Air New Zealand 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

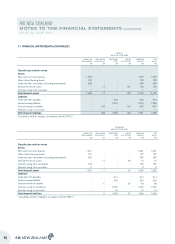

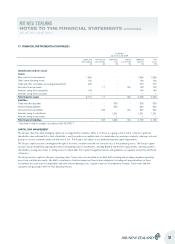

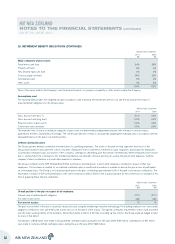

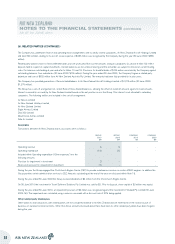

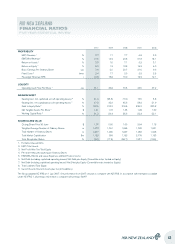

25. RETIREMENT BENEFIT OBLIGATIONS

Defined benefit plans

The Group operates two defined benefit plans for qualifying employees in New Zealand and overseas. The New Zealand plan is now closed to new

members. The plans provide a benefit on retirement or resignation based upon the employee’s length of membership and final average salary. Each year

an actuarial calculation is undertaken using the Projected Unit Credit Method to calculate the present value of the defined benefit obligation and the

related current service cost. The most recent actuarial valuation of the New Zealand plan was provided for 30 June 2010, and for the overseas plan for

31 March 2010.

GROUP AND COMPANY

2010

$M

2009

$M

Amounts recognised in the Statement of Financial Position:

Present value of funded obligations (112) (104)

Fair value of plan assets 100 82

(12) (22)

Unrecognised actuarial losses 11 21

Included in Statement of Financial Position (1) (1)

Expense recognised in the Statement of Financial Performance:

Current service cost (3) (2)

Interest cost (6) (6)

Expected return on plan assets 5 5

Net actuarial losses recognised in the year (2) -

Total included in "Labour" (6) (3)

Actual return on plan assets 11 (12)

Changes in the present value of the defined benefit obligation:

Defined benefit obligation at the beginning of the year (104) (95)

Current service cost (3) (2)

Interest cost (6) (6)

Contributions by plan participants (3) (2)

Actuarial gains/(losses) 1 (2)

Benefits paid 3 4

Foreign exchange differences on overseas plans - (1)

Defined benefit obligation at the end of the year (112) (104)

Changes in the fair value of plan assets are as follows:

Fair value of plan assets at the beginning of the year 82 94

Expected return on plan assets 5 5

Contributions by employer 7 2

Contributions by participants 3 2

Actuarial gains/(losses) 6 (17)

Benefits paid (3) (4)

Fair value of plan assets at the end of the year 100 82

The Group expects to contribute approximately $7 million to its defined benefit plans in 2011.

AIR NEW ZEALAND

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2010

45