Air New Zealand 2010 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2010 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

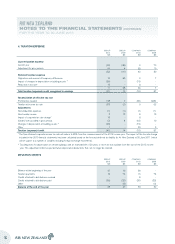

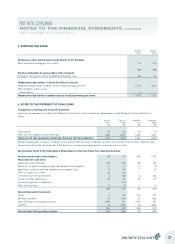

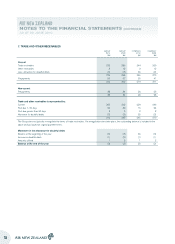

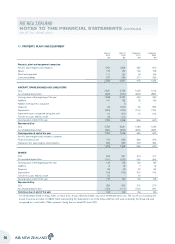

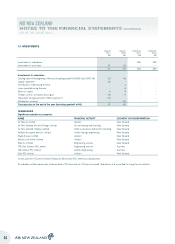

3. DERIVATIVE FINANCIAL INSTRUMENTS

Air New Zealand is subject to credit, foreign currency, interest rate, and fuel price risks. These risks are managed using various financial instruments, based on policies

approved regularly by the Board of Directors. Air New Zealand’s objectives, policies and processes for managing these risks are described more fully in Note 17.

Derivatives are required to be recognised in the Statement of Financial Position at their fair market value, with subsequent changes in fair value being recognised

through earnings. Changes in the fair value of those derivatives which have been successfully designated as part of a cash flow hedge relationship are recognised

through the cash flow hedge reserve within equity, to the extent that they are effective. Any accounting ineffectiveness is recognised through earnings.

NZ IAS 39: Financial Instruments: Recognition and Measurement requires hedge effectiveness to be determined for accounting purposes within strict

parameters. Each derivative transaction used to hedge identified risks must be documented and proven to be effective in offsetting changes in the value of

the underlying risk within a range of 80% - 125%. This measure of effectiveness may result in economically appropriate hedging transactions being deemed

ineffective for accounting purposes. In particular, the use of crude oil derivatives as a proxy for jet fuel, and the high volatility of fuel markets may cause cash flow

hedges in respect of fuel derivatives to fail the hedge effectiveness test.

Risk management practices are determined on an economic basis, rather than being designed to achieve a particular accounting outcome. Consequently, it

is expected that this will result in some transactions failing the accounting hedge effectiveness criteria from time to time and ineffectiveness being recorded

through earnings in periods other than when the hedged item occurs, causing some volatility through earnings. Normalised earnings, disclosed as supplementary

information at the foot of the Statement of Financial Performance, shows earnings after excluding movements on derivatives that hedge exposures in other

financial periods. Such movements include amounts required to be recognised as ineffective for accounting purposes.

Where changes in the fair value of a derivative provide a natural offset to the underlying hedged item as it impacts earnings, hedge accounting is not applied.

Both the changes in value of the hedged item and the hedging instrument are recognised through the same line within the Statement of Financial Performance.

Furthermore, some components of hedge accounted derivatives are excluded from the designated risk. Cash flow hedges in respect of fuel derivatives only

include the intrinsic value of the fuel options with all other components of the option value (mainly time value) being marked to market through earnings. Similarly,

forward points (the differential in interest rates between currencies) are excluded from the hedge designation in respect of foreign currency derivatives which

hedge account forecast foreign currency operating revenue and expenditure transactions. These components are not hedge accounted and, accordingly, marked

to market through earnings.

FOREIGN CURRENCY DERIVATIVES

Non-hedge accounted derivatives

Foreign currency translation gains or losses on lease return provisions and non-hedge accounted United States Dollar denominated interest-bearing liabilities

are recognised in the Statement of Financial Performance within “Foreign exchange gains”. Marked to market gains or losses on non-hedge accounted foreign

currency derivatives provide a natural offset to these foreign exchange movements, and are also recognised within “Foreign exchange gains”.

During the year to 30 June 2010, a loss of $56 million was recognised in respect of the above non-hedge accounted foreign currency derivatives (30 June

2009: $113 million gain), which was offset by exchange movements on the underlying exposures. Forward point costs of $19 million in respect of these

derivatives were marked to market through “Finance costs” in the year to 30 June 2010 (30 June 2009: $39 million of costs).

Hedge accounted derivatives

The Group hedge accounts the foreign currency risk arising on forecast foreign currency operating revenue, operating expense and capital expenditure

transactions.

Forward points are excluded from the hedge designation in respect of operating revenue and expenditure transactions and are marked to market through

earnings. Forward point costs of $21 million in respect of these derivatives were marked to market through “Finance costs” in the year to 30 June 2010 (30 June

2009: $59 million of costs).

Accounting ineffectiveness arising in the year to 30 June 2010 on these cash flow hedges was nil on operating transactions and a gain of $1 million on capital

transactions (30 June 2009: $1 million loss on operating transactions; $19 million loss on capital transactions).

The significant decrease in fuel prices in the prior year to 30 June 2009 led to a revision of forecast fuel costs. This, together with a shift in forecast foreign currency

revenues, required the de-designation of certain hedge relationships where the forecast transaction was no longer expected to occur. This included items which

whilst no longer meeting the hedge accounting requirements of NZ IFRS continued to provide economic hedge relationships (and were therefore excluded from

Normalised Earnings). NZ IFRS requires that the cumulative gains or losses on these hedging instruments that have been recognised in the cash flow hedge reserve

over the period in which the hedges were effective, be transferred to earnings. This had no impact in the year to 30 June 2010. In the prior year to 30 June 2009,

gains of $163 million were transferred from the cash flow hedge reserve to “Foreign exchange gains” within the Statement of Financial Performance.

FUEL DERIVATIVES

Where the Group uses crude oil collar options to hedge price risk in jet fuel, the intrinsic value component of these derivatives is designated as a cash flow hedge.

All other components are marked to market through earnings, as are any short-dated outright derivatives. In the year to 30 June 2010, losses of $4 million

relating to non-hedge accounted derivatives were recognised within “Fuel” (30 June 2009: $76 million gain).

Accounting ineffectiveness arising in the year to 30 June 2010 of $7 million (gain) was recognised within “Fuel” (30 June 2009: $9 million loss).

INTEREST RATE DERIVATIVES

Interest rate derivatives are not hedge accounted. Changes in the fair value of these derivatives are recognised each period within “Finance costs”. In the year to

30 June 2010, there were no interest rate derivatives outstanding nor any impact on earnings (30 June 2009: $1 million gain).

AIR NEW ZEALAND

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

FOR THE YEAR TO 30 JUNE 2010

15