Bank of the West 2009 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2009 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEALTH MANAGEMENT

Our wealth management services are an integral

component of Bank of the West’s solutions for our

clients with more complex financial management

needs.

Our wealth managers understand

that building and protecting

accumulated wealth is important

to our clients; so is the personal

service provided through

a single point of contact they

know and trust. Our integrated,

advisory-based approach to

financial planning is premised

upon building relationships with

clients to fully understand their financial objectives.

We enhance their plans by developing customized,

holistic strategies to meet both short- and long-term

needs and goals. This approach results in better

coordination of financial assets and liabilities, avoidance

of unnecessary fees and a broad diversification of

assets designed to optimize clients’ specific risk and

return criteria.

By closely aligning our Private Banking and Investment

Management & Trust professionals we are able to

coordinate a full complement of financial planning

services, including asset allocation and investment

management, retirement planning, portfolio analysis,

insurance and risk management, brokerage, and

Trust services. We also provide estate planning and

specialty services such as real

estate transaction finance and

business succession planning.

Faced with the unplanned

divestiture of their long-held

Chino, California dairy farm

through eminent domain

for a nearby dam, a 40-year

Bank of the West agribusiness

customer turned to our

Wealth Management team to

effectively manage their sudden increase in liquidity.

Our teams went into action modeling efficient asset

allocation portfolios and working with the client’s

attorney and accountant to discuss specific needs

related to the eminent domain exchange and the

expedited sale of their substantial dairy assets. Soon

after the sale closed, escrow proceeds were wired

to an investment management account to be prudently

managed for income and to fund future real estate

investment purchases.

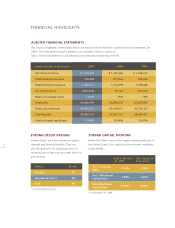

We strive to deliver

superior risk-adjusted

returns over time

through diversified

revenue streams.

8

results-oriented stewardship

The kind of bank that exercises thoughtful,