Barnes and Noble 2003 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2003 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

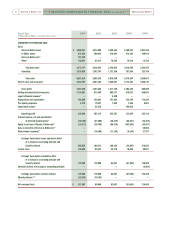

52 WEEKS ENDED FEBRUARY 1, 2003 COMPARED WITH

52 WEEKS ENDED FEBRUARY 2, 2002

Sales

The Company’s sales increased $398.9 million, or 8.2%,

during fiscal 2002 to $5.269 billion from $4.870 billion

during fiscal 2001. Contributing to this improvement

was an increase of $231.4 million from video game

operating segment sales. Fiscal 2002 sales from Barnes

& Noble stores, which contributed 67.8% of total sales

or 91.3% of total bookstore sales, increased 6.4% to

$3.575 billion from $3.359 billion in fiscal 2001.

The increase in book operating segment sales was

primarily attributable to the 47 new Barnes & Noble

stores opened during fiscal 2002. This increase was

partially offset by declining sales of B. Dalton, due to 47

store closings and a comparable store sales decline of

(6.4%) in fiscal 2002.

GameStop sales during fiscal 2002 increased to $1.353

billion from $1.121 billion during fiscal 2001. This

increase in sales was primarily attributable to the

11.4% growth in GameStop comparable store sales and

sales from the 210 new GameStop stores opened during

fiscal 2002.

Cost of Sales and Occupancy

The Company’s cost of sales and occupancy includes

costs such as rental expense, common area maintenance,

merchant association dues and lease-required advertising.

Cost of sales and occupancy increased $288.3 million,

or 8.1%, to $3.847 billion in fiscal 2002 from $3.559

billion in fiscal 2001, primarily due to growth in the

video game operating segment. The Company’s gross

margin rate decreased slightly to 27.0% in fiscal 2002

from 26.9% in fiscal 2001.

Selling and Administrative Expenses

Selling and administrative expenses increased $68.4

million, or 7.6%, to $973.5 million in fiscal 2002 from

$905.1 million in fiscal 2001, primarily due to the

increase in bookstore expenses from the opening of 47

Barnes & Noble stores in fiscal 2002 and to the growth

in the video game operating segment. Selling and

administrative expenses decreased to 18.5% of sales in

fiscal 2002 from 18.6% in fiscal 2001. This decrease

was primarily attributable to the lower selling and

administrative expenses as a percentage of sales in the

video game operating segment.

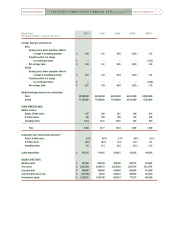

Legal Settlement Expense

In fiscal 2001, the Company recorded a pre-tax charge

of $4.5 million in connection with a lawsuit brought by

the American Booksellers Association and 26

independent bookstores. The charges included a

settlement of $2.4 million paid to the plaintiffs and

approximately $2.1 million in legal expenses incurred

by the Company.

Depreciation and Amortization

Depreciation and amortization increased $0.9 million,

or 0.6%, to $148.7 million in fiscal 2002 from $147.8

million in fiscal 2001. The increase was primarily the

result of the increase in depreciation related to the 47

new Barnes & Noble stores opened during fiscal 2002.

This increase was partially offset by the result of the

implementation of SFAS No. 142 in fiscal 2002,

whereby goodwill is no longer amortized but is

reviewed for impairment at least annually.

Pre-Opening Expenses

Pre-opening expenses increased in fiscal 2002 to $10.2

million from $8.0 million in fiscal 2001. The increase in

pre-opening expenses was primarily the result of

opening 47 new Barnes & Noble stores and 210 new

GameStop stores during fiscal 2002, compared with 40

new Barnes & Noble stores and 74 new GameStop

stores during fiscal 2001.

Impairment Charge

During the first quarter of fiscal 2002, the Company

deemed the decline in value in its available-for-sale

securities in Gemstar and Indigo to be other than

temporary. The investments had been carried at fair

market value with unrealized gains and losses included

in shareholders’ equity. Events such as Gemstar’s largest

shareholder taking an impairment charge for its

investment, the precipitous decline in the stock price

subsequent to the abrupt resignation of one of its senior

executives, the questioning of aggressive revenue

recognition policies and the filing of a class action

lawsuit against Gemstar, were among the items which

led to management’s decision to record an impairment

for its investment in Gemstar of nearly $24.0 million

(before taxes). The Company’s decision to record an

impairment charge for its investment in Indigo was

[MANAGEMENT’S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND RESULTS

OF OPERATIONS continued ]

16

2003 Annual ReportBarnes & Noble, Inc.