Barnes and Noble 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

Table of contents

-

Page 1

-

Page 2

... OF OPERATIONS CONSOLIDATED STATEMENTS OF OPERATIONS CONSOLIDATED BAL ANCE SHEETS CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUIT Y CONSOLIDATED STATEMENTS OF CASH FLOWS NOTES TO CONSOLIDATED FINANCIAL STATEMENTS REPORT OF INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS SHAREHOLDER INFORMATION

-

Page 3

...10 percent. At the same time, our Sterling Publishing division forged ahead, strengthening its lead within its market niche, adding title after title to its impressive backlist. Aside from achieving its target in sales, margin and profit, Sterling also delivered promised cost savings, reducing paper...

-

Page 4

... quarter of this fiscal year. Finally, we note the success of GameStop, the nation's largest video-game retailer. Sales in 2003 were $1.6 billion, a 17 percent increase over the prior year. In all, we opened 300 new stores, an astounding achievement by any measure. Operating profit was up 20 percent...

-

Page 5

... 31 fiscal year-ends. The Company accounted for its approximate 38 percent ownership interest in Barnes & Noble.com under the equity method through September 15, 2003 (the date the Company acquired Bertelsmann's interest in Barnes & Noble.com) and consolidated the results of Barnes & Noble.com...

-

Page 6

... the consolidated financial statements and notes included elsewhere in this report. The Company's fiscal year is comprised of 52 or 53 weeks, ending on the Saturday closest to the last day of January. The Statement of Operations Data for the 52 weeks ended January 31, 2004 (fiscal 2003), 52 weeks...

-

Page 7

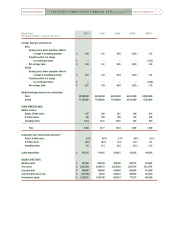

... OPERATIONS DATA: Sales Barnes & Noble stores B. Dalton stores Barnes & Noble.com(1) Other(4) Total book sales GameStop Total sales Cost of sales and occupancy Gross profit Selling and administrative expenses Legal settlement expense (5) Depreciation and amortization Pre-opening expenses Impairment...

-

Page 8

...OPERATING DATA: Number of stores Barnes & Noble stores B. Dalton stores GameStop stores Total Comparable store sales increase (decrease)(11) Barnes & Noble stores B. Dalton stores GameStop stores Capital expenditures BALANCE SHEET DATA: Working capital Total assets Long-term debt Long-term debt, net...

-

Page 9

... September 15, 2003, the date the Company acquired a controlling interest in Barnes & Noble.com. Prior to the acquisition date, the Company accounted for the results of Barnes & Noble.com under the equity method of accounting. See footnote 8 to the Notes to Consolidated Financial Statements. Fiscal...

-

Page 10

... Noble store sales. Complementing this extensive on-site selection, all Barnes & Noble stores provide customers with access to the millions of books available to online shoppers while offering an option to have the book sent to the store or shipped directly to the customer. All Barnes & Noble stores...

-

Page 11

... square feet (averaging 1,500 square feet) depending upon market demographics. Stores feature video-game hardware and software, PCentertainment software and a multitude of accessories. GameStop also operates a Web site (www.gamestop.com), and publishes Game Informer magazine (collectively, GameStop...

-

Page 12

...u e d ]

Barnes & Noble, Inc.

11

CRITICAL ACCOUNTING POLICIES

Management's Discussion and Analysis of Financial Condition and Results of Operations discusses the Company's consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the...

-

Page 13

... Annual Report

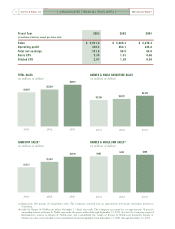

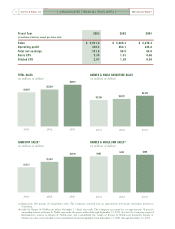

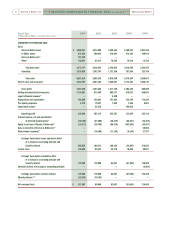

RESULTS OF OPERATIONS

The Company's sales, operating profit, comparable store sales, store openings, store closings, number of stores open and square feet of selling space at year end are set forth below:

Fiscal Year

(Thousands of dollars)

2003

2002

2001

SALES Books Video Games...

-

Page 14

... operating profit is net of legal and settlement expenses of $4,500.

(2) Comparable store sales for Barnes & Noble stores are determined using stores open at least 15 months, due to the high sales volume associated with grand openings. Comparable store sales for B. Dalton and GameStop stores are...

-

Page 15

...opening expenses related to the opening of 300 new GameStop stores during fiscal 2003 compared with 210 new GameStop stores during fiscal 2002.

Impairment Charge

During the first quarter of fiscal 2002, the Company deemed the decline in value in its available-for-sale securities in Gemstar-TV Guide...

-

Page 16

... credit facility due to effective working capital management.

Minority Interest

Minority interest was $23.4 million in fiscal 2003 compared with $19.1 million in fiscal 2002, and relates primarily to GameStop.

Earnings

As a result of the factors discussed above, the Company reported consolidated...

-

Page 17

... store sales and sales from the 210 new GameStop stores opened during fiscal 2002.

administrative expenses as a percentage of sales in the video game operating segment.

Legal Settlement Expense

In fiscal 2001, the Company recorded a pre-tax charge of $4.5 million in connection with a lawsuit...

-

Page 18

... and $88.4 million in fiscal 2002 and 2001, respectively.

Barnes & Noble Bookstores Barnes & Noble.com Total book operating segment Video game operating segment Impairment charge Other investments Legal settlement expense Consolidated EPS

$

1.52 ( 0.21) 1.31 0.40 ( 0.19) ( 0.13) --

1.61 ( 0.66...

-

Page 19

... inventory levels will fluctuate from quarter to quarter as a result of the number and timing of new store openings, as well as the amount and timing of sales contributed by new stores. Cash flows from operating activities, funds available under its revolving credit facility and short-term...

-

Page 20

... operating levels and the store expansion planned for the next fiscal year, management believes cash flows generated from operating activities, shortterm vendor financing and borrowing capacity under the Facility will be sufficient to meet the Company's working capital and debt service requirements...

-

Page 21

... the opening of new stores or the inability to obtain suitable sites for new stores, higherthan-anticipated store closing or relocation costs, higher interest rates, the performance of the Company's online initiatives such as Barnes & Noble.com, the performance and successful integration of acquired...

-

Page 22

... ]

Barnes & Noble, Inc.

21

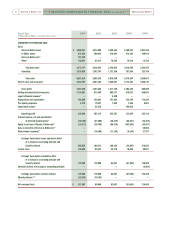

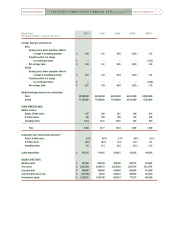

Fiscal Year

(Thousands of dollars, except per share data)

2003

2002

2001

Sales Cost of sales and occupancy Gross profit Selling and administrative expenses Legal settlement expense Depreciation and amortization Pre-opening expenses Impairment charge Operating profit...

-

Page 23

... property and equipment Goodwill Intangible assets, net Investment in Barnes & Noble.com Other noncurrent assets Total assets Liabilities and Shareholders' Equity Current liabilities: Accounts payable Accrued liabilities Total current liabilities Long-term debt Deferred income taxes Other long-term...

-

Page 24

...for-sale securities Unrealized gain on derivative instrument Minimum pension liability Total comprehensive earnings Exercise of 5,062,866 common stock options, including tax benefits of $18,724 Exercise of common stock options of subsidiaries, including tax benefits of $6,202 Treasury stock acquired...

-

Page 25

... Net cash flows from investing activities Cash flows from financing activities: Proceeds from exercise of common stock options Proceeds from GameStop initial public offering Net decrease in revolving credit facility Proceeds from issuance of long-term debt Purchase of treasury stock Acquisition of...

-

Page 26

... of video-game and entertainment-software stores primarily under the GameStop trade name, and a Web site (www.gamestop.com), and publisher of Game Informer magazine (hereafter collectively referred to as GameStop stores). Additionally, the Company owns an approximate 74 percent interest in Calendar...

-

Page 27

... the underlying leases. Costs incurred in purchasing management information systems are capitalized and included in property and equipment. These costs are amortized over their estimated useful lives from the date the systems become operational. Internally developed software is expensed as incurred...

-

Page 28

... at the time of sale. Sales returns (which are not significant) are recognized at the time returns are made. The Barnes & Noble Membership Program entitles the customer to receive a 10 percent discount on all purchases made during the twelve-month membership period. The annual membership fee of $25...

-

Page 29

... customer, credit/debit card, advertising, landlord and other receivables due within one year as follows:

January 31, 2004 February 1, 2003

Net earnings - as reported Compensation expense, net of tax BKS stock options GME stock options, net of minority interest BNBN stock options(a) Pro forma...

-

Page 30

... the Company's common stock at a conversion price of $32.512 per share. At the Company's option, it may redeem the notes at a premium to par beginning on March 20, 2004. The Company from time to time enters into interest rate swap agreements to manage interest-costs and risk

associated with changes...

-

Page 31

... balance sheet at their fair market value as a component of other noncurrent assets. The following marketable equity securities as of January 31, 2004 and February 1, 2003 have been classified as available-for-sale securities:

Fiscal 2003 Gemstar-TV Guide International Inc. Indigo Books & Music Inc...

-

Page 32

... $25,000 pre-tax gain in fiscal 1999. In November 2000, Barnes & Noble.com acquired Fatbrain.com, Inc. (Fatbrain) through a merger with bn.com. Bn.com issued shares of its common stock to Fatbrain shareholders as partial consideration for the merger. As a result of this acquisition, the Company and...

-

Page 33

... & Noble.com employees exercised 3.9 million options to acquire stock in bn.com, with the resulting proceeds being used to acquire membership units in Barnes & Noble.com, thereby reducing the Company's economic interest in Barnes & Noble.com to approximately 73 percent. The acquisition was accounted...

-

Page 34

... health care and life insurance benefits (the Postretirement Plan) to retired employees, limited to those receiving benefits or retired as of April 1, 1993.

A summary of the components of net periodic cost for the Pension Plan and the Postretirement Plan follows:

Pension Plan Fiscal Year 2003...

-

Page 35

... percent in 2009 and each year thereafter. The health-care cost trend assumption has a significant effect on the amounts reported. For example, a one percent increase or decrease in the health-care cost trend rate would change the accumulated postretirement benefit obligation by approximately $401...

-

Page 36

...:

Weighted- Average Expected Long-Term Rate of Return

Target Allocation

Percentage of Plan Assets

Fiscal Year Asset Category Large Capitalization Equities Mid Capitalization Equities Small Capitalization International Equities Fixed Income Core Bonds Global Bonds Cash

2003

2003

2002

2004...

-

Page 37

...n u e d ]

2003 Annual Report

Barnes & Noble.com

As of June 30, 2000, substantially all employees of Barnes & Noble.com were covered under Barnes & Noble.com's Employees' Retirement Plan (the B&N.com Retirement Plan). The B&N.com Retirement Plan is a defined benefit pension plan. As of July 1, 2000...

-

Page 38

... Percentage of Plan Assets at December 31, Weighted- Average Expected Long-Term Rate of Return

Fiscal Year Asset Category Large Capitalization Equities Mid Capitalization Equities Small Capitalization Equities International Equities Fixed Income Core Bonds Global Bonds Cash Total

2003

2003

2002...

-

Page 39

38

Barnes & Noble, Inc.

[ N OT E S TO C O N S O L I DAT E D F I N A N C I A L STAT E M E N T S c o n t i n u e d ]

2003 Annual Report

11. INCOME TAXES

The Company files a consolidated federal return with all 80 percent or more owned subsidiaries. Federal and state income tax provisions (benefits...

-

Page 40

... department, a magazine section and a calendar of ongoing events, including author appearances and children's activities. The 195 B. Dalton stores are typically small format mall-based stores. In addition, this segment includes Barnes & Noble.com (an online retailer of books, music and DVDs/videos...

-

Page 41

... of its segments based on operating profit.

Summarized financial information concerning the Company's reportable segments is presented below:

Sales Fiscal Year 2003 2002 2001 Depreciation and Amortization 2003 2002 2001

Book operating segment Video game operating segment Total

$ 4,372,177 1,578...

-

Page 42

...

A reconciliation of operating profit from reportable segments to earnings before taxes and minority interest in the consolidated financial statements is as follows:

Fiscal Year 2003 2002 2001

Reportable segments operating profit Interest, net Equity in net loss of Barnes & Noble.com Other expense...

-

Page 43

... acquired by the Company primarily in connection with the purchase of Sterling Publishing in the fourth quarter of fiscal 2002 and the purchase of Bertelsmann's interest in Barnes & Noble.com in fiscal 2003:

As of January 31, 2004

During the first quarter of fiscal 2003, the purchase price related...

-

Page 44

...to certain key executives and directors. The vesting terms and contractual lives of these grants are similar to that of the incentive plans. Leonard Riggio, the Company's chairman, exercised 1,318,750 stock options in September 2003, by tendering in payment of the exercise price of the stock options...

-

Page 45

...:

Fiscal Year 2003 2002 2001

A summary of the status of the Company's BKS stock options is presented below:

Weighted-Average Exercise Price

(Thousands of shares)

Shares

Volatility Risk-free interest rate Expected life

40% 2.71% 6 years

40% 3.51% 6 years

35% 4.86% 6 years

Balance, February...

-

Page 46

... Annual Report

[ N OT E S TO C O N S O L I DAT E D F I N A N C I A L STAT E M E N T S c o n t i n u e d ]

Barnes & Noble, Inc.

45

GME Stock Option Plans

In August 2001, the Company approved the 2001 Incentive Plan of GameStop (the 2001 Plan). The 2001 Plan assumed (by the issuance of replacement...

-

Page 47

...bn.com's Board of Directors. The 1999 Plan allows bn.com to grant options to purchase 25,500,000 shares of bn.com's Class A Common Stock.

The following table summarizes information as of December 31, 2003 (bn.com's fiscal year-end) concerning outstanding and exercisable options:

Options Outstanding...

-

Page 48

...provide for both minimum and percentage rentals and require the Company to pay all insurance, taxes and other maintenance costs. Percentage rentals are based on sales performance in excess of specified minimums at various stores. Rental expense under operating leases are as follows:

Fiscal Year 2003...

-

Page 49

... d ]

2003 Annual Report

Orange County against the Company. The complaint alleges that the Company improperly classified the assistant store managers, department managers and receiving managers working in its California stores as salaried exempt employees. The complaint alleges that these employees...

-

Page 50

... whereby Barnes & Noble.com receives various services from the Company, including, among others, services for payroll processing, benefits administration, insurance (property, casualty, medical, dental, life, etc.), tax, traffic, fulfillment and telecommunications. In accordance with the terms of...

-

Page 51

... items ordered by customers at the Company's stores and shipped directly to customers' homes by Barnes & Noble.com. Commissions paid for these sales were $1,505, $1,547 and $359 during fiscal 2003, 2002 and 2001, respectively. The Company paid B&N College certain operating costs B&N College incurred...

-

Page 52

2003 Annual Report

[ N OT E S TO C O N S O L I DAT E D F I N A N C I A L STAT E M E N T S c o n t i n u e d ]

Barnes & Noble, Inc.

51

Since 1993, the Company has used AEC One Stop Group, Inc. (AEC) as its primary music and DVD/video supplier and to provide a music and video database. AEC is one ...

-

Page 53

...2003 Annual Report

REPORT OF INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS

The Board of Directors Barnes & Noble, Inc. We have audited the accompanying consolidated balance sheets of Barnes & Noble, Inc. and subsidiaries as of January 31, 2004 and February 1, 2003 and the related consolidated statements...

-

Page 54

... Vice President of Corporate Communications and Public Affairs David S. Deason Vice President of Barnes & Noble Development Gary King Vice President and Chief Information Officer Michelle Smith Vice President of Human Resources Mark Bottini Vice President and Director of Stores Michael N. Rosen...

-

Page 55

... on the common stock since the initial public offering date and dividend payments are currently restricted by the Company's revolving credit agreement.

CORPORATE INFORMATION Corporate Headquarters:

Barnes & Noble, Inc. 122 Fifth Avenue New York, New York 10011 (212) 633-3300

Annual Meeting:

The...

-

Page 56

...Rules for Discovering the Successful Student in Every Child Ron Clark, Hyperion (111,675) Eragon Christopher Paolini, Knopf (98,862) The Devil in the White City: Murder, Magic, and Madness at the Fair That Changed America Erik Larson, Vintage (41,373) The Stones of Summer Dow Mossman, Barnes & Noble...

-

Page 57

... Canning Season Polly Horvath Farrar, Straus & Giroux NATIONAL BOOK CRITICS CIRCLE AWARDS Fiction The Known World Edward P. Jones Amistad/HarperCollins General Non-Fiction Sons of Mississippi Paul Hendrickson Knopf Biography/Autobiography Khrushchev: The Man and His Era William Taubman W.W. Norton...

-

Page 58

Barnes

&

Noble,

Inc

â-

122

Fifth

Avenue

â-

New

Yo r k ,

NY

10011