Barnes and Noble 2006 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2006 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

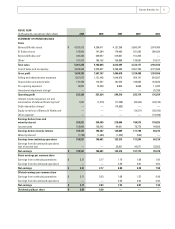

Earnings

As a result of the factors discussed above, the Company

reported consolidated net earnings of . million (or

. per share) during fi scal compared with net

earnings of . million (or . per share) during

fi scal . Components of diluted earnings per share

(EPS) are as follows:

FISCAL YEAR 2005 2004

EPS from continuing operations $ 2.03 1.68

EPS from discontinued operations — 0.25

Consolidated EPS $ 2.03 1.93

SEASONALITY

The Company’s business, like that of many retailers, is

seasonal, with the major portion of sales and operating

profi t realized during the fourth quarter which includes

the holiday selling season.

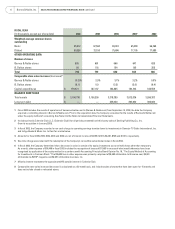

LIQUIDITY AND CAPITAL RESOURCES

Working capital requirements are generally at their

highest in the Company’s fi scal quarter ending on or

about January due to the higher payments to vendors

for holiday season merchandise purchases. In addition,

the Company’s sales and merchandise inventory levels

will fl uctuate from quarter to quarter as a result of the

number and timing of new store openings.

Cash and cash equivalents on hand, cash fl ows from

operating activities, funds available under its senior

credit facility and short-term vendor fi nancing continue

to provide the Company with liquidity and capital

resources for store expansion, seasonal working capital

requirements and capital investments.

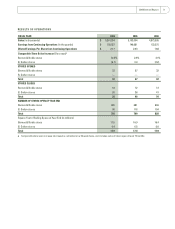

Cash Flow

Cash fl ows provided from operating activities were .

million, . million and . million during fi scal

, and , respectively. In fi scal , the

decrease in cash fl ows from operating results was primar-

ily due to an approximate . million diff erence in

the timing of payments on inventory and rent accounts

payable related principally to the impact of the rd week.

In fi scal , the decrease in cash fl ows from operating

results was primarily due to a decrease in the portion of

income taxes expense that was deferred taxes. In fi scal

, the increase in cash fl ows from operating activities

was primarily attributable to improved working capital

management and an increase in net earnings.

The weighted-average age per square foot of the

Company’s Barnes & Noble stores was . years as of

February , and is expected to increase to approxi-

mately . years by February , . As the Barnes &

Noble stores continue to mature, and as the number of

new stores opened during the fi scal year decreases as

a percentage of the existing store base, the increasing

operating profi ts of Barnes & Noble stores are expected

to generate a greater portion of the cash fl ows required

for working capital, including new store inventories,

capital expenditures and other initiatives.

Capital Structure

Strong cash fl ows from operations and a continued

emphasis on working capital management strengthened

the Company’s balance sheet in fi scal .

On August , , the Company entered into

Amendment No. (Amended New Facility) to the

Company’s Credit Agreement, dated as of June ,

(the New Facility). The Amended New Facility amended

the New Facility to extend the maturity date to July ,

from June , . The Amended New Facility also

amended the New Facility: () to reduce the applicable

margin that is applied to (x) Eurodollar -based loans

above the publicly stated Eurodollar rate and (y) standby

letters of credit to a spread ranging from . to

. from the current range of . to .; ()

to reduce the fee paid on commercial letters of credit to

a range of . to . from the current range

of . to .; and () to reduce the commit-

ment fee to a range of . to . from a range

of . to .. In each case, the applicable rate

is based on the Company’s consolidated fi xed charge

coverage ratio. Proceeds from the Amended New Facility

will be used for general corporate purposes, including

seasonal working capital needs.

The Amended New Facility, as did the New Facility,

includes an . million fi ve-year revolving credit

facility, which under certain circumstances may be

increased to . billion at the option of the Company.

The New Facility replaced the Amended and Restated

Credit and Term Loan Agreement, dated as of August ,

(the Prior Facility), which consisted of a .

million revolving credit facility and a . million

term loan. The revolving credit facility portion was

due to expire on May , and the term loan had a

maturity date of August , . The Prior Facility was

terminated on June , , at which time the prior

2006 Annual Report 15