as measured by Comscore Media

Metrix. As a result of this reach, the Company believes

that the website provides signifi cant advertising power

which would be valued in the tens of millions of dollars

if such advertising were placed with third party websites

with comparable reach. In this way, Barnes & Noble.com

serves as both the Company’s direct-to-home delivery

service and as an important broadcast channel and

advertising medium for the Barnes & Noble brand. For

example, the online store locator at Barnes & Noble.com

receives millions of customer visits each year providing

store hours, directions, information about author events

and other in-store activities.

The Company fi rmly believes that its website is a key

factor behind its industry leading comparable store sales

performance. Barnes & Noble.com has continued to

receive high ratings for its service: in the fourth quarter

of , the American Customer Satisfaction Index

ranked Barnes & Noble.com as Number One for

customer satisfaction. This well-regarded survey,

compiled by the University of Michigan, of ,

consumers rating over companies is the industry’s

leading indicator of customer satisfaction. marked

the third year in a row that Barnes & Noble.com received

the highest rating.

The Company’s subsidiary Sterling is a leading gen-

eral nonfi ction trade book publisher, with more than

, books in print. Sterling publishes a wide range of

nonfi ction and illustrated books, consisting primarily of

reference and “how-to” titles on subjects such as crafts,

food and wine, home design, woodworking, puzzles and

games, and children’s books. Sterling also publishes

books for a number of brands, including AARP, Mensa

and HASBRO.

In fi scal , the Company’s Board of Directors approved

an overall plan for the complete disposition of all of its

Class B common stock in GameStop Corp. (GameStop),

the Company’s former video game operating segment.

This disposition was completed in two steps. The fi rst

step was the sale of ,, shares of GameStop Class

B common stock held by the Company to GameStop

(Stock Sale) for an aggregate consideration of .

million. The Stock Sale was completed on October ,

. The second step in the disposition was the spin-

off by the Company of its remaining ,, shares

of GameStop’s Class B common stock (Spin-Off ). The

Spin-Off was completed on November , with

the distribution of . of a share of GameStop

Class B common stock as a tax-free distribution on each

outstanding share of the Company’s common stock to

the Company’s stockholders of record as of the close

of business on November , . As a result of the

Stock Sale and the Spin-Off , GameStop is no longer a

subsidiary of the Company. The disposition of all of the

Company’s stockholdings in GameStop resulted in the

Company presenting all historical results of operations

of GameStop as discontinued operations.

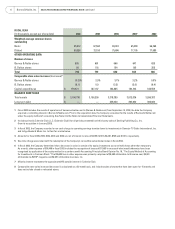

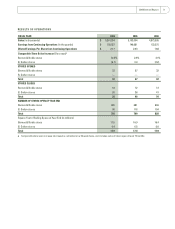

8 Barnes & Noble, Inc. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS continued