Alpine 2009 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2009 Alpine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Operational Review

In this segment, Alpine’s iPod-LINK Digital media head unit, which was selected for the Fiscal 2008 Good Design Awards (G-Mark) in recognition of its innovative

design, continued to post favorable after-market sales in Japan, the United Sates and Europe. However, sluggish market conditions and intensifying price

competition caused sales of digital media head units to decrease. Such factors also led to a dramatic falloff in sales of our mainstay CD players from the second

half of the fiscal year.

Sales of high-end speakers for minivans also faced challenging conditions during the second half, despite

the favorable record to date resulting from aggressive proposal-based domestic after-market sales.

Genuine products for automobile manufacturers also faced a significant second-half downturn, led by the

impact of cuts in the production of compact cars on orders for CD audio systems. This was in spite of the

excellent reputation for quality of Alpine’s CD audio systems, culminating in a first-place ranking in the North

American Multimedia Quality and Customer Satisfaction Survey.

Furthermore, audio products for the after-market and automobile manufacturers are undergoing structural

changes in the wake of rapid development of products integrating visual and navigation systems. Accordingly,

sales for such integrated products are now accounted for under Information and Communication Equipment.

As a result of the above factors, sales by the Audio Products segment during the term decreased by 28.1%

compared to the corresponding period of the previous fiscal year, to ¥88.4 billion (US$900.0 million).

Audio Products Segment

Driving Mobile Media Solutions

Alpine is committed to offering new and advanced value propositions that will enhance our customers' lifestyles. We will offer

exciting new innovations in all the product categories in which we are active.

Our aim is exciting advances in every product category, products that combine the highest quality and craftsmanship with the most advanced technology,

continuing a tradition that began with our founding in 1967. We got our start in car audio and have since become a leader in car navigation and other

systems that combine audio, visual and communication advances. Now we are moving forward with Drive Assist and other multifunction systems. Through

single-minded focus on equipment for cars, we have accumulated expertise and built a reputation for excellence among auto manufacturers around the

world. Many now turn to us for the OEM equipment they build into their cars. Through consistent leadership in advanced technology, equipment sold

under our own

Alpine

brand has become the choice of drivers in North America, Europe, Japan, and the rapidly growing economies of Asia.

Information and Communication Products Segment

In this segment, we introduced the wide-screen, high-quality monitor Rear Vision TMX-R1500/ R1100 to boost domestic after-market sales. Attuned to user

needs and facilitating rearseat viewing of terrestrial digital broadcasts and DVDs, this new product was awarded the 2008 Product Grand Prize, sponsored by

the Nikkan Jidosha Shinbun (a national automotive newspaper), for superior product planning and development.

In step with customer lifestyles, Alpine also focused on its solutions business, which contributes to adding higher value to products. Activities included

showcasing the Rear Vision X077, which packages a large, high-resolution screen with a next-generation

car navigation system, at various trade exhibitions. This initiative, targeting minivan users, was successful in

boosting sales. However, deteriorating global market conditions, exacerbated by the widespread adoption of

portable navigation devices (PNDs) that drove down prices, resulted in a decline in after-market sales.

Sales of genuine products for automobile manufacturers also declined, owing to lower sales of luxury and

larger cars in the crucial Notrh American market. A high percentage of these models employ navigation

systems and visual products; accordingly, with sales negatively impacted accordingly. We enjoyed growth

in orders of large-scale systems, centering on car navigation systems, to high-end European automobile

manufacturers. However, production cutbacks by automobile manufacturers from second half led to a falloff

in orders for genuine products. As a result of the above factors, segment sales decreased by 16.1% year on

year, to ¥108.3 billion (US$ 1,102.1 million).

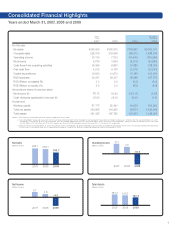

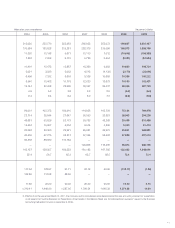

0

50

100

150

200

-4

22

48

74

100

2007 2009

2008

Net Sales

Operating Income

135.7 129.0

108.3

8.9 9.5

-3.7

Net Sales/Operating Income

(Billions of yen)

6

Operational Review

2007 2009

2008

Net Sales

Operating Income

129.3 122.9

88.4

10.0 5.4 -0.3

Net Sales/Operating Income

(Billions of yen)