Bank of the West 2009 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2009 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

specialized expertise in livestock feed lots. We also

specialize in supporting nursery businesses throughout

the country, and the agricultural group banks a wide

variety of nut and tree fruit growers and processors.

Our premium wine bankers in California and the

Northwest have grown their business rapidly from a

base in Napa.

As the nation’s leading specialized bank lender to

churches, our thorough understanding of the business

dynamics of religious organizations has produced a

superb record over 20 years of helping congregations

develop facilities that further their ministries. With

more than $1.2 billion in its church portfolio, the bank

has no nonperforming borrowers. Working with us

since 1997, Vineyard Christian Fellowship in Phoenix,

Arizona completed a $21 million project in 2009 that

included a ‘compassion center,’ a 6,000 square foot

building designed to provide a food bank, clothing

center, job counseling service and other community

outreach services in an area hard-hit by recession.

Vineyard also turned to us for cash management and

investment services.

Government banking, another area of specialized

focus, develops public finance, cash management, and

investment relationships in the

public sector. In September 2009,

our Government Banking

group entered into a five-year

relationship with Los Angeles

County’s Deferred

Compensation Division to

manage an employee benefit

“We believe in a customer-centric, full relationship banking model focused

on our customers’ growth goals. The partnership we forge with our middle-

market customers is what enables us to effectively tailor solutions that address

a company’s total spectrum of financial needs. This approach differentiates us,

as does our deep expertise in specialized market segments including agriculture,

real estate, government and church banking. Our customers also seek out our

expertise in equipment finance, investment services, foreign exchange, global

trade, syndication, commercial cards and cash management.”

Gerard Denot, Vice Chairman, Commercial Banking Group

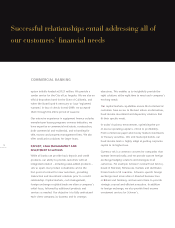

Avid Health, Inc. manufactures vitamins in Vancouver,

Washington, with products in the largest national retailers.

Seeking to refinance part of their debt capital, Avid wanted

a consultative bank partner. Our Seattle-based commercial

team, working with cash management, foreign exchange,

capital markets and syndication experts, offered credit and

ancillary solutions, and Avid established a relationship with

a bank that fully understands its banking needs.

Avid Health, Inc. CEO Martin Rifkin, left, and our Regional VP Bruce Kendrex at the Avid plant in Vancouver, Washington.

13