Barnes and Noble 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

Table of contents

-

Page 1

-

Page 2

-

Page 3

2006 Annual Report

1

C ONTENTS

2 4 7 21 22 23 25 27 47 49 50 52 54

Barnes & Noble 2006 Letter to Shareholders Selected Consolidated Financial Data Management's Discussion and Analysis of Financial Condition and Results of Operations Consolidated Statements of Operations Consolidated Balance Sheets...

-

Page 4

...remain conï¬dent, however, that short-term effects notwithstanding, the long-range beneï¬ts to Barnes & Noble will be positive. The Barnes & Noble brand continues to be viewed positively by retail and online customers. In 2006, Barnes & Noble was ranked the number-one retail brand for quality for...

-

Page 5

2006 Annual Report

3

We closed the year with our strongest balance sheet ever, generating 670 million in free cash ï¬,ow. At year-end, after paying out approximately 640 million in dividends, we had 6349 million in cash on hand and no outstanding debt. We continue to believe that a sound balance ...

-

Page 6

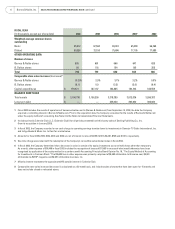

... in this report. The Company's ï¬scal year is comprised of 52 or 53 weeks, ending on the Saturday closest to the last day of January. The Statement of Operations Data for the 53 weeks ended February 3, 2007 (ï¬scal 2006), 52 weeks ended January 28, 2006 (ï¬scal 2005) and 52 weeks ended January...

-

Page 7

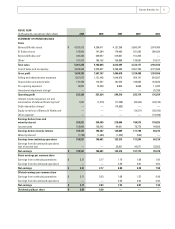

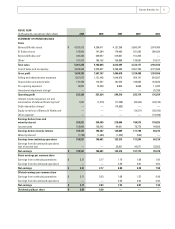

... thousands, except per share data)

STATEMENT OF OPERATIONS DATA

2006

2005

2004

20031

2002

Sales Barnes & Noble stores B. Dalton stores Barnes & Noble.com Other

2 1...0.50 1.50 0.99 0.40 1.39 -

Total sales Cost of sales and occupancy Gross proï¬t Selling and administrative expenses Depreciation ...

-

Page 8

... average common shares outstanding Basic Diluted OTHER OPERATING DATA Number of stores Barnes & Noble stores B. Dalton stores Total Comparable store sales increase (decrease)8 Barnes & Noble stores B. Dalton stores Capital expenditures BALANCE SHEET DATA Total assets Long-term debt $ $ $

2006

2005...

-

Page 9

... trade book publisher. Additionally, the Company owns an approximate 74 interest in Calendar Club L.L.C. (Calendar Club), an operator of seasonal kiosks. The Company employed approximately 39,000 full- and part-time employees as of February 3, 2007. Barnes & Noble stores are located in all 50 states...

-

Page 10

... of Michigan, of 65,000 consumers rating over 200 companies is the industry's leading indicator of customer satisfaction. 2006 marked the third year in a row that Barnes & Noble.com received the highest rating. The Company's subsidiary Sterling is a leading general nonï¬ction trade book publisher...

-

Page 11

2006 Annual Report

9

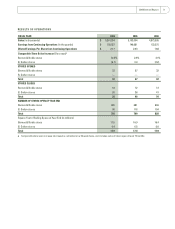

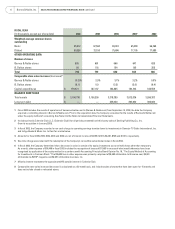

RE SU LT S O F O PE R AT IO N S

FISCAL YEAR 2006 2005 2004

Sales (in thousands) Earnings from Continuing Operations (in thousands) Diluted Earnings Per Share from Continuing Operations Comparable Store Sales Increase (Decrease) Barnes & Noble stores B. Dalton stores

STORES ...

-

Page 12

10

Barnes & Noble, Inc.

MANAGEMENT 'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPER ATIONS continued

The following table sets forth, for the periods indicated, the percentage relationship that certain items bear to total sales of the Company:

FISCAL YEAR 2006 2005 2004

Sales...

-

Page 13

... Commission (SEC) regarding the Company's stock option grant practices. In addition, the Company is also cooperating fully with the United States Attorney's office for the Southern District of New York in connection with its inquiry into such matters.

Tax-Related Payments

under Section 409A far...

-

Page 14

...the 53rd week in ï¬scal 2006 that contributed an increase to sales of 61.4 million. In ï¬scal 2006, the Company opened 32 Barnes & Noble stores and closed 18, bringing its total number of Barnes & Noble stores to 695 with 17.5 million square feet. The Company closed 20 B. Dalton stores, ending the...

-

Page 15

...stores and closed 12, bringing its total number of Barnes & Noble stores to 681 with 16.9 million square feet. The Company closed 36 B. Dalton stores, ending the period with 118 B. Dalton stores and 0.5 million square feet. As of January 28, 2006, the Company operated 799 stores in the ï¬fty states...

-

Page 16

...ATIONS continued

through the Company's distribution network, reduced sales of lower margin music and increased sales volume leveraging ï¬xed occupancy costs in the Barnes & Noble stores, offset by the deep discounted selling price on J. K. Rowling's Harry Potter and the Half-Blood Prince.

Selling...

-

Page 17

... the number and timing of new store openings. Cash and cash equivalents on hand, cash ï¬,ows from operating activities, funds available under its senior credit facility and short-term vendor ï¬nancing continue to provide the Company with liquidity and capital resources for store expansion, seasonal...

-

Page 18

... of Directors authorized a new share repurchase program of up to 6200.0 million of the Company's common stock.

Revolving credit facility Term loan Balance at end of year Average balance outstanding during the year Maximum borrowings outstanding during the year Weighted average interest rate during...

-

Page 19

... all of Bertelsmann AG's (Bertelsmann) interest in barnesandnoble.com llc (Barnes & Noble.com). The purchase price paid by the Company was $165.7 million (including acquisition related costs) in a combination of cash and a note. The note issued to Bertelsmann in the amount of $82.0 million was paid...

-

Page 20

... term of the option granted. The expected term of stock option awards granted is derived from historical exercise experience under the Company's stock option plans and

Merchandise inventories are stated at the lower of cost or market. Cost is determined primarily by the retail inventory method...

-

Page 21

2006 Annual Report

19

represents the period of time that stock option awards granted are expected to be outstanding. The assumptions used in calculating the fair value of share-based payment awards represent management's best estimates, but these estimates involve inherent uncertainties and the ...

-

Page 22

... store closing or relocation costs, higher interest rates, the performance of the Company's online initiatives such as Barnes & Noble.com, the performance and successful integration of acquired businesses, the successful and timely completion and integration of

the Company's new distribution center...

-

Page 23

2006 Annual Report

21

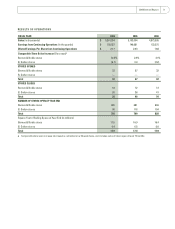

C ONSOLIDATED STATEMEN TS OF OPE R AT I O N S

FISCAL YEAR (In thousands, except per share data)

2006

2005

2004

Sales Cost of sales... share Earnings from continuing operations Earnings from discontinued operations Net earnings Weighted average common shares outstanding ...

-

Page 24

22

Barnes & Noble, Inc.

C O N SOLIDATED BALAN CE SHEETS

(In thousands, except per share data)

ASSETS FEBRUARY 3, 2007 JANUARY 28, 2006

Current assets Cash and cash equivalents Receivables, net Merchandise inventories Prepaid expenses and other current assets Total current assets Property and ...

-

Page 25

... period of subsidiary (See Note 4) Tax adjustments and costs attributable to the sale of GameStop Class B shares (See Note 3) Acquisition of partial interest in a subsidiary of Calendar Club (See Note 8) Treasury stock acquired, 200 shares Balance at January 29, 2005

COMPREHENSIVE EARNINGS

2 79...

-

Page 26

... Minimum pension liability Total comprehensive earnings Exercise of 1,177 common stock options Stock options and restricted stock tax beneï¬ts Stock-based compensation expense Cash dividends paid to stockholders APB 25 cumulative adjustment (See Note 2) Treasury stock acquired, 2,830 shares Balance...

-

Page 27

... of property and equipment Payments on GameStop note receivable Net increase in other noncurrent assets Acquisition of consolidated subsidiaries, net of cash acquired Net cash ï¬,ows from investing activities

CASH FLOWS FROM FINANCING ACTIVITIES

Purchase of treasury stock Cash dividends paid to...

-

Page 28

...acquired Assets acquired, net of cash acquired Liabilities assumed Cash paid

NON CASH ACTIVITIES

$ $ $ $ $ $

(1,040) 85,898 - - - - -

810 28,611 - - - - -

16,536 42,215 162,161 7,734 154,427 160,417 74,020

Net assets distributed in spin-off of GameStop Note receivable on sale of GameStop shares

-

Page 29

... Dalton Bookseller trade name (hereafter collectively referred to as B. Dalton stores). Barnes & Noble conducts the online part of its business through barnesandnoble.com llc (Barnes & Noble.com), one of the largest sellers of books on the Internet. The Company publishes books under its own imprints...

-

Page 30

... for Barnes & Noble customers. Refunds of membership fees due to cancellations within the ï¬rst 30 days are minimal.

Advertising Costs

The costs in excess of net assets of businesses acquired are carried as goodwill in the accompanying consolidated balance sheets. At February 3, 2007, the Company...

-

Page 31

2006 Annual Report

29

The Company receives payments and credits from vendors pursuant to co-operative advertising and other programs, including payments for product placement in stores, catalogs and online. In accordance with Emerging Issues Task Force (EITF) Issue 02-16, "Accounting by a Customer...

-

Page 32

... on the Saturday closest to the last day of January. The reporting period ended February 3, 2007 contained 53 weeks. The reporting periods ended January 28, 2006 and January 29, 2005 contained 52 weeks.

Newly Issued Accounting Pronouncements

Effective January 29, 2006, the Company adopted the...

-

Page 33

2006 Annual Report

31

awards under APB 25. The impact on basic and diluted earnings per share for ï¬scal 2006 was a reduction of 60.08 per share. Prior to the adoption of SFAS 123R, the Company presented all tax beneï¬ts related to deductions resulting from the exercise of stock options as ...

-

Page 34

32

Barnes & Noble, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

derived from historical exercise experience under the Company's stock option plans and represents the period of time that stock option awards granted are expected to be outstanding. The expected term assumption ...

-

Page 35

2006 Annual Report

33

The aggregate intrinsic value in the table above represents the total pretax intrinsic value (the difference between the Company's closing stock price on the last trading day of the related ï¬scal year and the exercise price, multiplied by the related in-the-money options) ...

-

Page 36

...(SEC) regarding the Company's stock option grant practices. In addition, the Company is also cooperating fully with the United States Attorney's office for the Southern District of New York in connection with its inquiry into such matters.

Tax-Related Payments

Incorrectly dated options that vested...

-

Page 37

... taxable capital gain on the Stock Sale, amounting to 614,443, have been charged directly to retained earnings. Also included in the charge to retained earnings are 6263 of GameStop costs related to the redemption of their shares from the Company. The second step in the disposition was the spin...

-

Page 38

...17, 2005, at which time the prior outstanding term loan of 6245,000 was repaid. Letters of credit issued under the Prior Facility, which totaled approximately 630,000 as of June 17, 2005, were transferred to become letters of credit under the New Facility. On June 28, 2004, the Company completed the...

-

Page 39

2006 Annual Report

37

being the Waiver Termination Date); and (2) potential adjustments to previously delivered Company ï¬nancial statements arising solely from the stock option review will not affect the Company's ability to obtain credit extensions between the date of the Waiver Agreement and ...

-

Page 40

... beneï¬t expenses for the Savings Plan were 610,243, 69,174 and 68,145 during ï¬scal 2006, 2005 and 2004, respectively. In addition, the Company provides certain health care and life insurance beneï¬ts (the Postretirement Plan) to retired employees, limited to those receiving beneï¬ts or retired...

-

Page 41

..., as follows:

FISCAL YEAR 2006 2005 2004

Loss carryover Lease transactions Estimated accruals Stock-based compensation Insurance liability Pension Inventory Investments in equity securities Total deferred tax assets Net deferred tax liabilities

BALANCE SHEET CAPTION REPORTED IN

Net earnings

OTHER...

-

Page 42

... acquired by the Company primarily in connection with the purchase of Sterling Publishing during the 52 weeks ended February 1, 2003, the purchase of Bertelsmann AG's interest in Barnes & Noble.com during the 52 weeks ended January 31, 2004 and the purchase of the public interest in Barnes & Noble...

-

Page 43

... 65,000, relating to the fair market value of this distribution facility calculated at the conclusion of the lease term. The Company believes that the possibility that any such payment would be required under this guarantee is remote.

The Company leases retail stores, warehouse facilities, office...

-

Page 44

... business the sale of trade books, mass market paperbacks, children's books, bargain books, magazines, music, movies, calendars, games and gift items direct to customers. Most of these products are sourced by third parties while some are sourced through the Company's own publishing activities. These...

-

Page 45

....

While Barnes & Noble.com is currently collecting sales tax in a majority of states, the Company receives communications from time to time from various states regarding the applicability of state sales tax to sales made to customers in their respective states prior to the commencement of sales tax...

-

Page 46

... Barnes & Noble.com dealer network. Barnes & Noble.com earned a commission of 61,930 on the MBS used book sales in ï¬scal 2006. In addition, Barnes & Noble.com maintains a link on its website which is hosted by MBS and through which Barnes & Noble.com customers are able to sell used books directly...

-

Page 47

... its programs prior to June 2005 and any such costs applicable to insurance claims against GameStop will be charged to GameStop at the time incurred. The Company is provided with national freight distribution, including trucking services by the Argix Direct Inc. (Argix) (formerly the LTA Group, Inc...

-

Page 48

... of the last two ï¬scal years is as follows:

FISCAL 2006 QUARTER ENDED ON OR ABOUT APRIL 2006 JULY 2006 OCTOBER 2006 JANUARY 2007 TOTAL FISCAL YEAR 2006

Sales Gross proï¬t Net earnings (loss) Earnings (loss) per common share Basic Diluted

FISCAL 2005 QUARTER ENDED ON OR ABOUT

$ $ $ $ $

1,114...

-

Page 49

2006 Annual Report

47

R EP OR T OF IN DEPEN DEN T REGISTER E D P U B LI C A C C O U N T I N G FI R M

The Board of Directors Barnes & Noble, Inc. New York, New York We have audited the accompanying consolidated balance sheets of Barnes & Noble, Inc. and subsidiaries as of February 3, 2007 and ...

-

Page 50

..., in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Barnes & Noble, Inc. and subsidiaries as of February 3, 2007 and January 28, 2006, and the related consolidated statements of operations, changes in shareholders...

-

Page 51

...Executive Officer and the Chief Financial Officer of the Company as Exhibits 31.1 and 31.2 to its Annual Report on Form 10-K for ï¬scal 2006 ï¬led with the Securities and Exchange Commission, and the Company has submitted to the New York Stock Exchange a certiï¬cate of the Chief Executive Officer...

-

Page 52

...Higgins

Executive Vice President of Distribution and Logistics

Mary Ellen Keating

Former President and Chief Executive Officer Switch & Data Facilities Company, Inc.

Irene R. Miller

Senior Vice President of Corporate Communications and Public Affairs

David S. Deason

Chief Executive Officer Akim...

-

Page 53

...Company's Stockholders will be held at 9:00 a.m. on Wednesday, May 30, 2007 at Barnes & Noble Booksellers, Union Square, 33 East 17th Street, New York, New York.

Stockholder Services

New York Stock Exchange, Symbol: BKS

Transfer Agent and Registrar

The Bank of New York Investor Services Department...

-

Page 54

...ICTION Night TOP 1 0 PAPERBACK F ICTION The Da Vinci Code

Mitch Albom Hyperion 308,933

Cross

John Grogan HarperCollins 401,529

The World is Flat

Elie Wiesel Hill and Wang 335,320

A Million Little Pieces

Dan Brown Knopf 426,987

The Memory Keeper's Daughter

James Patterson Little, Brown & Company...

-

Page 55

2006 Annual Report

53

T O P 1 0 J U VE N I LE Eragon

S LE E P E R S The God Delusion

Christopher Paolini Knopf 209,453

The End: Book the Thirteenth

Richard Dawkins Houghton Mifflin 71,414

Manhunt

Lemony Snicket HarperCollins 202,681

Goodnight Moon

James L. Swanson HarperCollins 61,310

The ...

-

Page 56

...

Sharon Draper Simon & Schuster

THE HUGO AWARD Spin

Troy Jollimore MARGIE Poetry

D IS C O V E R AWA R DS Brief Encounters with Che Guevara

Richard Powers Farrar, Straus & Giroux Fiction

The Worst Hard Time

Robert Charles Wilson Tor Books Best Novel

THE EDGAR AWARD Citizen Vince

Timothy Egan...

-

Page 57

(THIS PAGE LEFT INTENTIONALLY BLANK)

-

Page 58

(THIS PAGE LEFT INTENTIONALLY BLANK)

-

Page 59

-

Page 60