Air New Zealand 2010 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2010 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

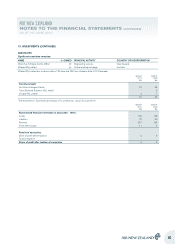

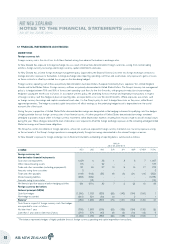

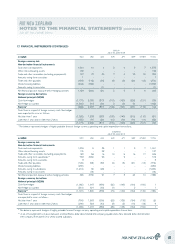

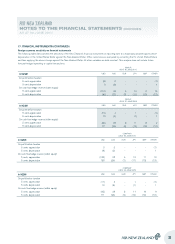

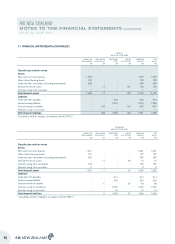

17. FINANCIAL INSTRUMENTS (CONTINUED)

Sensitivity analyses

The sensitivity analyses shown above are hypothetical and should not be considered predictive of future performance. They only include financial

instruments (derivative and non-derivative) and do not include the future forecast hedged transactions. As the sensitivities are only on financial

instruments the sensitivities ignore the offsetting impact on future forecast transactions which many of the derivatives are hedging. Changes in fair value

can generally not be extrapolated because the relationship of change in assumption to change in fair value may not be linear.In addition, for the purposes

of the above analyses, the effect of a variation in a particular assumption is calculated independently of any change in another assumption. In reality,

changes in one factor may contribute to changes in another, which may magnify or counteract the sensitivities. Furthermore, sensitivities to specific

events or circumstances will be counteracted as far as possible through strategic management actions. The estimated fair values as disclosed should not

be considered indicative of future earnings on these contracts.

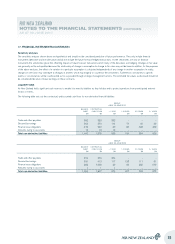

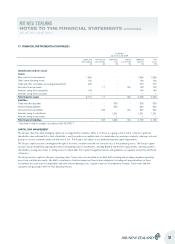

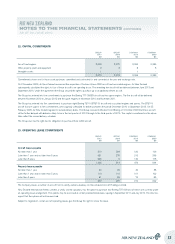

LIQUIDITY RISK

Air New Zealand holds significant cash reserves to enable it to meet its liabilities as they fall due and to protect operations from unanticipated external

factors or events.

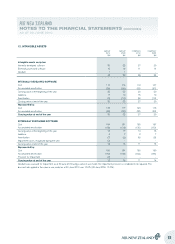

The following table sets out the contractual, undiscounted cash flows for non-derivative financial liabilities:

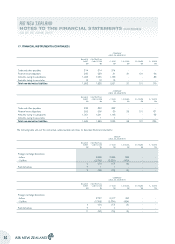

GROUP

AS AT 30 JUNE 2010

BALANCE

SHEET

$M

CONTRACTUAL

CASH FLOWS

$M

< 1 YEAR

$M

1-2 YEARS

$M

2-5 YEARS

$M

5+ YEARS

$M

Trade and other payables 352 352 352 - - -

Secured borrowings 263 270 114 71 46 39

Finance lease obligations 812 940 80 83 308 469

Amounts owing to associates 13 13 13 - - -

Total non-derivative liabilities 1,440 1,575 559 154 354 508

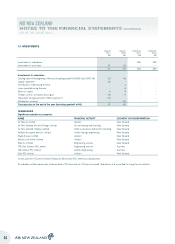

GROUP

AS AT 30 JUNE 2009

BALANCE

SHEET

$M

CONTRACTUAL

CASH FLOWS

$M

< 1 YEAR

$M

1-2 YEARS

$M

2-5 YEARS

$M

5+ YEARS

$M

Trade and other payables 374 374 374 - - -

Secured borrowings 391 412 117 123 111 61

Finance lease obligations 888 1,060 82 84 282 612

Amounts owing to associates 1 1 1 - - -

Total non-derivative liabilities 1,654 1,847 574 207 393 673

AIR NEW ZEALAND

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2010

33