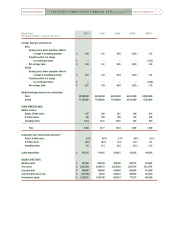

Barnes and Noble 2003 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2003 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the effect of the $25.3 million impairment charge during

fiscal 2002.

Interest Expense, Net and Amortization of Deferred

Financing Fees

Interest expense, net of interest income, and amortization

of deferred financing fees, decreased $1.4 million, or

6.4%, to $20.1 million in fiscal 2003 from $21.5 million

in fiscal 2002. The decrease was primarily the result

of reduced average borrowings under the Company’s

senior credit facility due to effective working capital

management.

Equity in Net Loss of Barnes & Noble.com

The Company accounted for its approximate 38

percent economic interest in Barnes & Noble.com

under the equity method through September 15, 2003.

Equity losses in Barnes & Noble.com were $14.3

million and $26.8 million in fiscal 2003 and 2002,

respectively.

Other Expense

In fiscal 2002, the Company determined that a decrease

in value in certain of its equity investments occurred

which was other than temporary. As a result, other

expense of $16.5 million during fiscal 2002 included the

recognition of losses of $11.5 million in excess of what

would otherwise have been recognized by application of

the equity method in accordance with Accounting

Principles Board Opinion No. 18, “The Equity Method

of Accounting for Investments in Common Stock”. The

$16.5 million loss in other expense was primarily

comprised of $8.5 million attributable to iUniverse.com,

$5.1 million attributable to BOOK®magazine and $2.4

million attributable to enews, inc.

Income Taxes

Barnes & Noble’s effective tax rate in fiscal 2003

increased to 40.75 percent compared with 40.25

percent during fiscal 2002.

Minority Interest

Minority interest was $23.4 million in fiscal 2003

compared with $19.1 million in fiscal 2002, and relates

primarily to GameStop.

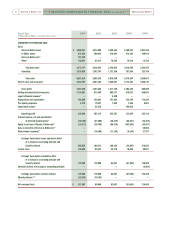

Earnings

As a result of the factors discussed above, the Company

reported consolidated net earnings of $151.9 million

(or $2.07 per share) during fiscal 2003 compared with

net earnings of $99.9 million (or $1.39 per share)

during fiscal 2002. Components of diluted earnings per

share are as follows:

Fiscal Year 2003 2002

Barnes & Noble Bookstores $ 1.75 1.52

Barnes & Noble.com ( 0.18) ( 0.21)

Total book operating segment 1.57 1.31

Video game operating segment 0.50 0.40

Impairment charge -- ( 0.19)

Other investments -- ( 0.13)

Consolidated EPS $ 2.07 1.39

15

2003 Annual Report Barnes & Noble, Inc.

[MANAGEMENT’S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND RESULTS

OF OPERATIONS continued ]