Alpine 2009 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2009 Alpine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

See accompanying notes

18

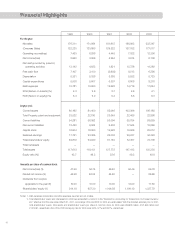

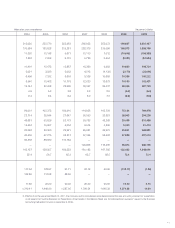

2009 2008 2007 2009

Cash flows from operating activities:

Income (loss) before income taxes and minority interests ¥ (4,035) ¥ 6,345 ¥ 10,302 $ (41,077)

Adjustments to reconcile income before income taxes

and minority interests to cash provided by operating activities:

Depreciation and amortization (Note 12) 10,336 10,655 9,326 105,222

Increase (decrease) in provision for retirement benefits (16) 45 8 (163)

Increase (decrease) in provision for directors' retirement benefits 28 (14) 83 285

Interest and dividends income (752) (930) (735) (7,655)

IInterest expenses 122 169 126 1,242

Equity in earnings of affiliates (1,143) (1,047) (677) (11,636)

Loss on sale of property, plant and equipment 11 6 11 112

Prior compensation expenses for products — — 935 —

Decrease in notes and accounts receivable-trade 10,241 5,779 3,504 104,255

Decrease (increase) in inventories 6,349 (1,020) 1,129 64,634

Decrease in notes and accounts payable-trade (9,234) (1,624) (2,307) (94,003)

Increase (decrease) in provision for product warranties (814) (501) 903 (8,286)

Gain on valuation of options (2,578) — — (26,245)

Other-net 2,133 (3,383) (2,191) 21,714

Subtotal 10,648 14,480 20,417 108,399

Interest and dividends income received 783 927 735 7,971

Interest expenses paid (119) (169) (126) (1,212)

Income taxes paid (1,669) (5,275) (3,692) (16,991)

Income taxes refund 1,037 — — 10,557

Payments for Prior compensation expenses for products — — (935) —

Net cash provided by operating activities 10,680 9,963 16,399 108,724

Cash flows from investing activities:

Purchase of property, plant and equipment (7,139) (11,029) (8,573) (72,676)

Proceeds from sales of property, plant and equipment 88 27 100 896

Purchase of intangible assets (3,156) (2,945) (3,593) (32,129)

Proceeds from sales of investment securities 131 247 0 1,334

Purchase of stocks of subsidiaries and affiliates (245) — — (2,494)

Purchase of investments in subsidiaries (544) — — (5,538)

Payments of loans receivable (1,858) (61) (47) (18,915)

Collection of loans receivable 66 38 49 672

Other-net (193) (378) 177 (1,965)

Net cash used in investment activities (12,850) (14,101) (11,887) (130,815)

Cash flows from financing activities:

Net increase (decrease) in short-term loans payable 1,576 34 (113) 16,044

Repayment of long-term loans payable — — (7) —

Cash dividends paid (1,744) (1,744) (1,395) (17,754)

Cash dividends paid to minority shareholders (16) (189) (82) (163)

Liquidating dividends paid to minority shareholders — (452) — —

Proceeds from stock issuance to minority shareholders — 63 59 —

Other—net (145) (2) (3) (1,476)

Net cash used in financing activities (329) (2,290) (1,541) (3,349)

Effect of exchange rate change on cash and cash equivalents (1,519) (1,017) 1,139 (15,464)

Net increase (decrease) in cash and cash equivalents (4,018) (7,445) 4,110 (40,904)

Cash and cash equivalents at beginning of period 30,159 37,507 33,207 307,024

Increase in cash and cash equivalents resulting from inclusion of

additional subsidiaries in the consolidation — — 163 —

Increase in cash and cash equivalents resulting from merger

of consolidated and unconsolidated subsidiaries — 97 27 —

Cash and cash equivalents at end of period ¥ 26,141 ¥ 30,159 ¥ 37,507 $ 266,120

Thousands of U.S.

Dollars (Note 1)Millions of Yen

Years ended March 31, 2009, 2008 and 2007

ALPINE ELECTRONICS, INC.

Consolidated Statements of Cash Flows