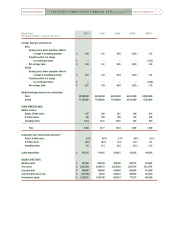

Barnes and Noble 2003 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2003 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

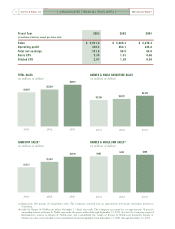

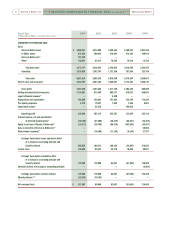

(1) Fiscal 2003 includes the results of operations of

barnesandnoble.com llc (Barnes & Noble.com) from

September 15, 2003, the date the Company acquired a

controlling interest in Barnes & Noble.com. Prior to the

acquisition date, the Company accounted for the results

of Barnes & Noble.com under the equity method of

accounting. See footnote 8 to the Notes to Consolidated

Financial Statements.

(2) Fiscal 2000 includes the results of operations of Funco,

Inc. from June 14, 2000, the date of acquisition. In fiscal

2000, the Company acquired a controlling interest in

Calendar Club L.L.C. (Calendar Club). The Company’s

consolidated statement of operations includes the results

of operations of Calendar Club. Prior to fiscal 2000, the

Company included its equity in the results of operations of

Calendar Club as a component of other income (expense).

(3) Fiscal 1999 includes the results of operations of Babbage’s

Etc. LLC from October 28, 1999, the date of acquisition.

(4) Includes primarily Sterling Publishing Co., Inc. and Calendar

Club.

(5) Represents legal and settlement costs associated with the

lawsuit brought by the American Booksellers Association.

(6) In fiscal 2002, the Company recorded a non-cash charge

to operating earnings to write down its investments in

Gemstar-TV Guide International, Inc. (Gemstar) and

Indigo Books & Music Inc. (Indigo) to their fair market

value. In fiscal 2000, the Company recorded a non-cash

charge to adjust the carrying value of certain assets,

primarily goodwill relating to the purchase of B. Dalton

and other mall-bookstore assets.

(7) Interest expense for fiscal 2003, 2002, 2001, 2000 and

1999 is net of interest income of $2,193, $3,499, $1,319,

$939 and $1,449, respectively.

(8) In fiscal 1999, the Company recognized a gain on the

formation of Barnes & Noble.com in connection with the

joint venture agreement with Bertelsmann AG. See

footnote 8 to the Notes to Consolidated Financial

Statements.

(9) In fiscal 2002, the Company determined that a decrease

in value in certain of its equity investments occurred

which was other than temporary. As a result, other

expense of $16,498 in fiscal 2002 includes the recognition

of losses of $11,485 in excess of what would otherwise

have been recognized by application of the equity method

in accordance with Accounting Principles Board Opinion

No. 18, “The Equity Method of Accounting for Investments

in Common Stock”. The $16,498 loss in other expense

was primarily comprised of $8,489 attributable to

iUniverse.com, $5,081 attributable to BOOK®magazine

and $2,351 attributable to enews, inc. Included in other

expense in fiscal 2001 are losses of $12,066 from the

Company’s equity investments. Included in other expense in

fiscal 2000 are losses of $9,730 from the Company’s equity

investments. Included in other income in fiscal 1999 are

pre-tax gains of $22,356 and $10,975 recognized in

connection with the Company’s investments in Gemstar

and Indigo, respectively, as well as a charge of $5,000

attributable to the termination of the Ingram Book Group

acquisition and losses from equity investments of $994.

(10) During fiscal 2002, the Company completed an IPO for its

GameStop subsidiary which resulted in the Company

retaining an approximate 63 percent economic interest in

GameStop. At the end of fiscal 2003, the Company’s

economic interest in GameStop was approximately 64

percent.

(11) Comparable store sales increase (decrease) is calculated

on a 52-week basis, and includes sales of stores that have

been open for 15 months for Barnes & Noble stores (due

to the high sales volume associated with grand openings)

and 12 months for B. Dalton and GameStop stores.

[ SELECTED CONSOLIDATED FINANCIAL DATA continued ]

8

2003 Annual ReportBarnes & Noble, Inc.