Alpine 2009 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2009 Alpine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

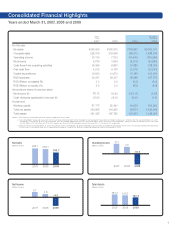

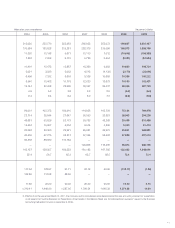

Consolidated Financial Highlights

For the year

Net sales

Overseas sales

Operating income

Net income

Cash flows from operating activities

Free cash flow

Capital expenditures

R&D expenses

ROA (Return on assets) (%)

ROE (Return on equity) (%)

Amounts per share of common stock

Net income (¥)

Cash dividends applicable to the year (¥)

At year-end

Working capital

Total net assets

Total assets

2008

¥252,072

219,056

7,012

3,554

9,963

-4,138

13,673

29,337

2.0

3.0

50.95

25.00

55,491

116,265

167,785

2007

¥265,055

228,379

10,110

5,729

16,399

4,512

12,620

30,347

3.3

5.0

82.12

25.00

61,175

120,908

181,185

millions

of yen

2009

$2,002,107

1,698,799

(108,368)

(94,584)

108,724

(22,091)

103,431

287,753

(6.2)

(8.8)

(1.36)

0.10

454,393

1,160,445

1,348,091

thousands of

U.S.Dollars

2009

¥196,667

166,873

(10,645)

(9,291)

10,680

(2,170)

10,160

28,266

(6.2)

(8.8)

(133.17)

10.00

44,635

96,874

132,423

1. R&D expenses include labor and other expenses reported as cost of sales.

2. Total shareholders' equity and total assets for 2000 are reclassified to conform to the "Standard for Accounting for Transactions by Foreign Currency, etc." effective from the year ended March 31, 2001.

Accordingly, ROA and ROE for 2000 are recalculated. With the standard adopted prior to 2001, total shareholders' equity, total assets and shareholders' equity per share of common stock for 2000 were

¥58,533 million, ¥121,694 million and ¥1,019.91, respectively. Also, ROA, ROE and equity ratio for 2000 were 2.6%, 5.7% and 48.1%, respectively.

3. Effective from the year ended March 31, 2007, the Company and its consolidated subsidiaries adopted the new accounting standard for presentation of net assets ("Accounting Standard for Presentation

of Net Assets in the Balance Sheet and its Implementation Guidance" issued by the Business Accounting Deliberation Council on December 9, 2005).

Notes:

Years ended March 31, 2007, 2008 and 2009

Net Sales

(Billions of yen)

0

80

160

240

320

400

2007 2008 2009

196.7

252.1

26 5.1

Total Assets

(Billions of yen)

0

100

200

300

400

132.4

167. 8

181.2

2007 2008 2009

-20.00

-16.75

-13.50

-10.25

-7.00

-3.75

-0.50

2.75

6.00

Net Income

(Billions of yen)

-9.3

3.6

5.7

2007 2008 2009

Operating Income

(Billions of yen)

-12000

-7200

-2400

2400

7200

12000

-10.6

7.0

10.1

2007 2008 2009