American Home Shield 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 American Home Shield annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

-

146

-

147

-

148

-

149

-

150

-

151

-

152

-

153

-

154

-

155

-

156

-

157

-

158

-

159

-

160

-

161

-

162

-

163

-

164

-

165

-

166

-

167

-

168

-

169

-

170

-

171

-

172

-

173

-

174

-

175

-

176

-

177

-

178

-

179

-

180

-

181

-

182

-

183

-

184

-

185

-

186

-

187

-

188

-

189

-

190

-

191

-

192

-

193

-

194

-

195

-

196

-

197

-

198

-

199

-

200

-

201

-

202

-

203

-

204

-

205

-

206

-

207

-

208

-

209

-

210

-

211

-

212

-

213

-

214

-

215

-

216

-

217

-

218

-

219

-

220

SERVICEMASTER CO

10-K

Annual report pursuant to section 13 and 15(d)

Filed on 03/06/2012

Filed Period 12/31/2011

Table of contents

-

Page 1

SERVICEMASTER CO

10-K

Annual report pursuant to section 13 and 15(d) Filed on 03/06/2012 Filed Period 12/31/2011

-

Page 2

... jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 860 Ridge Lake Boulevard, Memphis, Tennessee 38120 (Address of principal executive offices, including zip code) (901) 597-1400 (Registrant's telephone number, including area code) Securities registered pursuant to...

-

Page 3

... held corporation and its equity shares are not publicly traded. At March 6, 2012, 1,000 shares of the registrant's common stock were outstanding, all of which were owned by CDRSVM Holding, Inc. The ServiceMaster Company is not required to file this Annual Report on Form 10-K with the Securities and...

-

Page 4

... Item 11. Executive Compensation 128 Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters 153 Item 13. Certain Relationships and Related Transactions, and Director Independence 156 Item 14. Principal Accounting Fees and Services 159 PART IV Item 15...

-

Page 5

... ("ServiceMaster," the "Company," "we," "us" or "our") is a national company serving both residential and commercial customers. Our services include lawn care, termite and pest control, home service contracts, cleaning and disaster restoration, house cleaning, furniture repair and home inspection...

-

Page 6

... and pest control services and distributes pest control products primarily under the Terminix brand name. Terminix is a leading provider of termite and pest control services in the United States, serving both residential and commercial customers. Of the Terminix segment's 2011 operating revenue, 38...

-

Page 7

... replace electrical, plumbing, central heating and central air conditioning systems, water heaters and other covered household systems and appliances and services those contracts through independent repair contractors. In 2011, 68 percent of the home service contracts written by American Home Shield...

-

Page 8

... by enabling American Home Shield to educate real estate professionals, financial institutions and insurance agencies about the benefits of home service contracts. We also believe that our size and scale improve our purchasing power, route density, marketing and operating efficiencies compared to...

-

Page 9

..., such as commercial spraywork, pest and termite commercial opportunities, servicing national accounts and adding key sales and management personnel across our network. We believe that we also are well positioned to use our competitive advantages within our existing American Home Shield network to...

-

Page 10

...-year service programs, which are renewable annually. Our customer retention rates were approximately 66.7 percent for TruGreen, 80.6 percent for Terminix Pest Control, 86.1 percent for Terminix Termite and 75.1 percent for American Home Shield for the year ended December 31, 2011. We have generally...

-

Page 11

... AND COMPETITION We compete in the residential and commercial services industry, focusing on lawn care, termite and pest control, home service contracts, cleaning and disaster restoration, house cleaning, furniture repair and home inspection. We target market segments that meet our criteria for...

-

Page 12

... of new home service contracts is the number of existing homes sold in the United States, since a home service product is often recommended by a real estate sales professional or offered by the seller of a home in conjunction with a real estate transaction. According to the National Association of...

-

Page 13

... residential real estate market place, such as real estate brokerages, financial institutions and insurance agencies and, for American Home Shield, an internal sales organization that supports these distribution channels. SERVICE MARKS, TRADEMARKS AND TRADE NAMES ServiceMaster holds various service...

-

Page 14

... effect on its reputation, business, financial condition, results of operations and cash flows. These international, federal, state, provincial and local laws and regulations include laws relating to consumer protection, wage and hour, deceptive trade practices, permitting and licensing, real estate...

-

Page 15

... payment of royalties or fees, location of branches, advertising, purchase of products by franchisees, non-competition covenants, compliance with ServiceMaster standards and franchise renewal criteria. There can be no assurance that compliance problems will not be encountered from time to time...

-

Page 16

... elsewhere in this Annual Report on Form 10-K. Risks Related to Our Business and Our Industry Adverse credit and financial market events and conditions could, among other things, impede access to or increase the cost of financing or cause our commercial customers to incur liquidity issues that could...

-

Page 17

... cannot travel to service locations due to hazardous road conditions. In addition, extreme temperatures can lead to an increase in service requests related to household systems and appliances in our American Home Shield business, resulting in higher claim frequency and costs and lower profitability...

-

Page 18

...materials, wages, employee benefits, healthcare, vehicles, insurance and other operating costs. To the extent such costs increase, we may be prevented, in whole or in part, from passing these cost increases through to our existing and prospective customers, and the rates we pay to our subcontractors...

-

Page 19

... or products could impact our reputation, business, financial position, results of operations and cash flows. Our financial performance is affected by changes in the services and products we offer our customers. For example, when Terminix transitioned from offering primarily bait termite services to...

-

Page 20

... laws relating to consumer protection, wage and hour requirements, franchising, the employment of immigrants, labor relations, permitting and licensing, workers' safety, the environment, insurance and home service contracts, employee benefits, marketing (including, without limitation, telemarketing...

-

Page 21

... adversely impact our business, financial position, results of operations and cash flows. If we fail to protect the security of personal information about our customers, we could be subject to interruption of our business operations, private litigation, reputational damage and costly penalties. We...

-

Page 22

... effectively depends in part on our rights to service marks, trademarks, trade names and other intellectual property rights we own or license, particularly our registered brand names, ServiceMaster, Terminix, TruGreen, Merry Maids, ServiceMaster Clean, American Home Shield, AmeriSpec and Furniture...

-

Page 23

...of operations and cash flows, including by limiting our capacity to monitor, operate and control our operations effectively. Failures of our information technology systems could also lead to violations of privacy laws, regulations, trade guidelines or practices related to our customers and employees...

-

Page 24

... our ability to solicit potential customers or employees. To the extent that such restrictive covenants prevent us from taking advantage of business opportunities, or if we fail to comply with them, our business, financial position, results of operations and cash flows may be adversely impacted...

-

Page 25

... estimated fair value less cost to sell in accordance with applicable accounting standards. Upon completion of the sale, a $6.2 million loss on sale ($1.9 million, net of tax) was recorded in loss from discontinued operations, net of tax. In the second quarter of 2010, we recorded a pre-tax non-cash...

-

Page 26

... less debt or with comparable debt on more favorable terms and, as a result, they may be better positioned to withstand economic downturns; our ability to refinance debt may be limited or the associated costs may increase; our flexibility to adjust to changing market conditions and ability to...

-

Page 27

...may be beyond our control, and as described under "Risks Relating to Our Business and Our Industry" above. The payment of ordinary and extraordinary dividends by our subsidiaries that are regulated as insurance, home service, or similar companies is subject to applicable state law limitations. If we...

-

Page 28

... rates would increase the cost of servicing our debt and could materially reduce our profitability and cash flows. As of December 31, 2011, each one percentage point change in interest rates would result in approximately an $11.0 million change in the annual interest expense on our Term Facilities...

-

Page 29

... our other debt may prevent us from taking actions that we believe would be in the best interest of our business and may make it difficult for us to execute our business strategy successfully or effectively compete with companies that are not similarly restricted. We may also incur future debt...

-

Page 30

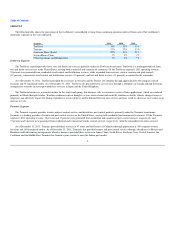

... the corporate headquarters, call center facility, offices, training facilities and warehouse described above, are suitable and adequate to support the current needs of its business.

Operating Company

Owned Facilities

Leased Facilities

TruGreen Terminix American Home Shield ServiceMaster Clean...

-

Page 31

... and commercial liability, wage and hour and environmental proceedings. The Company has entered into settlement agreements in certain cases, including with respect to putative collective and class actions, which are subject to court approval. As previously reported, American Home Shield Corporation...

-

Page 32

... The Company's sole class of issued equity is common stock. As of March 6, 2012, all of the Company's common stock was owned by CDRSVM Holding, Inc. On July 24, 2007, the Company completed the Merger pursuant to which the Company's publicly traded securities were cancelled in exchange for cash. As...

-

Page 33

... Contents

include lease termination and other costs related to the closing of the Santa Rosa call center; employee retention, severance and other costs related to the Company's consolidation of its corporate headquarters into its operations support center in Memphis, Tennessee and the closing of its...

-

Page 34

..., reflecting the net effect of (i) $6.6 million recorded in the year ended December 31, 2011, which include recruiting costs and signing bonuses related to the hiring in 2011 of our Chief Executive Officer ("CEO"), Chief Financial Officer ("CFO") and President of ServiceMaster Clean and Merry Maids...

-

Page 35

... the Company has executed to date for 2012, the Company projects that fuel prices will increase our fuel costs by $10 million to $15 million for 2012 compared to 2011. After adjusting for the impact of year over year changes in the number of covered employees, health care and related costs increased...

-

Page 36

... change as a percentage of revenue primarily reflects an increase in incentive compensation expense, contract claims costs at American Home Shield and product distribution revenue at Terminix, which has lower margins than termite or pest revenue, offset, in part, by the favorable impact of acquiring...

-

Page 37

... income on other cash balances. The effective tax rate on income from continuing operations was a provision of 39.3 percent for the year ended December 31, 2011 compared to a provision of 38.6 percent for the year ended December 31, 2010 and a benefit of 300.6 percent for the year ended December 31...

-

Page 38

... Business Machines Corporation ("IBM") pursuant to which IBM provides information technology operations and applications development services to the Company. These services were phased in during the first half of 2009. For the year ended December 31, 2009, these charges included transition fees...

-

Page 39

... Accounts Customer Retention Rate Terminix- Growth (Reduction) in Pest Control Customers Pest Control Customer Retention Rate (Reduction) Growth in Termite Customers Termite Customer Retention Rate American Home Shield- Growth in Home Service Contracts Customer Retention Rate(1) (1) Segment Review...

-

Page 40

... accounting and non-cash stock-based compensation expense may provide an additional means for comparing the Company's performance to the performance of other companies by eliminating the impact of differently structured equity-based, long-term incentive plans (although care must be taken in making...

-

Page 41

... the business to be understated.

•

•

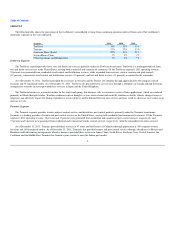

Operating Revenues and Comparable Operating Performance by operating segment are as follows:

Year Ended Dec. 31, (In thousands) 2011 2010 2009

Operating Revenue: TruGreen Terminix American Home Shield ServiceMaster Clean Other Operations and Headquarters...

-

Page 42

... (loss) to Adjusted EBITDA and Comparable Operating Performance for the periods presented.

(in thousands)

Other American Operations Home ServiceMaster and TruGreen Terminix Shield Clean Headquarters

Total

Year Ended Dec. 31, 2011 Operating income $129,324 $220,622 $ 94,869 (loss)(1) Depreciation...

-

Page 43

...)

Other American Operations Home ServiceMaster and TruGreen Terminix Shield Clean Headquarters

Total

Year Ended Dec. 31, 2010 Operating income (loss) (1) Depreciation and amortization expense EBITDA Interest and net investment income(2) Residual value guarantee charge(8) Adjusted EBITDA Non-cash...

-

Page 44

...)

Other American Operations Home ServiceMaster and TruGreen Terminix Shield Clean Headquarters

Total

Year Ended Dec. 31, 2009 Operating income (loss) (1) Depreciation and amortization expense EBITDA Interest and net investment income(2) Residual value guarantee charge(8) Non-cash trade name...

-

Page 45

(Loss) income from discontinued operations, net of income taxes Net Income (Loss) 42

(27,016) (31,998) 7,353 $ 40,821 $ (14,559) $ 13,495

-

Page 46

... increase in Comparable Operating Performance for the year ended December 31, 2011 compared to 2010. Revenue from core lawn service customers, which was 55 percent of the segment's operating revenue in 2011, was comparable to 2010, reflecting a 4.3 percent increase in the average application price...

-

Page 47

... to improve customer service, offset, in part, by a reduction in fuel and fertilizer prices and health care costs. Terminix Segment The Terminix segment, which provides termite and pest control services and distributes pest control products, reported a 3.1 percent increase in operating revenue, a 10...

-

Page 48

...product distribution revenue, which has lower margins than pest or termite revenue. American Home Shield Segment The American Home Shield segment, which provides home service contracts to consumers that cover heating, ventilation, air conditioning, plumbing and other systems and appliances, reported...

-

Page 49

... rate. American Home Shield's sales in the real estate channel were negatively impacted by softness in the home resale market, offset, in part, by growth in consumer sales. American Home Shield's Comparable Operating Performance as a percentage of revenue decreased to 17.8 percent for the year...

-

Page 50

...company-owned branches to existing and new franchisees in the fourth quarter of 2011, offset, in part, by a 630 bps increase in the customer retention rate. Royalty fees, which were 19 percent of Merry Maids' revenue in 2011, increased 6.3 percent in 2011 compared to 2010, primarily driven by market...

-

Page 51

... in legal related expense, sales and marketing expense, incentive compensation expense and healthcare costs, offset, in part, by an increase in other overhead and support costs. The Comparable Operating Performance of SMAC and the Company's headquarters functions declined $12.3 million for the year...

-

Page 52

... adjustments could be significant to the sale price. In 2010 and 2009, the Company recorded pre-tax non-cash impairment charges of $46.9 million ($28.7 million, net of tax) and $1.4 million ($0.9 million, net of tax), respectively, associated with the goodwill and trade name at TruGreen LandCare in...

-

Page 53

... tax benefits. Net cash provided from operating activities in 2010 was comprised of $253.8 million in earnings adjusted for non-cash charges, offset, in part, by $10.8 in cash payments related to restructuring charges and a $20.5 million increase in cash required for working capital. For the year...

-

Page 54

... December 31, 2011, compared with $393.3 million as of December 31, 2010. As of December 31, 2011 and 2010, $226.2 million and $242.2 million, respectively, of the cash and short- and long-term marketable securities balances are associated with regulatory requirements at American Home Shield and for...

-

Page 55

...million in its Consolidated Statements of Operations for the year ended December 31, 2011 for write-offs of unamortized debt issuance costs related to the extinguished debt. In February 2012, the Company sold in transactions exempt from registration under the Securities Act of 1933, as amended, $600...

-

Page 56

... results, cash requirements and financial condition and general business conditions. Our insurance subsidiaries and home services and similar subsidiaries (through which we conduct our American Home Shield business) are subject to significant regulatory restrictions under the laws and regulations of...

-

Page 57

...

Principal repayments* Capital leases Estimated interest payments(1) Non-cancelable operating leases(2) Purchase obligations: Supply agreements and other(3) Outsourcing agreements(4) Other long-term liabilities:* Insurance claims Discontinued Operations Other, including deferred compensation trust...

-

Page 58

... services at agreed-upon pricing for up to 24 months. Due to the uncertainty with respect to the timing of future cash flows associated with unrecognized tax benefits at December 31, 2011, the Company is unable to reasonably estimate the period of cash settlement with the respective taxing authority...

-

Page 59

... to termite baiting, termite inspection and protection contracts and pest contracts, as well as home service contracts. These costs vary with and are directly related to a new sale, and will be amortized over the life of the related contract. Current deferred tax assets increased from prior year...

-

Page 60

... Home Shield business. Other accrued liabilities decreased from prior year levels, reflecting a reduction in reserve levels for unrecognized tax benefits. Deferred revenue increased from prior year levels, reflecting an increase in home service contracts written at American Home Shield. Long-term...

-

Page 61

...systems. Termite services using baiting systems, termite inspection and protection contracts, as well as home service contracts, are frequently sold through annual contracts for a one-time, upfront payment. Direct costs of these contracts (service costs for termite contracts and claim costs for home...

-

Page 62

... not be required. For the 2011 annual goodwill impairment review performed as of October 1, 2011, the Company performed qualitative assessments on the Terminix, American Home Shield and ServiceMaster Clean reporting units. Based on these assessments, the Company determined that, more likely than...

-

Page 63

...estimates, which are based on assumed growth rates. The discount rates used in the DCF analyses are intended to reflect the risks inherent in the future cash flows of the respective reporting units. In addition, the market-based comparable and transaction approaches utilize comparable company public...

-

Page 64

...years ended December 31, 2011, 2010 and 2009, as well as the remaining value of the trade names not subject to amortization by business segment as of December 31, 2011 and 2010 are as follows:

(In thousands)

American Other Home ServiceMaster Operations & TruGreen Terminix Shield Clean Headquarters...

-

Page 65

... services; expansion opportunities in domestic and international territories; our estimates of market segment size and segment share; expectations for enhancing American Home Shield's ability to interact with customers through its new CRM system; projections for increases in existing home re-sales...

-

Page 66

... of statutes of limitations; the valuation of marketable securities; estimates of accruals for self-insured claims related to workers' compensation, auto and general liability risks; estimates of accruals for home service contract claims; estimates of future payments under operating and capital...

-

Page 67

..., representative or class action litigation; labor organizing activities at the Company or its franchisees; risk of liabilities being passed through from our franchisees; risks associated with acquisitions, including, without limitation, acquired liabilities, retaining customers from businesses...

-

Page 68

...consumer spending, labor wages, fuel prices, fertilizer and other material costs, home re-sales, unemployment rates, insurance costs and medical costs could have a material adverse impact on future results of operations. The Company does not hold or issue derivative financial instruments for trading...

-

Page 69

...Before the application of the incremental borrowing margin (2.50 percent as of December 31, 2011). Interest rate swap agreements in effect as of December 31, 2011 are as follows:

Trade Date

Effective Date

Expiration Date

Notional Amount

Weighted Average Fixed Rate(1)

Floating Rate

February 15...

-

Page 70

... about the Company's debt as of December 31, 2011 (after considering the effect of the interest rate swap agreements), including the principal cash payments and related weighted-average interest rates by expected maturity dates based on applicable rates at December 31, 2011.

Expected Year of...

-

Page 71

... 2.8%

Before the application of the incremental borrowing margin (2.5 percent as of December 31, 2011).

The Company is exposed to market risk for changes in fuel prices through the consumption of fuel by its vehicle fleet in the delivery of services to its customers. The Company uses approximately...

-

Page 72

... REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors of The ServiceMaster Company Memphis, Tennessee We have audited the accompanying consolidated statements of financial position of The ServiceMaster Company and subsidiaries (the "Company") as of December 31, 2011 and 2010, and the related...

-

Page 73

...

Year Ended December 31, 2011 2010 2009

Operating Revenue Operating Costs and Expenses: Cost of services rendered and products sold Selling and administrative expenses Amortization expense Trade name impairment Restructuring charges Total operating costs and expenses Operating Income Non-operating...

-

Page 74

...-insured claims and related expenses Accrued interest payable Other Deferred revenue Liabilities of discontinued operations Current portion of long-term debt Total Current Liabilities Long-Term Debt Other Long-Term Liabilities: Deferred taxes Liabilities of discontinued operations Other long-term...

-

Page 75

71

-

Page 76

... 31, 2010 Net income Other comprehensive income, net of tax: Net unrealized loss on securities Net unrealized gain on derivative instruments Foreign currency translation Total comprehensive income Stock-based employee compensation -contribution from Holdings Balance December 31, 2011

$ - $1,438...

-

Page 77

...,789) (23,601) Cash payments related to restructuring charges Change in working capital, net of acquisitions: (2,856) (6,757) 10,245 Current income taxes (22,992) (32,914) (13,300) Receivables 1,538 (238) 1,375 Inventories and other current assets 2,581 11,899 (17,936) Accounts payable 22,134 (1,928...

-

Page 78

... of management estimates relate to revenue recognition; the allowance for uncollectible receivables; accruals for self-insured retention limits related to medical, workers' compensation, auto and general liability insurance claims; accruals for home service contracts and termite damage claims; the...

-

Page 79

...December 31, 2011 and 2010, respectively. Deferred revenue consists primarily of payments received for annual contracts relating to home service contracts, termite baiting, termite inspection, pest control and lawn care services. Deferred Customer Acquisition Costs: Customer acquisition costs, which...

-

Page 80

... market. The Company's inventory primarily consists of finished goods to be used on the customers' premises or sold to franchisees. Property and Equipment, Intangible Assets and Goodwill: Property and equipment consist of the following:

Balance as of December 31, (In millions) 2011 2010

Estimated...

-

Page 81

... not be required. For the 2011 annual goodwill impairment review performed as of October 1, 2011, the Company performed qualitative assessments on the Terminix, American Home Shield and ServiceMaster Clean reporting units. Based on these assessments, the Company determined that, more likely than...

-

Page 82

...estimates, which are based on assumed growth rates. The discount rates used in the DCF analyses are intended to reflect the risks inherent in the future cash flows of the respective reporting units. In addition, the market-based comparable and transaction approaches utilize comparable company public...

-

Page 83

...years ended December 31, 2011, 2010 and 2009, as well as the remaining value of the trade names not subject to amortization by business segment as of December 31, 2011 and 2010 are as follows:

(In thousands)

American Other Home ServiceMaster Operations & TruGreen Terminix Shield Clean Headquarters...

-

Page 84

... potential interest and penalties related to its uncertain tax positions in income tax expense. Stock-Based Compensation: The Company accounts for stock-based compensation under accounting standards for share based payments, which require that stock options, restricted stock units and share grants...

-

Page 85

... financial statements. Note 2. Acquisition of ServiceMaster On the Closing Date, ServiceMaster was acquired pursuant to the Merger, and, immediately following the completion of the Merger, all of the outstanding common stock of Holdings, the ultimate parent company of ServiceMaster, was owned by...

-

Page 86

... The Terminix segment provides termite and pest control services to residential and commercial customers. The American Home Shield segment provides home service contracts to consumers that cover heating, ventilation, air conditioning, plumbing and other home systems and appliances. The ServiceMaster...

-

Page 87

... directly related to its operations. Segment information for continuing operations is presented below:

Year Ended Dec. 31, (In thousands) 2011 2010 2009

Operating Revenue: TruGreen Terminix American Home Shield ServiceMaster Clean Other Operations and Headquarters Total Operating Revenue Operating...

-

Page 88

... Statements (Continued) Note 3. Business Segment Reporting (Continued)

Year Ended Dec. 31, (In thousands) 2011 2010 2009

Depreciation & Amortization Expense: TruGreen Terminix American Home Shield ServiceMaster Clean Other Operations and Headquarters Total Depreciation & Amortization Expense...

-

Page 89

... costs. Presented below is a summary of restructuring charges (credits) by segment:

Year Ended Dec. 31, (In thousands) 2011 2010 2009

(4) (5)

Restructuring charges (credits): $ 1,115 $ TruGreen 3,560 Terminix - American Home Shield 36 ServiceMaster Clean 3,451 Other Operations and Headquarters...

-

Page 90

... of the amortization of tax deductible goodwill and foreign exchange rate changes. For 2011, the amount shown in the Other Operations & Headquarters column also reflects $0.8 million related to the sale of certain Merry Maids company-owned branches to existing and new franchisees. There were no...

-

Page 91

... tax benefits would impact the effective tax rate if recognized. A reconciliation of the beginning and ending amount of gross unrecognized tax benefits is as follows:

Year Ended Dec. 31, (In millions) 2011 2010 2009

Gross unrecognized tax benefits at beginning of period Increases in tax positions...

-

Page 92

...

In the effective tax rate reconciliation above, the state rate benefit for the year ended December 31, 2009 is primarily the result of a change in the state tax rates used to measure deferred taxes. The effective tax rate for discontinued operations for the years ended December 31, 2011, 2010 and...

-

Page 93

... reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting and income tax purposes. The deferred tax asset primarily reflects the impact of future tax deductions related to the Company's accruals and certain net operating loss...

-

Page 94

... unless certain business units of the Company are sold. As of December 31, 2011, the Company had deferred tax assets, net of valuation allowances, of $137.7 million for federal and state net operating loss and capital loss carryforwards which expire at various dates up to 2031. The Company also had...

-

Page 95

... at their estimated fair values as of the acquisition dates. Current Year During the year ended December 31, 2011, the Company completed several lawn care and pest control and termite acquisitions for a total net purchase price of $57.1 million. Related to these acquisitions, the Company recorded...

-

Page 96

... 2010 and 2009 the Company recorded pre-tax non-cash impairment charges of $46.9 million ($28.7 million, net of tax) and $1.4 million ($0.9 million, net of tax), respectively, associated with the goodwill and trade name at its TruGreen LandCare business in (loss) income from discontinued operations...

-

Page 97

...tax) in 2010 and 2009, respectively. The table below summarizes the activity during the year ended December 31, 2011 for the remaining liabilities from operations that were discontinued in years prior to 2011. The remaining obligations primarily relate to long-term self-insurance claims. The Company...

-

Page 98

... information technology operations and applications development services to the Company. These services were phased in during the first half of 2009. For the year ended December 31, 2009, these charges included transition fees paid to IBM of $7.6 million, employee retention and severance costs of...

-

Page 99

... the Company expects to renew the leases or substitute another location and lease. Rental expense for the years ended December 31, 2011, 2010 and 2009 was $76.7 million, $104.7 million and $106.9 million, respectively. Based on leases in place as of December 31, 2011, future long-term non-cancelable...

-

Page 100

... American Home Shield business are made based on the Company's claims experience and actuarial projections. Termite damage claim accruals are recorded based on both the historical rates of claims incurred within a contract year and the cost per claim. Current activity could differ causing a change...

-

Page 101

... governmental authorities. These proceedings include, on an individual, collective, representative and class action basis, regulatory, insured and uninsured employment, general and commercial liability, wage and hour and environmental proceedings. The Company has entered into settlement agreements...

-

Page 102

... interest payable to Holdings as of December 31, 2011. Note 11. Employee Benefit Plans Effective January 2, 2007, the Company approved a long-term incentive plan (the "LTIP") designed to reward certain employees based on the accumulated three-year Company financial performance against pre-tax income...

-

Page 103

... from 2010 to 2011 reflects the amortization of fair value adjustments related to purchase accounting, which increases the effective interest rate from the coupon rates shown above. In connection with the completion of the Transactions, the Company entered into (i) the senior secured term loan...

-

Page 104

... margin (2.50 percent as of December 31, 2011). The changes in interest rate swap agreements in effect for the years ended December 31, 2011, 2010 and 2009, as well as the cumulative interest rate swaps outstanding as of December 31, 2011 and 2010 are as follows:

(In thousands)

Notional Amount...

-

Page 105

...its Consolidated Statements of Operations for the year ended December 31, 2009 related to these retirements. During the fourth quarter of 2011, the Company purchased $65.0 million in face value of the 2015 Notes from Holdings for a cost of $68.0 million, which included payment of accrued interest of...

-

Page 106

...Statements (Continued) Note 12. Long-Term Debt (Continued) $0.8 million in its Consolidated Statements of Operations for the year ended December 31, 2011 for write-offs of unamortized debt issuance costs related to the extinguished debt. In February 2012, the Company sold in transactions exempt from...

-

Page 107

... Company's short- and long-term investments in debt and equity securities as of December 31, 2011 and 2010 is as follows:

(In thousands)

Amortized Cost

Gross Unrealized Gross Unrealized Gains Losses Fair Value

Available-for-sale and trading securities, December 31, 2011: Debt securities Equity...

-

Page 108

... as of December 31, 2011 and 2010, respectively. As of December 31, 2011 and 2010, $226.2 million and $242.2 million, respectively, of the cash and short- and long-term marketable securities balance are associated with regulatory requirements at American Home Shield and for other purposes. Such...

-

Page 109

... times, limit the amount available to the Company from the sale of these interests. As of December 31, 2011, the amount of eligible receivables was approximately $31.1 million. During the years ended December 31, 2011, 2010 and 2009, there were no transfers of interests in the pool of trade accounts...

-

Page 110

... Income (Continued) The following table summarizes the activity in other comprehensive income (loss) and the related tax effects.

Year Ended Dec. 31, (In thousands) 2011 2010 2009

Net unrealized gains (losses) on securities: Unrealized gains(1) Reclassification adjustment for net (gains...

-

Page 111

...share of Holdings stock on the grant date. Any stock options granted will generally have a term of ten years and vesting will be subject to an employee's continued employment. The board of directors of Holdings, or a committee designated by it, may accelerate the vesting of an option at any time. In...

-

Page 112

... granted ServiceMaster's executives, officers and employees options to purchase 2,280,391, 284,400 and 906,000 shares of Holdings common stock in 2011, 2010 and 2009, respectively, at an exercise price of $11.00 per share for options issued in 2011 and $10.00 per share for options issued in 2010 and...

-

Page 113

... of option activity under the MSIP as of December 31, 2011, and changes during the year then ended is presented below:

Stock Options

Weighted Avg. Exercise Price

Weighted Avg. Remaining Contractual Term (in years)

Total outstanding, December 31, 2010 Granted to employees Exercised Forfeited...

-

Page 114

... cost related to non-vested stock options and RSUs granted by Holdings under the MSIP. These remaining costs are expected to be recognized over a weighted-average period of 2.9 years. In September 2010, ServiceMaster announced the retirement of its former CEO with a retirement date of March 31, 2011...

-

Page 115

... Prices In Other Significant December 31, 2010 Balance Active Observable Unobservable Sheet Carrying Markets Carrying Estimated Inputs Inputs Locations Value (Level 1) Value Fair Value (Level 2) (Level 3) Long-term marketable securities $ 10,834 $ 10,834 Marketable securities and longterm marketable...

-

Page 116

Balance as of December 31, 2011 (1)

$

(733)

Gains (losses) included in earnings are reported in cost of services rendered and products sold. 111

-

Page 117

..., 2011

Fuel swap contracts

$

(7,382)

$

$

Interest rate swap contracts

$

28,340

$

9,739 Cost of services rendered and products sold 271 Loss (income) from discontinued operations, net of income tax (37,613)Interest expense

Derivatives designated as Cash Flow Hedge Relationships

Effective...

-

Page 118

... with accounting standards as cash flow hedge relationships were insignificant during the year ended December 31, 2011. As of December 31, 2011, the Company had fuel swap contracts to pay fixed prices for fuel with an aggregate notional amount of $45.5 million, maturing through 2012. Under the terms...

-

Page 119

... of Operations For the Year Ended December 31, 2011 (In thousands)

The ServiceMaster NonCompany Guarantors Guarantors Eliminations Consolidated

Operating Revenue Operating Costs and Expenses: Cost of services rendered and products sold Selling and administrative expenses Amortization expense Trade...

-

Page 120

... COMPANY AND SUBSIDIARIES Condensed Consolidating Statement of Operations For the Year Ended December 31, 2010 (In thousands)

The ServiceMaster NonCompany Guarantors Guarantors Eliminations Consolidated

Operating Revenue Operating Costs and Expenses: Cost of services rendered and products sold...

-

Page 121

..., 2009 (In thousands)

The ServiceMaster NonCompany Guarantors Guarantors Eliminations Consolidated

$ - $2,284,625 $ 765,609 $ (72,349)$2,977,885 Operating Revenue Operating Costs and Expenses: Cost of services rendered and - 1,419,278 343,011 (71,038) 1,691,251 products sold 9,582 505,945 315,220...

-

Page 122

...and related expenses Self-insured claims and related expenses Accrued interest payable Other Deferred revenue Liabilities of discontinued operations Current portion of long-term debt Total Current Liabilities Long-Term Debt Other Long-Term Liabilities: Deferred taxes Intercompany payable Liabilities...

-

Page 123

117

-

Page 124

...and related expenses Self-insured claims and related expenses Accrued interest payable Other Deferred revenue Liabilities of discontinued operations Current portion of long-term debt Total Current Liabilities Long-Term Debt Other Long-Term Liabilities: Deferred taxes Intercompany payable Liabilities...

-

Page 125

118

-

Page 126

... Investing Activities from Continuing Operations: - (68,189) (28,351) - (96,540) Property additions - 4,433 172 - 4,605 Sale of equipment and other assets Acquisition of The ServiceMaster (35) - - - (35) Company Other business acquisitions, net of - (43,316) (1,049) - (44,365) cash acquired - (1,900...

-

Page 127

...from Investing Activities from Continuing Operations: - (82,594) (51,640) - (134,234) Property additions - 1,003 352 - 1,355 Sale of equipment and other assets Acquisition of The ServiceMaster (2,245) - - - (2,245) Company Other business acquisitions, net of - (57,724) (217) - (57,941) cash acquired...

-

Page 128

... 1,654 Sale of equipment and other assets Acquisition of The ServiceMaster (1,695) - - - (1,695) Company Other business acquisitions, net of - (32,647) - - (32,647) cash acquired Notes receivable, financial - - 6,151 - 6,151 investments and securities, net Net Cash Used for Investing Activities from...

-

Page 129

...of Contents

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors of The ServiceMaster Company Memphis, Tennessee We have audited the internal control over financial reporting of The ServiceMaster Company and subsidiaries (the "Company") as of December 31, 2011, based on...

-

Page 130

... discussed in the "Interim Reporting" section in the Significant Accounting Policies, for interim accounting purposes, TruGreen and other business segments of the Company incur pre-season advertising costs. In addition, TruGreen incurs costs related to annual repairs and maintenance procedures that...

-

Page 131

... of the end of the period covered by this Annual Report on Form 10-K. ServiceMaster's disclosure controls and procedures include a roll-up of financial and non-financial reporting that is consolidated in the principal executive office of ServiceMaster in Memphis, Tennessee. Messrs. Mullany and Cregg...

-

Page 132

... LLP, the Company's independent registered public accounting firm, has issued an attestation report on the effectiveness of our internal control over financial reporting as of December 31, 2011. This attestation report is included in Item 8 of this Annual Report on Form 10-K. Changes in Internal...

-

Page 133

...a management consultant and experience as a director of other consumer-oriented service businesses with nationwide locations that are similar to ServiceMaster's business structure give him beneficial insight into the Company's capital and liquidity needs, in addition to its challenges, opportunities...

-

Page 134

..., Furniture Medic & AmeriSpec 2011 David J. Crawford 54 President & Chief Operating Officer, American Home Shield 2005 Roger A. Cregg 55 Senior Vice President & Chief Financial Officer 2011 Charles M. Fallon 49 President, Terminix 2011 Greerson G. McMullen 49 Senior Vice President, General Counsel...

-

Page 135

... who requests it by writing to the Corporate Secretary at the following address: The ServiceMaster Company, 860 Ridge Lake Boulevard, Memphis, Tennessee 38120. The Company intends to post on its website all disclosures required by law or regulation, including the SEC's Form 8-K rules, related to...

-

Page 136

...term Company (and, where applicable, business unit) performance goals; Stock, RSUs and stock options to motivate executives to achieve long-term performance goals and to provide equity ownership of Holdings to our executives to ensure goal alignment with Holdings' stockholders; and Employee benefits...

-

Page 137

... Aon Hewitt in 2011 to conduct a total market review to determine whether executive officer total compensation opportunities were competitive. Companies used for the executive compensation pay comparison included a broad group of companies similar in size to ServiceMaster. In consultation with...

-

Page 138

... data provided by Aon Hewitt in 2011 and adjusted it to mirror general market merit increases, as identified in market salary increase surveys sponsored by compensation consulting organizations. We then evaluated base pay and annual bonuses for our executives as discussed below. Differences in total...

-

Page 139

... his calculated bonus as Senior Vice President, Controller and Chief Accounting Officer. The actual awards are calculated based on year-end salary. To encourage our executive officers to focus on short-term Company (and, where applicable, business unit) goals and financial performance, incentives...

-

Page 140

...at the Terminix and corporate consolidated levels, respectively. For executive officers holding positions within corporate headquarters functions, such as the CEO and CFO positions, ABP payments are based 100 percent on overall Company performance. For executive officers in charge of a business unit...

-

Page 141

...achieving the corporate ACOP and the business unit revenue components. The 2011 ABP target payout opportunity for each participating NEO (see table below) was based on our review of Peer Group data and the importance of the NEO's position relative to the overall financial success of the Company. The...

-

Page 142

... 366,238

Messrs. Mullany and Cregg joined the company during 2011 and as such received a pro-rated total bonus award based on the number of days employed by the Company during 2011. Although not applicable due to the Company's performance in 2011, Messrs. Mullany and Cregg were guaranteed minimum...

-

Page 143

... long-term growth and performance. For 2011, our NEOs participated in the MSIP. MSIP The MSIP provides certain key employees of ServiceMaster (including all of our NEOs) with the opportunity to invest in shares of Holdings' common stock, receive RSUs and to receive options to purchase shares...

-

Page 144

.... The costs of these transactions are borne by the Company and are reflected in our financial statements. We believe that the opportunity to purchase shares and to receive options to purchase shares of Holdings' stock and grants of RSUs encourages our executive officers to focus on our long-term...

-

Page 145

...450,000 stock options following his retirement. Those shares were also subsequently repurchased by Holdings in 2011 at the fair market value ($11 per share) on the date of repurchase. Retirement Benefits Employees, including the NEOs, are generally eligible to participate in the ServiceMaster Profit...

-

Page 146

... by the Board. Employment Arrangements The Company generally executes an offer of employment prior to the time an executive joins the Company, which describes the basic terms of the executive's employment, including his or her start date, starting salary and ABP bonus target and any signing bonus or...

-

Page 147

... effect at the time employment is terminated. The terms of these post-termination arrangements are described in detail below under the Potential Payments Upon Termination or Change in Control section in this Item 11. REPORT OF THE BOARD OF DIRECTORS The Company's Board of Directors has reviewed the...

-

Page 148

... Spainhour Former Chief Executive Officer

Year

Salary ($)

Bonus ($)

Non-Equity Stock Option Incentive Plan All Other Awards Awards Compensation Compensation ($)(1) ($)(2) ($) ($)(3) Total ($) 427,338 161,140 8,431,746

2011 856,482(4) 2,422,662(5) 950,004 3,614,120

2011 246,250(6) 2010 976,250...

-

Page 149

...'s 2011 bonus represents a discretionary bonus paid to Mr. Brackett for his leadership as President of both the TruGreen and Terminix businesses for a substantial portion of the year. This amount represents a sign-on bonus of $400,000 paid at the commencement of Mr. Coba's service with the Company...

-

Page 150

...The PSRP is the Company's tax-qualified retirement savings plan. Tax payments related to moving expenses were paid to Messrs. Mullany and Cregg. Mr. Mullany's perquisites include personal use of the corporate aircraft ($68,130), reimbursement of personal air transportation costs ($31,415), personal...

-

Page 151

... option awards are disclosed in the Stock-Based Compensation footnote in the audited financial statements for the fiscal year ended December 31, 2011 included in Item 8 of this Annual Report on Form 10-K. In addition, for the Superperformance Options, the likelihood of achieving the market condition...

-

Page 152

...nonqualified stock options to purchase five shares at an exercise price equal to the fair market value of a share of common stock at the time of the option grant ("Matching Options"). The Matching Options vest at a rate of one-fourth per year on each of the first four anniversaries of the grant date...

-

Page 153

... his service time with the Company in 2011. Base salary, target annual bonus and all other compensation are subject to approval each year by the Board. In addition, the offer letters provided that each would be offered a grant of stock options to be made in connection with their purchase of Holdings...

-

Page 154

...-Long-Term Incentive Plan above. See Potential Payments Upon Termination or Change in Control below for information regarding the cancellation or acceleration of vesting of stock options and RSUs upon certain terminations of employment or a change in control. Outstanding Equity Awards at Fiscal Year...

-

Page 155

... $25 per share for 20 consecutive trading days. Fair market value as of December 31, 2011 of $14 per share was determined by Holdings' Compensation Committee.

(3)

(4)

Option Exercises and Stock Vested (2011)

Named Executive Officer

Option Awards Number of Value Shares Aquired Realized on on...

-

Page 156

.... Spainhour exercised 450,000 stock options following his retirement. Those shares were also subsequently repurchased by Holdings in 2011 at the fair market value ($11 per share) on the date of repurchase. The Company will continue medical, prescription drug and life insurance for Mr. Spainhour and...

-

Page 157

...would be payable to the terminated executive at the same time as annual bonuses are paid to other executives for the applicable year. Mr. David Martin, as a member of senior management, would be eligible for the same severance benefits as stated above. MSIP If an executive's employment is terminated...

-

Page 158

.... The shares Mr. Spainhour acquired pursuant to the stock option exercise were later repurchased by the Company following a specified holding period. If an executive's employment terminates by reason of death or disability before there is a public offering of the shares, Holdings and certain Equity...

-

Page 159

... affiliates) of 50 percent or more of the voting power of Holdings' voting stock (other than an acquisition by Holdings or by a benefit plan of Holdings); a change in a majority of Holdings' Board (other than by action of the incumbent Board members); a merger, consolidation or similar transaction...

-

Page 160

... services in exchange for a fee. For a discussion of this agreement and other agreements between the Company, Holdings and the Equity Sponsors, see Item 13 of this Annual Report on Form 10-K. The Company does not currently separately compensate our directors for their service on our Board. Board...

-

Page 161

No member of the Company's Board was at any time during 2011 an officer or employee of the Company or any of our subsidiaries nor is any such person a former officer of the Company or any of our subsidiaries. The CEO recommends to the Board the compensation for the Company's other executive officers...

-

Page 162

... OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS Security Ownership of Certain Beneficial Owners and Management CDRSVM Holding, Inc., whose address is 860 Ridge Lake Boulevard, Memphis, Tennessee 38120, owns all of the outstanding common stock of ServiceMaster. CDRSVM Investment Holding, Inc...

-

Page 163

... shares of common stock held by CD&R Parallel Fund VII, L.P., whose general partner is CD&R Parallel Fund Associates VII, Ltd. CD&R Investment Associates VII, Ltd. and CD&R Parallel Fund Associates VII, Ltd. are each managed by a three-person board of directors, and all board action relating to the...

-

Page 164

... Lexington Avenue, 17th Floor, New York, NY 10017. Does not include common stock held by investment funds associated with or designated by Clayton, Dubilier & Rice, LLC. Messrs. Giuriceo and Wasserman are directors of The ServiceMaster Company and Holdings and executives of Clayton, Dubilier & Rice...

-

Page 165

..., as of December 31, 2011, about the amount of shares in Holdings, our indirect parent company, to be issued upon the exercise of outstanding options granted under the MSIP.

(8)

Plan Category

Number of Number of Securities Securities to Remaining Available for be Issued Upon Future Issuance Under...

-

Page 166

Table of Contents executive officer of ServiceMaster or a nominee to become a director of ServiceMaster; any person who is known to be the beneficial owner of more than five percent of ServiceMaster's or its parent or affiliate's common stock; any immediate family member of any of the foregoing ...

-

Page 167

...recorded consulting fees related to these agreements in each of the years ended December 31, 2011, 2010 and 2009 of $1.25 million. As of December 22, 2011, Holdings purchased from BAS 7.5 million shares of capital stock of Holdings. Effective January 1, 2012, the annual management fee payable to BAS...

-

Page 168

... Company did not have interest payable to Holdings as of December 31, 2011. Financing Arrangements with Related Parties Affiliates of JPMorgan (which is one of the Equity Sponsors) have provided investment banking and commercial banking services to us for which they have received customary fees and...

-

Page 169

... Public Accounting Firm contained in Item 8 of this Annual Report on Form 10-K. Consolidated Statements of Financial Position as of December 31, 2011 and 2010 contained in Item 8 of this Annual Report on Form 10-K. Consolidated Statements of Operations for the years ended December 31, 2011, 2010...

-

Page 170

... by the undersigned, thereunto duly authorized.

THE SERVICEMASTER COMPANY Date: March 6, 2012 By /s/ HARRY J. MULLANY III

Harry J. Mullany III Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on...

-

Page 171

... REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors The ServiceMaster Company Memphis, Tennessee We have audited the consolidated statements of financial position of The ServiceMaster Company and subsidiaries (the "Company") as of December 31, 2011 and 2010, and...

-

Page 172

... of Costs and End of Period Expenses Deductions(1) Period

AS OF AND FOR THE YEAR ENDING DECEMBER 31, 2011 Continuing Operations- Allowance for doubtful accounts Accounts receivable Notes receivable Income tax valuation allowance AS OF AND FOR THE YEAR ENDING DECEMBER 31, 2010 Continuing Operations...

-

Page 173

... 1997 between the Company (as successor to ServiceMaster Limited Partnership and The ServiceMaster Company Limited Partnership) and the Harris Trust and Savings Bank, as trustee, is incorporated by reference to Exhibit 4.4 to the registrant's Annual Report on Form 10-K for the year ended December 31...

-

Page 174

... Guarantors named therein and J.P. Morgan Securities LLC, as representative of the initial purchasers, is incorporated by reference to Exhibit 4.2 to the registrant's Current Report on Form 8-K filed February 16, 2012 (File No. 001-14762). Term Loan Credit Agreement, dated as of July 24, 2007...

-

Page 175

Table of Contents

10.8

Security Agreement, dated as of July 24, 2007, made by the Company and ServiceMaster Consumer Services Limited Partnership, in favor of the Term Loan Collateral Agent and Term Loan Administrative Agent is incorporated by reference to Exhibit 10.4 to the 2007 8-K. Revolving ...

-

Page 176

... and Restated Consulting Agreement, dated as of November 23, 2009, among the Company; ServiceMaster Global Holdings, Inc. ("Holdings"); and Clayton, Dubilier & Rice, LLC is incorporated by reference to Exhibit 10.10 to the registrant's Annual Report on Form 10-K for the year ended December 31, 2009...

-

Page 177

...'s Quarterly Report on Form 10-Q for the quarter ended June 30, 2011 (File No. 001-14762). Employment Offer Letter executed on August 15, 2011, between the Company and Roger A. Cregg related to his appointment as the Company's Senior Vice President and Chief Financial Officer is incorporated...

-

Page 178

... under the MSIP is incorporated by reference to Exhibit 10.31 to the registrant's Annual Report on Form 10-K for the year ended December 31, 2007 (File No. 001-14762 (the "2007 10-K")). Form of Employee Stock Option Agreement under the MSIP is incorporated by reference to Exhibit 10.32 to the 2007...

-

Page 179

...adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Certification of Chief Executive Officer pursuant to Section 1350 of Chapter 63 of Title 18 of the United States ....CAL 101.DEF 101.LAB 101.PRE * â€

Indicates management compensatory plan, contract or arrangement. Filed herewith 170

-

Page 180

-

Page 181

...at the next offering of the sale of shares following your start date. The price of the shares at the time of your purchase will be the Fair Market Value (as defined in the Plan documents), as determined by the Compensation Committee of the Board of Directors. The number of shares you receive will be...

-

Page 182

... flexible benefits package that allows you to choose coverage that best meet your needs. Regular, full-time associates are eligible to participate in medical, dental, vision, disability and life insurance, the legal services plan, and reimbursement accounts. Coverage for most plans is effective the...

-

Page 183

... will add to our team. Sincerely, /s/ Hank Mullany Hank Mullany Chief Executive Officer The ServiceMaster Company I accept this offer of employment under the terms and conditions set forth above. Signature: /s/ Thomas J. Coba Date: November 11, 2011

Confidential November 22, 2011 Mr. Thomas J. Coba...

-

Page 184

... of employment for the position of President, Terminix. In this position, you will report to me. Your effective start date will be December 5, 2011. Your base compensation in this position will be at an annual rate of $500,000. This will be paid semi-monthly on the 15th and the last business day...

-

Page 185

... flexible benefits package that allows you to choose coverage that best meet your needs. Regular, full-time associates are eligible to participate in medical, dental, vision, disability and life insurance, the legal services plan, and reimbursement accounts. Coverage for most plans is effective the...

-

Page 186

... you will add to our team. Sincerely, /s/ Hank Mullany Hank Mullany Chief Executive Officer The ServiceMaster Company I accept this offer of employment under the terms and conditions set forth above. Signature: /s/ Charles M. Fallon Date: November 17, 2011

December 1, 2011 Charles M. Fallon 6890 SW...

-

Page 187

Sincerely, /s/ Hank Mullany Hank Mullany Chief Executive Officer The ServiceMaster Company Accepted and acknowledged: Signature: /s/ Charles M. Fallon Date: December 1, 2011

-

Page 188

... by the CEO of ServiceMaster. Based on the performance of the businesses to date, you are tracking toward a payment of the full $200,000. Outstanding MSIP awards Shares purchased - 50,000 Stock Options - 425,000 Restricted Stock Units (RSUs Vested - 15,937 (Net shares vested on 9/24/2011) Unvested...

-

Page 189

... this letter shall not constitute an employment contract, and nothing herein changes the terms of your status as an at-will employee. We look forward to you continuing your leadership of the TruGreen business, while working closely with the President, Terminix to deliver outstanding results across...

-

Page 190

... corporation ("ServiceMaster" or the "Company"). WHEREAS, ServiceMaster desires to employ Executive as its President, Terminix, and Executive desires to be employed by ServiceMaster in such capacities, and in connection therewith both parties desire to set forth certain terms and conditions relating...

-

Page 191

...year). (b) In the event that Executive's employment hereunder is terminated at any time by ServiceMaster for Cause or by Executive for any reason other than Good Reason, including by reason of retirement, death or disability, then ServiceMaster shall pay to Executive (or Executive's executors, legal...

-

Page 192

..., Executive enter into a general release of claims waiving any and all claims against the Company, its subsidiaries, their affiliates and their respective officers, directors, employees, agents, representatives, stockholders, members and partners relating to this Agreement and to his employment...

-

Page 193

..., officer, employee, principal, agent, consultant, independent contractor, partner or otherwise), in North America or any other geographic area in which ServiceMaster or any subsidiary of ServiceMaster is then conducting business, own, manage, operate, control, participate in, perform services for...

-

Page 194

...given when delivered, addressed (a) if to Executive, at his address in the records of the Company, and if to ServiceMaster, to ServiceMaster Global Holdings, Inc., c/o The ServiceMaster Company, 860 Ridge Lake Blvd., Memphis, TN 38120, attention Senior Vice President, Human Resources, or (b) to such...

-

Page 195

... an employment contract or establish a term of employment, and nothing herein will change Executive's status as an "at-will" employee. No provision of this Agreement shall be construed to impair the right of the Company and Executive to elect to terminate Executive's employment at any time and...

-

Page 196

... terms) with the Company shall be construed to refer to Executive's "separation from service" (as determined under Treas. Reg. Section 1.409A-1(h), as uniformly applied by the Company) with the Company. Whenever a provision under this Agreement specifies a payment period with reference to a number...

-

Page 197

IN WITNESS WHEREOF, the parties have caused this Agreement to be executed the day and year first written above. THE SERVICEMASTER COMPANY By: /s/ Jed L. Norden Name: Jed L. Norden Title: Senior Vice President - Human Resources EXECUTIVE /s/ Charles M. Fallon Charles M. Fallon

-

Page 198

... in effect on the date hereof or as the same may be increased from time to time thereafter, other than reductions that are proportionate to reductions applicable to other senior executives of the Company If Executive determines that Good Reason exists, Executive must notify ServiceMaster in writing...

-

Page 199

... determines constitutes Good Reason, or such event shall not constitute Good Reason under the terms of Executive's employment. If ServiceMaster remedies such event within thirty (30) days following receipt of such notice, Executive may not terminate employment for Good Reason as a result of such...

-

Page 200

...applicable vesting date. (b) Effect of a Change in Control. In the event of a Change in Control occurring prior to the Second Vesting Date, subject to the Employee's continued employment with the Company or any Subsidiary from the Grant Date to the date of the Change in Control, any Restricted Stock...

-

Page 201

...

If the Company pays any cash dividend or similar cash distribution on the Common Stock, the Company shall credit to the Employee's account an amount equal to the product of (x) the number of the Employee's Restricted Stock Units as of the record date for such distribution times (y) the per...

-

Page 202

...the Employee understands the terms and conditions that apply to the Restricted Stock Units and the risks associated with an investment in the Restricted Stock Units; (ii) (iii) the Employee has a good understanding of the English language; and the Employee is an officer or employee of the Company or...

-

Page 203

..., if the Employee elects not to remit cash in respect of such obligations, the Company shall retain a number of Settlement Shares subject to the Restricted Stock Units then vesting that have an aggregate Fair Market Value as of the Settlement Date equal to the amount of such taxes required to be...

-

Page 204

... to apply if the stock of the Company or any direct or indirect parent or subsidiary of the Company becomes readily tradable on an established securities market or otherwise within the meaning of 26 CFR 1.280G-1, Q/A-6. (c) Authorization to Share Personal Data. The Employee authorizes any Affiliate...

-

Page 205

...Global Holdings, Inc. c/o The ServiceMaster Company 860 Ridge Lake Boulevard Memphis, Tennessee 38120 Attention: General Counsel Fax: (901) 597-XXXX (ii) if to the Employee, to the Employee at his or her most recent address as shown on the books and records of the Company or Subsidiary employing the...

-

Page 206

... or by reason hereof shall be assignable by the Company or the Employee without the prior written consent of the other. (j) Applicable Law. This Agreement shall be governed in all respects, including, but not limited to, as to validity, interpretation and effect, by the internal laws of the State of...

-

Page 207

..., the Company and the Employee have executed this Agreement as of the date first above written. SERVICEMASTER GLOBAL HOLDINGS, INC. By: /s/ Jed L. Norden Name: Jed L. Norden Title: Vice President

THE EMPLOYEE: /s/ Thomas G. Brackett Thomas G. Brackett Total Number of Shares of Common Stock as to...

-

Page 208

... ratios of earnings to fixed charges for the years ended December 31, 2011, 2010, 2009 and 2008, the Successor period from July...ServiceMaster continued as the same legal entity after the Merger, the accompanying ratio calculation is presented for two periods: Predecessor and Successor, which relate...

-

Page 209

QuickLinks

Exhibit 12 RATIOS OF EARNINGS TO FIXED CHARGES

-

Page 210

... LLC Furniture Medic Limited Partnership GreenLawn, Ltd. Home Shield Insurance Agency, Inc. Merry Maids Limited Partnership MM Maids L.L.C. New Jersey Home Shield Corporation Personal Profesional de Pesticidas, S.A. de C.V. Petgar Holdings, Inc. ServiceMaster Acceptance Corporation ServiceMaster...

-

Page 211

... Service Company, LLC SVM Vanguard Service Company, LLC Terminix International, Inc. Terminix International, S.A. The ServiceMaster Acceptance Company Limited Partnership The ServiceMaster Foundation The Terminix International Company Limited Partnership TruGreen Companies L.L.C. TruGreen Home...

-

Page 212

QuickLinks

Exhibit 21 SUBSIDIARIES OF THE SERVICEMASTER COMPANY

-

Page 213

... financial information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting.

(b)

Date: March 6, 2012

/s/ HARRY J. MULLANY III Harry J. Mullany III Chief Executive Officer

-

Page 214

QuickLinks

Exhibit 31.1 CERTIFICATIONS

-

Page 215

... information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting.

(b)

Date: March 6, 2012

/s/ ROGER A. CREGG Roger A. Cregg Senior Vice President and Chief Financial Officer

-

Page 216

QuickLinks

Exhibit 31.2 CERTIFICATIONS

-

Page 217

... States Code I, Harry J. Mullany III, the Chief Executive Officer of The ServiceMaster Company, certify that (i) the Annual Report on Form 10-K for the year ended December 31, 2011, fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934 and (ii) the...

-

Page 218

QuickLinks

Exhibit 32.1 Certification of Chief Executive Officer Pursuant to Section 1350 of Chapter 63 of Title 18 of The United States Code

-

Page 219

... 63 of Title 18 of The United States Code I, Roger A. Cregg, the Senior Vice President and Chief Financial Officer of The ServiceMaster Company, certify that (i) the Annual Report on Form 10K for the year ended December 31, 2011, fully complies with the requirements of Section 13(a) or 15(d) of the...

-

Page 220

QuickLinks

Exhibit 32.2 Certification of Chief Financial Officer Pursuant to Section 1350 of Chapter 63 of Title 18 of The United States Code