Bank of the West 2009 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2009 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

regional awards of excellence from financial consulting

and research firm Greenwich Associates for 2009, for

overall satisfaction in small business/middle market

customer service, relationship

manager performance, cash

management, and financial stability.

In addition to providing a full

range of solutions, we serve diverse

industries, including manufacturers,

retailers, law offices, accounting

firms and medical practices.

Dr. Basil Besh decided to build a

state-of-the-art orthopedic surgery

center in Fremont, California,

and he wanted more than a loan;

Dr. Besh wanted to do business

with a lender committed to a long-

term relationship. So he turned to us for an SBA loan,

and maintains multiple personal and business deposit

accounts with us as well.

Environmental engineering firm Trihydro Corporation in

Laramie, Wyoming, needed a mix of deposit and loan

solutions in 2009. The company was attracted to Bank

of the West's creativity, teamwork and responsiveness.

After considering various banks’ proposals, Trihydro

moved its banking relationship to Bank of the West,

including lines of credit, deposit accounts and cash

management services with remote deposit.

Through our branch network, we provide small and mid-

sized companies and entrepreneurs with both deposit

and credit solutions. Equipment leasing, inventory

flooring plans, corporate

cards, and other

commercial banking

products, as well as

insurance and wealth

management services, are

also available to business

owners.

A certified Preferred Small

Business Administration

(SBA) Lender, Bank of the

West has SBA experts

ready to help business

partners and their clients

choose from a variety

of financing solutions on government-guaranteed loans

that range from $25,000 to $5,000,000.

Small and medium-sized businesses are the backbone of

the American economy and the primary generator of

employment growth. We are committed to developing

relationships with small and mid-sized firms to assist in

their growth, ensure their success and thus contribute to

the success of our communities. We continued to lend

to credit-worthy businesses through the downturn, and

we plan to do even more as our economy improves.

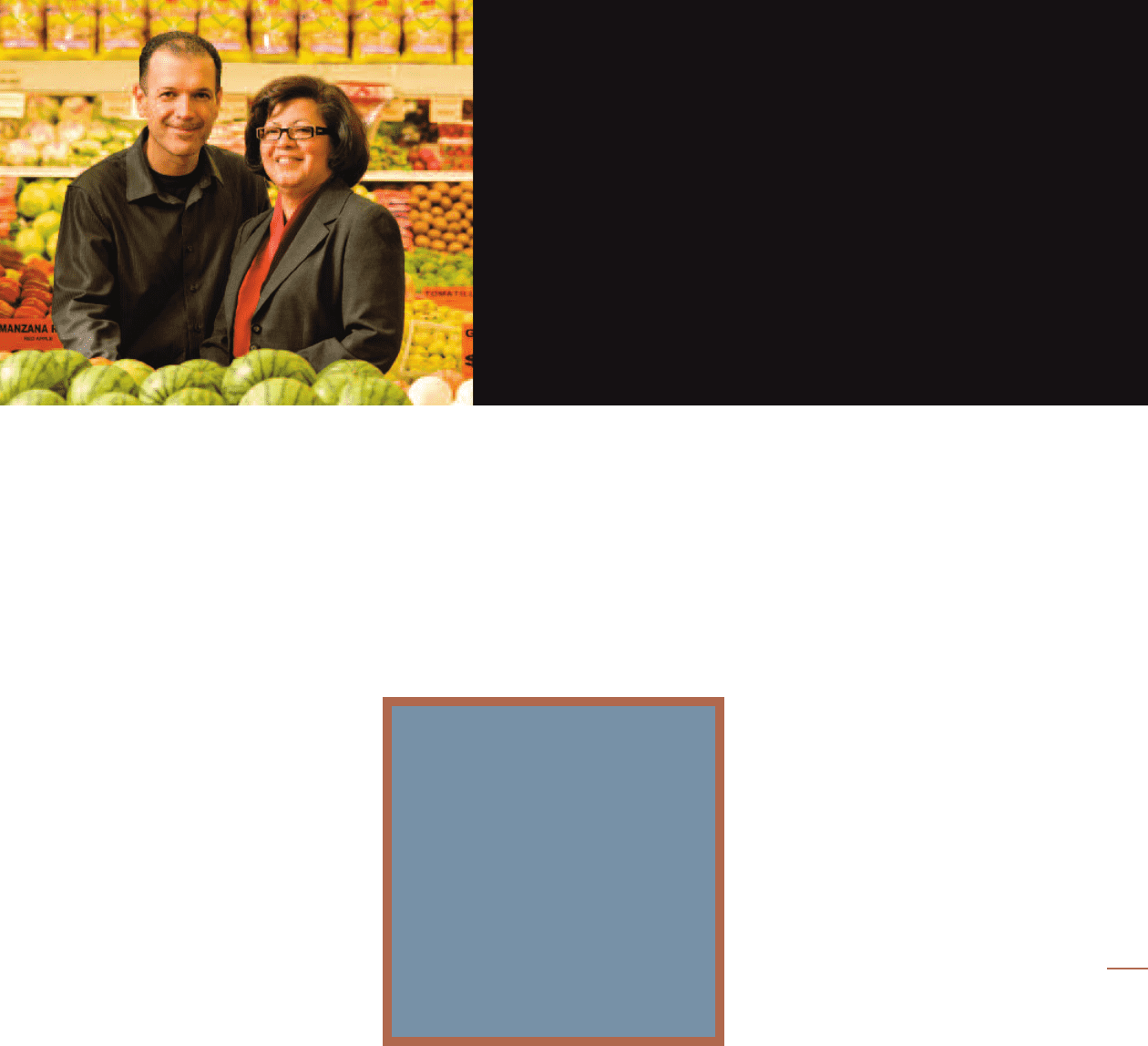

When Enrique Mendoza, a veteran store manager for a large

supermarket chain, and his partner decided to open their own

store in San Jose, California, we helped finance his dream.

A few months later we helped him add a taqueria next door.

Six months later, he acquired a second store and soon after

opened a third Santa Fe Mercado. Mendoza has more than a

dozen business deposit accounts with us and also uses our

credit card.

We are customer oriented.

We are knowledgeable

about our customers’

needs and goals and are

committed to ensuring they

have the best solutions.

We are honored by their

business and their referrals.

Santa Fe Mercado co-owner Enrique Mendoza with Oakland Main Branch manager Kim Ramirez, at his San Jose store.

11