Barnes and Noble 2003 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2003 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

[LETTER TO OUR SHAREHOLDERS continued]

3

2003 Annual Report Barnes & Noble, Inc.

2003 was another good year for Barnes & Noble.com (www.bn.com), where expense

leveraging and cost reductions continue to drive us towards our goal of breakeven EBITDA

(earnings before interest, taxes, depreciation, and amortization) in 2004. The site continues

to receive accolades by all the rating organizations for its outstanding usability and excellent

customer service. Barnes & Noble.com also validates our belief that all 21st century

retailers, especially booksellers, should have a viable multi-channel service for customers.

The site is a broadcast channel to our millions of customers and a key conversion point for

millions of book buyers who are not yet our customers. We are convinced that Barnes &

Noble.com adds value to our brand.

The previously announced acquisition of the remaining shares of Barnes & Noble.com is

expected to be completed by the second quarter of this fiscal year.

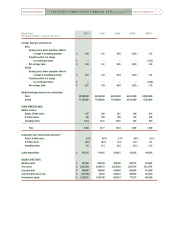

Finally, we note the success of GameStop, the nation’s largest video-game retailer. Sales in

2003 were $1.6 billion, a 17 percent increase over the prior year. In all, we opened 300 new

stores, an astounding achievement by any measure. Operating profit was up 20 percent, and

our share of GameStop’s EPS grew from $0.40 to $0.50.

Financially, our company is stronger today than it ever has been. Free cash flow in our

book-operating segment more than tripled to $290 million in 2003. We have a very strong

liquidity position, with a debt to equity ratio of only 0.24 to 1.00. At fiscal year-end,

our revolving credit facility had a zero balance outstanding. We continued with our share

repurchase program, buying approximately 305,000 shares of Barnes & Noble, Inc. in 2003.

Many thanks to our shareholders, and of course, to our excellent booksellers in the field and

home office for contributing to our success.

Sincerely,

Leonard Riggio

Chairman