Ameriprise 2015 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2015 Ameriprise annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 | Annual Report 2015

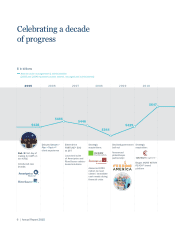

Operating earnings per diluted share

$5.59

$7.05

$8.52

$9.32

$5.17

Operating return on equity, ex. AOCI

Our strength comes from our people —

individuals who care deeply about our

clients and the company

I frequently hear from employees and advisors

about their proudest moments from the past

decade. Their comments are consistent:

We serve clients the right way and for the

long-term, earn trust and condence, and make

our communities better places. The moment

raised most often is how we handled the 2008

nancial crisis and stood by clients when other

rms couldn’t — because we had our own

nancial plan, made good decisions, managed

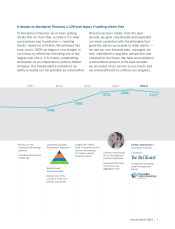

conditions. Revenue growth was tempered as

assets under management and administration

declined due to higher equity market volatility,

and client activity naturally slowed. Given that we

operate in markets around the world, the strong

U.S. dollar also impacted the value of non-dollar

assets for U.S. reporting purposes. And we

continued to manage the persistent pressure

of extremely low interest rates. However, we

offset these market headwinds because of our

consistent and prudent expense management

and strong nancial foundation, which enable us

to continue to invest for growth and return capital

to shareholders at a differentiated level.

risk well and invested for the future. This is good

perspective when considering how far Ameriprise

has come in the last ten years, and as we reect

on our 2015 results.

In this, my annual letter to shareholders, I will

update you on our progress and reinforce why I

believe we are well-situated to navigate a more

challenging operating environment and help our

clients realize their nancial goals today and in

the future.

Delivering solid results

Ameriprise delivered solid business results in

2015, a period characterized by difcult market

For the year, operating earnings grew 3% to

$1.7 billion and operating earnings per share

increased 9% to a record $9.32. In fact, with

the strength of our business model and capital

management, we’re generating one of the

highest returns in the industry — operating

return on equity, excluding accumulated other

comprehensive income grew to a record 24.3%,

up 130 basis points from a year ago.

Few nancial services companies have the ability

to invest strongly in the business while delivering

this level of return and maintaining signicant

capital exibility. For the fth consecutive year,

we returned more than 100% of our operating

2015

2014

2013

2012

2011

16.2%

19.7%

23.0%

24.3%

16.0%

2015

2014

2013

2012

2011