Barnes and Noble 2006 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2006 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

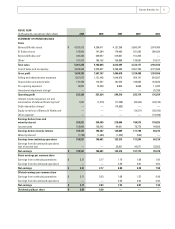

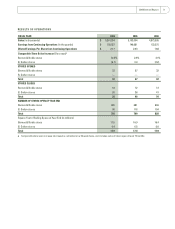

The following table sets forth, for the periods indicated, the percentage relationship that certain items bear to total

sales of the Company:

FISCAL YEAR 2006 2005 2004

Sales 100.0% 100.0% 100.0%

Cost of sales and occupancy 68.9 69.3 69.5

Gross margin 31.1 30.7 30.5

Selling and administrative expenses 22.8 22.2 21.6

Depreciation and amortization 3.2 3.4 3.7

Pre-opening expenses 0.2 0.2 0.2

Operating margin 4.8 4.9 5.0

Interest expense, net and amortization of deferred

fi nancing fees — — (0.2)

Debt redemption charge — — (0.3)

Earnings before income taxes and minority interest 4.9 4.9 4.5

Income taxes 2.0 2.0 1.9

Income before minority interest 2.9 2.9 2.6

Minority interest — — (0.1)

Income from continuing operations 2.9% 2.9% 2.5%

Stock Option Review

In July , the Company created a Special Committee

of the Board of Directors, consisting of Patricia

Higgins, to review, with the assistance of independent

outside counsel and an independent forensic auditor,

the Company’s stock option granting practices. This

review was completed and on April , , the Special

Committee presented its fi ndings and recommendations

to the Company’s Board of Directors.

Among other fi ndings, the Special Committee deter-

mined that there were numerous instances of stock

option grants for which there was an improper mea-

surement of compensation expense under Accounting

Principles Board (APB) Opinion No. , “Accounting

for Stock Issued to Employees” (APB ). Although the

Special Committee determined that there were instances

of stock options having been dated using favorable dates

that were selected with the benefi t of hindsight and that

serious mistakes were made, the Special Committee did

not fi nd any intent to defraud or fraudulent misconduct

by any individual or group of individuals. The Special

Committee found that the Company’s dating and pricing

practice for stock options was applied uniformly by

Company personnel to stock options granted and was not

used selectively to benefi t any one group or individual

within the Company. The Company has evaluated these

fi ndings and agrees with the Special Committee. The

Company has concluded, however, that the charges

are not material to the fi nancial statements in any of

the periods to which such charges relate and therefore

will not restate its historic fi nancial statements. The

Company has recorded an adjustment of . million

(. million after tax) to increase non-cash compensa-

tion expense in the fourth quarter of fi scal to cor-

rectly present compensation expense for fi scal . The

Company has also recorded an adjustment to decrease

retained earnings by . million, increase deferred

taxes by . million and increase additional paid in

capital by . million, to correct the consolidated

balance sheet for the cumulative impact of the misstated

compensation cost in periods prior to fi scal .

In December , the Board members and all cur-

rent Section offi cers holding options unvested as of

December , voluntarily agreed to reprice such

options, upon a fi nding by the Special Committee that

such options were improperly priced, to an exercise

price determined to be the appropriate fair market value

by the Special Committee. The Special Committee has

recommended that all incorrectly dated and unexercised

stock options issued to current Section offi cers and

10 Barnes & Noble, Inc. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS continued