Ameriprise 2015 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2015 Ameriprise annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8 | Annual Report 2015

Through our investments in technology, advisors

can share information with clients more easily

and securely, and process business even faster.

We continue to see good advisor uptake of

the tools we’ve put in place, including eFile

delivery, money movement systems and our

paperless ofce.

We also enhanced our digital presence,

including incorporating responsive design within

ameriprise.com making it easy for clients to

access their information from multiple types of

devices. And we further strengthened our wealth

results in our Advice & Wealth Management

business. In 2015, client net inows in fee-

based investment advisory accounts were more

than $11 billion and overall advisor productivity

reached an all-time high of $514,000 in

operating net revenue per advisor. Operating

revenues and earnings were up nicely, even

in a more challenging environment. And

as we grow the business and navigate the

environment, we continue to manage expenses

prudently — operating margin in Advice & Wealth

Management increased 60 basis points last year

to a competitive 17.1%.

management platform, including enhancing our

research function and adding to our growing

managed account product line.

Advisors recognize the strength of the Ameriprise

value proposition. In 2015, 347 experienced,

highly productive advisors joined the rm —

bringing our three-year total to nearly 1,000

advisors — which has added thousands of new

client relationships and signicant assets to

the rm.

The combination of personal client relationships,

broad capabilities and strong reputation

translated into strong metrics and nancial

Annuities and Protection — providing important

solutions within our Condent Retirement®

approach and strengthening asset persistency

From helping clients maintain their lifestyles in

retirement to preparing for the unexpected and

leaving a legacy — we help protect assets and

retirement income. For shareholders, our Annuity

and Protection businesses are solid and stable

with strong risk characteristics that generate

attractive returns across market cycles and

contribute to our ability to retain client assets

over time.

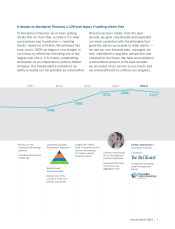

Our Condent Retirement® approach

Our exclusive Condent Retirement approach

brings together our capabilities to help address a

critical consumer need — planning and preparing

for retirement. It links together dreams, goals,

recommendations, product solutions and action

steps in a way that’s easy for people to understand.

Using the approach, clients work with their advisors

to address four key retirement needs: covering

essentials, ensuring lifestyle, preparing for the

unexpected and leaving a legacy. ®

Leaving

a legacy

Preparing for

the unexpected

Ensuring

lifestyle

Covering

essentials