Adidas 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 Adidas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

scoring on all fields

Annual Report 2005

Table of contents

-

Page 1

scoring on all fields Annual Report 2005 -

Page 2

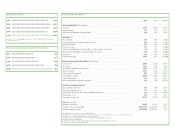

... of net sales Operating margin 3) Effective tax rate Net income attributable to shareholders 2) as a percentage of net sales Operating working capital4) as a percentage of net sales Equity ratio 5) Financial leverage 5) Balance Sheet and Cash Flow Data (â,¬ in millions) Total assets 5) Inventories... -

Page 3

.... ...adidas ...adidas Sport Performance The largest adidas division (78% of adidas sales) features highly innovative products for athletes around the world. Technological innovation and a commitment to performance are the cornerstones of this division. adidas Sport Heritage Once innovative, now... -

Page 4

... of 10 to 15% versus the 2004 level of â,¬ 314 million Group earnings grow 22% to â,¬ 383 million, the highest earnings ever Deliver double-digit net income growth versus 2005 level of â,¬ 383 million Further increase shareholder value adidas-Salomon AG share price grows 35% Further increase... -

Page 5

scoring on all fields 1 We are a sports company. A highly trained team. Constantly striving to achieve new best performance. A Group expanding its strengths in pursuit of one clear goal: to be the leader. With the World Cup. With Reebok. With groundbreaking innovations. And with all our skills. we... -

Page 6

... emociones se desborden Apasionado The penalty area is his ground. Light-footed. Quick-witted. Versatile. Raúl's always a dangerous striker. And never afraid to let emotions run wild. Passionate. -

Page 7

3 -

Page 8

... |||||||||||||||||||||||||||||||||||||||||||||| |||||||||||||||||||||||||||||||||||||||||||||| Exquisitely elegant footwork. Unpredictable moves. Once in possession of the ball, Kaká is almost unstoppable. His anticipation and creativity bring football to another level. Innovative. -

Page 9

5 -

Page 10

... Durch Kaltschnäuzigkeit im Abschluss Ohne große Worte Ein Vorbild an Disziplin und Teamwork Engagiert Ballack's a leader. With outstanding performance. With fighting spirit. With incomparable instinct in front of the goal. Not with big words. A model of discipline and teamwork. Committed. -

Page 11

7 -

Page 12

8 124!"x$%&(q wertxui opüQWE. RTZUIOasdfgh jklöäyxcvbn. ASDFGH N K L Y X C V B M Nakamura's style of play transcends the borders of his national team. Tremendously talented. Supremely focused. Superbly team-oriented. True to the game. Honest. -

Page 13

9 -

Page 14

|||||||||||||||||||||||||||||||||||||||||||||| 10 |||||||||||||||||||||||||||||||||||||||||||||| |||||||||||||||||||||||||||||||||||||||||||||| Il ne s'agit pas de popularité. |||||||||||||||||||||||||||||||||||||||||||||| |||||||||||||||||||||||||||||||||||||||||||||| Ni de faire du spectacle. ... -

Page 15

11 -

Page 16

12 The world's most famous footballer Beckham's a star on and off the pitch Enthusing the masses. With Precision passes With phenomenal free kicks Inspirational The world's most famous soccer player. Beckham's a star on and off the field. Enthusing the masses. With precision passes. With ... -

Page 17

13 -

Page 18

14 Our brand values also define our biggest strengths and highest priorities. Passionate innovative, committed, honest, authentic and inspirational. this is what adidas is all about a group dedicated to sport and athletes -

Page 19

scoring on all fields 15 -

Page 20

... for our shareholders 2005 has been a milestone year in the history of the adidas Group. With the divestiture of the Salomon business segment and the announcement of the Reebok acquisition, which was completed on January 31, 2006, the adidas Group has changed the face of the sporting goods industry... -

Page 21

... across teams, athletes, events and leagues. We now hold the number one or number two position in every market we service, which gives us a much more competitive platform. You also sold your Salomon business segment in 2005. Why now, and what did you learn from this investment? Selling Salomon was... -

Page 22

... Group's business going forward? TaylorMade-adidas Golf had a great 2005, with our best performance coming from North America. Our industry-leading product pipeline, including the r7® quad driver, rac™ irons and ClimaCool®, helped us to translate innovations into market share gains and sales... -

Page 23

... adidas long after the tournament ï¬nishes. I see other growth areas such as the running segment, where we are clearly leading the market in terms of innovation and are now focused on further commercializing this strength in functional running products. Also, the women's athletic apparel business... -

Page 24

... Group? In the medium term, we expect to achieve mid- to high-single-digit sales growth each year, a gross margin of 46 to 48%, an operating margin of 11% and regularly deliver double-digit earnings growth. This will come on the back of an energized and efï¬cient integration of Reebok, the success... -

Page 25

21 -

Page 26

..., the world's ï¬rst intelligent shoe, hits the stores and is sold out at most retailers within hours. June The FIFA Confederations Cup in Germany is a successful dress rehearsal for adidas with respect to teams, venues, timing and marketing efforts for the 2006 FIFA World Cupâ„¢. June Winning her... -

Page 27

...June The adidas design team is chosen as "Design Team Of The Year 2005" by the prestigious red dot Design Award jury. July adidas-Salomon AG and Porsche Design Group sign a long-term strategic partnership including licensing agreement. August adidas-Salomon AG announces plans to acquire Reebok to... -

Page 28

...inï¬,uenced the markets. The adidas-Salomon AG Share Number of shares outstanding 2005 average At year-end 2005 Type of share Free ï¬,oat Initial Public Offering Stock exchange Stock registration number (ISIN) Stock symbol Important indices 46,736,958 50,761,755 1) No-par-value share 100% November... -

Page 29

... the 2005 Annual General Meeting. The adidas Group, however, later decided to use free cash in the ï¬nancing of the acquisition of Reebok International Ltd. instead of buying back shares. The Group believes that this strategic initiative will beneï¬t shareholder value more than a share buyback and... -

Page 30

...year-end 2005. Our Level 1 ADR closed the year at US$ 94.56. This represents an increase of 18% versus the ï¬rst trading price of US$ 80.02. Compared to our common stock, the facilities were negatively affected by the depreciating euro. Excellent Long-Term Development of the adidas-Salomon AG Share... -

Page 31

... and private investors. In the course of the year, Management and the Investor Relations team took part in several international conferences. Our presentations revolved around our ï¬nancial results as well as strategic initiatives such as the Salomon divestiture and the acquisition of Reebok. We... -

Page 32

28 ana te wanawana, he kanohi o to - ratou E tu te Kapa Pango. He manawa whenua. He toa taua oro...- turu wera i te whutupa ...tu Proud to represent their country. The All Blacks fight like warriors. Rugby is in their blood. Authentic. -

Page 33

the group 29 -

Page 34

30 The Group The adidas Group strives to be the global leader in the sporting goods industry with sports brands built on a passion for sports and a sporting lifestyle. -

Page 35

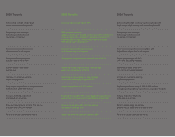

... performance...In the medium term ...we will extend our leading market positions in Europe and Asia, expand our share of the US footwear market and be the fastest growing major sporting goods supplier in Latin America. The resulting top-line growth, together with strict cost control and working... -

Page 36

...fashion-conscious consumers golfers Brands/Divisions adidas Sport Performance adidas Sport Heritage adidas Sport Style TaylorMade-adidas Golf Focused Resources Marketing / Operations / Sales Group Strategy The actions we took in 2005 in reshaping our business were signiï¬cant steps towards our... -

Page 37

...with Stella McCartney, Polar and Porsche Design help us widen our design and innovation reach (see Brand Strategies / adidas). Information about our major innovations for 2006 is outlined in the Outlook section of this report. Developing Leading Positions in All Our Major Markets We are in business... -

Page 38

..." communications campaign, special attention to the football, running and basketball categories as well as continued efforts to commercialize our major promotion partnerships. Impossible Is Nothing: adidas' Attitude Drives Brand Campaign A key factor to securing the brand's long-term success is... -

Page 39

...performance products with our most commercial technologies. We will support these innovations and the rest of our strong offering in running with high-impact marketing and communication around the world. Sponsorship with Key Players and Innovation to be Drivers of Basketball Business The basketball... -

Page 40

... one of the key trendsetting brands in the market for the sports lifestyle consumer. Selective distribution to prevent dilution of the brand plays a major role in the development of this division. Our ambitious own-retail strategy will also help us to further commercialize this success. In 2006, we... -

Page 41

... was brought in-house in late 2005 and the value category is being outsourced to Asia. As a result of this new sourcing strategy, TaylorMade-adidas Golf plans to increase both golf ball sales and proï¬tability at double-digit rates in 2006. adidas Golf Enjoys Continuing Success adidas Golf is the... -

Page 42

... USA 12 TaylorMade Golf Co. Inc. - Carlsbad, California / USA Major Locations The adidas Group is represented in major markets around the world. As at December 31, 2005, the Group had more than 80 subsidiaries worldwide with headquarters in Herzogenaurach, Germany. The major subsidiaries are listed... -

Page 43

...Major Locations ......11 5 ...234 9 ...6 1 ...7 ...16 15 18 ...8 12 ...14 ...13 ...10 ...19 ...21 ...20 ...17 ......For a detailed list of all subsidiaries of the adidas Group at December 31, 2005, see Shareholdings... 39 -

Page 44

40 Flair? Always. Style? Absolutely Every shot Natalie Gulbis plays is an expression of her love for the game...Passionate -

Page 45

|||||||||||||| |||||||||||||| |||||||||||||| |||||||||||||| |||||||||||||| corporate |||||||||||||| governance 41 -

Page 46

...), adidas-Salomon AG has a dual board structure consisting of an Executive Board with management functions and a Supervisory Board with control functions. These two Boards are strictly separated in terms of membership and competencies. Our Executive Board is currently composed of four members... -

Page 47

... make new information immediately available to institutional investors, private shareholders, ï¬nancial analysts and the public in both English and German. For this purpose, we use the Internet as our main communication platform (www.adidas-Group.com). With our ï¬nancial reports, analyst and press... -

Page 48

... of the German Securities Trading Act (Wertpapierhandelsgesetz), Executive and Supervisory Board members as well as other key executives are required to disclose purchase or sale transactions with adidas-Salomon AG shares and related ï¬nancial instruments (Directors' Dealings). In 2005, we received... -

Page 49

... past Declarations of Compliance. adidas-Salomon AG has been and will be in compliance with all recommendations of the German Corporate Governance Code dated June 2, 2005, with the following exceptions: ...The D&O liability insurance for our Executive and Supervisory Board members does not include... -

Page 50

..., has been attained (see Notes - Additional Information/note 32). Executive Board members were last granted options under the Management Share Option Plan (MSOP) in August 2002. No new share option plan has been adopted by the Annual General Meeting. 1) The General Committee has decided to... -

Page 51

... Information/note 34) as required by the German Corporate Governance Code. Stock Options In 2005, a total of 29,900 options were exercised within the scope of the Management Share Option Plan (MSOP) by the current members of our Executive Board in the full year period and by the retired Executive... -

Page 52

48 Corporate Governance Supervisory Board Report Dear Shareholders, 2005 was another very successful year for the adidas Group. Our currency-neutral sales from continuing operations grew by 12%, and our earnings by 31%. With the sale of the Salomon business segment and the Reebok acquisition, ... -

Page 53

...the Executive Board, the Management Boards of the Group companies, the Works Council and all adidas Group employees. We thank all of them for their contributions. For the Supervisory Board The main focus of our meeting on November 2, 2005, was the budget and investment plan for the adidas Group for... -

Page 54

... Team Leader Quality Service Systems, Global Operations, adidas-Salomon AG Dr. iur. Manfred Gentz German, born in 1942 Former member of the Executive Board of DaimlerChrysler AG ...Member of the Supervisory Board, Deutsche Börse AG, ...Frankfurt am Main, Germany ...Member of the Supervisory Board... -

Page 55

... Trade Union, Headquarter Nuremberg, Germany ...Member of the Supervisory Board, BP Gelsenkirchen GmbH, ...Gelsenkirchen, Germany ...Member of the Supervisory Board, CeramTec AG, ...Plochingen, Germany Hans Ruprecht German, born in 1954 Sales Director Customer Service, Area Central, adidas-Salomon... -

Page 56

...professional career with Reebok International Ltd. in 1983, where he worked for ten years in various operations and product functions. In 1993, he joined adidas AG 2) as Head of Worldwide Development. He was appointed to the Executive Board in 1997 and is responsible for Global Operations activities... -

Page 57

... an MBA, he started his professional career in 1976 as a management consultant with McKinsey & Company. In 1982, he became a McKinsey Partner and Principal. He joined adidas AG 2) as an Executive Board member in 1989. Michel Perraudin retired from the Executive Board on March 31, 2005, to focus on... -

Page 58

|||||||||||||||||||||||||||||||||||||||||||||| 54 |||||||||||||||||||||||||||||||||||||||||||||| |||||||||||||||||||||||||||||||||||||||||||||| MNpoBb |||||||||||||||||||||||||||||||||||||||||||||| |||||||||||||||||||||||||||||||||||||||||||||| |||||||||||||||||||||||||||||||||||||||||||||| ... -

Page 59

|||||||||||||| |||||||||||||| |||||||||||||| |||||||||||||| |||||||||||||| group |||||||||||||| activities 55 -

Page 60

||||||||| scoring ||||||||| with our ||||||||| innovation ||||||||| 56 Group Activities In our business, consumer buying and brand perception are closely linked to cutting-edge design and market-leading, high-proï¬le technologies. Innovation is a key factor to our success. For this reason, we ... -

Page 61

Innovation 57 ...adidas +F50 TUNITâ„¢ ...The +F50 TUNITâ„¢ is the ï¬rst modular football boot ever and is made up of three interchangeable components: the upper, the chassis and the studs. Each component comes in a variety of styles and functions. Simply by mixing and matching these components, ... -

Page 62

58 ...adidas +Predator ® Absolute ...The new +Predator® Absolute features Exchangeable PowerPulse™ technology. Engineered Predator® elements have been integrated into a Power Zone on top of the forefoot for even more power behind every shot, while enhanced Predator® technology in the Swerve ... -

Page 63

... accuracy and control. The thermal bonding technology, which adidas pioneered in 2004, has been further reï¬ned to give the +Teamgeistâ„¢ performance qualities found in no other football. The +Teamgeistâ„¢ will be played in all 64 matches of the 2006 FIFA World Cupâ„¢. Our goal is to sell more than... -

Page 64

... of the surface athletes are running on, each a3® cushioning element adapts individually to the ground, stabilizing, guiding and driving the foot forward. A structured midsole offers optimal stability. The Gigaride is the newest addition to our successful a3® footwear business. Group Activities -

Page 65

... fatigue, while strategically placed TPU power bands boost the power of key muscle groups, storing energy when muscles are contracted, and releasing it when they are expanded. In addition, ClimaCool® technology is utilized to maintain an athlete's optimal body temperature. adidas TechFit is the... -

Page 66

... distance monitoring equipment into adidas apparel and footwear. Special ï¬bers bonded onto adidas tops work in conjunction with Polar's WearLinkâ„¢ technology to eliminate the need for a separate chest strap to monitor heart rate. In addition, the adiStar® Fusion shoe has a strategically placed... -

Page 67

Innovation 63 ...adidas_1, Intelligence Level 1.1 ...adidas_1, the World's First Intelligent Shoe, has ...shoe has been reprogrammed to ï¬nd the right level of cushioning even more quickly. In 2006, we will also release the ï¬rst intelligent basketball shoe and we believe that in the medium term... -

Page 68

... drivers. Inverted Cone Technology changes the way the clubface behaves at impact and increases the size of the zone that delivers high initial ball speed. That makes the r7® CGB MAX more forgiving and easier to launch while promoting longer yardage, shot after shot. This state-of-the art golf... -

Page 69

... the successful r7® 425 which was the number one model at its PGA Tour debut at the 2006 Mercedes Championships. The 460's clubhead measures 460 cc, helping make it TaylorMade's most forgiving driver ever, while its extremely low center-of-gravity makes it easy to launch high, long and straight... -

Page 70

... success and we will continue to strengthen this message in 2006. "Impossible Is Nothing" is integrated in our biggest ever global football campaign: "+10". In 2006, we will also launch Kevin Garnett's "What's Inside", Stella McCartney for Sport Performance and TaylorMade's "I AM A GOLFER" marketing... -

Page 71

Marketing 67 -

Page 72

... +10 In the run-up to the 2006 FIFA World Cupâ„¢, "+10" is the kick-off for adidas' biggest event-driven marketing effort ever. The campaign celebrates what the individual can do for the team and what the team can do for the individual stars. Only when individuals work together within, and for, the... -

Page 73

||||||||||| ||||||||||| ||||||||||| ||||||||||| Marketing 69 -

Page 74

70 ...adidas KG "What's Inside" ...In basketball, "What's Inside" highlights eight-time All-Star forward Kevin Garnett and his latest adidas signature shoe, the a3® Garnett '06. The strategy behind this highly-integrated brand campaign is to celebrate the different characteristics that make up who ... -

Page 75

Marketing 71 -

Page 76

72 Group Activities -

Page 77

... ...adidas by Stella McCartney ...In its ï¬rst year, the adidas by Stella McCartney performance collection exclusively for women created a complete new segment and exceeded our expectations in terms of sales, margin and image. With the new product category tennis, the collection is bringing design... -

Page 78

... golf, are passionate about its history, faithful to the rules and believe their identity is rooted in the game. The essence of I AM A GOLFER was created to reach golfers through a sense of community. I AM A GOLFER sets out to establish TaylorMade as the brand for authentic golfers, through a shared... -

Page 79

Marketing 75 More than a Ryder Cup hero I AM A GOLFER -

Page 80

76 Propel. Recover. Release. Ian Thorpe's one-of-a-kind stroke technique has led him to 22 world records...Innovative | | | | | | -

Page 81

|||||||||||||| |||||||||||||| |||||||||||||| |||||||||||||| group |||||||||||||| management |||||||||||||| report 77 -

Page 82

..., investment activity and private consumption increased strongly. Hurricane Katrina, high oil prices and a less optimistic job market outlook depressed consumer conï¬dence in the third quarter. This effect was partially offset by continuously buoyant housing prices and signiï¬cant sales discounts... -

Page 83

... and innovation trends. The region's emerging markets developed positively from a low base. In Latin America, the sporting goods industry enjoyed high-single-digit growth throughout the year. adidas Group Develops Better Than Industry and Overall Economy in All Regions In 2005, adidas Group revenues... -

Page 84

80 Income Statement Focus on Continuing Operations On May 2, 2005, our Group announced the divestiture of the Salomon business segment to Amer Sports Corporation as part of ongoing efforts to better focus on our core activities and improve the Group's proï¬tability. The transaction was completed on... -

Page 85

... increased number of units sold and higher average price points. Licensee sales are not included in the Group's total sales ï¬gure. Royalties calculated on the basis of these licensee revenues, however, are reported under royalty and commission income in our income statement. Net Sales by Product... -

Page 86

... policy, see Risk Report. Record Level Gross Proï¬t and Margin The Group's gross margin grew 0.2 percentage points to 48.2% in 2005 from 48.0% in 2004, representing the fourth consecutive year of improvement and reï¬,ecting the highest gross margin in the Group's history. This positive development... -

Page 87

... working budget at TaylorMadeadidas Golf compensating a slight increase at brand adidas. This increase was driven by marketing initiatives in the fourth quarter related to product launches for the 2006 FIFA World Cupâ„¢. These investments were taken to further strengthen the strategic position... -

Page 88

... 2004. Employees by Function 1) in % 2004 Own retail 32 28 Sales 16 18 12 11 3 4 3 17 19 Logistics Marketing Central functions & administration Production Research & development IT 13 12 4 4 3 1) Figures reï¬,ect continuing operations as a result of the divestiture of the Salomon business... -

Page 89

... In 2005, the Group's positive operating proï¬t development was driven by improvement in all regions. In Europe, operating proï¬t grew 25% to â,¬ 365 million in 2005 from â,¬ 291 million in 2004. This was mainly generated by gross margin improvement at brand adidas. In North America, operating pro... -

Page 90

... generation from the Group's operating activities. Financial Expenses Increase 22% Financial expenses increased 22% to â,¬ 94 million in 2005 (2004: â,¬ 76 million), mainly as a result of one-time effects including the cost for options related to the hedging of the Reebok purchase price (payable in... -

Page 91

... 31% The Group's net income from continuing operations increased 31% to â,¬ 434 million in 2005 from â,¬ 333 million in 2004. Strong sales increases, coupled with improving gross and operating margins, were the main drivers of this improvement. The tax rate declined 3.0 percentage points to 33.7% in... -

Page 92

... of adidas-Salomon AG for the purpose of creating an adidas entity to be merged into Reebok International Ltd. upon completion of the Reebok acquisition. On January 23, 2006, Ruby Merger Corporation was transferred to the Group's North American holding company adidas North America Inc. and shortly... -

Page 93

Group Business Performance Income Statement Balance Sheet and Cash Flow 89 Balance Sheet and Cash Flow Salomon Divestiture Impacts Balance Sheet Items In the 2005 balance sheet, the assets and liabilities for the Salomon business segment, which was deconsolidated at the beginning of the fourth ... -

Page 94

... instruments used for hedging activities within the Group. Other non-current liabilities from continuing operations were reduced by 16%. Balance Sheet Structure 1) in % of total liabilities and equity Liabilities and equity Short-term borrowings Accounts payable Long-term borrowings 2005 0 11.9 18... -

Page 95

... 10% increase of the adidas-Salomon AG share capital had a strong positive impact on shareholders' equity. Expenses Related to Off-Balance Sheet Items The most important off-balance sheet assets are operating leases, which are related to ofï¬ces, retail stores, warehouses and equipment. Rent... -

Page 96

... institution. Banking partners of the Group's treasury department as well as of foreign Group subsidiaries are required to have a long-term investment grade rating by Standard & Poor's or an equivalent rating by another leading rating agency (see Notes to the Consolidated Balance Sheet/note 23). The... -

Page 97

... Time to Maturity of Available Facilities 1) â,¬ in millions 2005 2004 Financing Structure 1) â,¬ in millions 2005 Total cash and short-term ï¬nancial assets Bank borrowings Commercial paper Asset-backed securities Private placements Convertible bond Gross total borrowings Net cash position... -

Page 98

... of new and revised International Financial Reporting Standards had a positive impact on the reported operational performance in 2005. On a comparable basis, adidas operating proï¬t increased 20%. adidas at a Glance â,¬ in millions 2005 Net sales Gross margin Operating proï¬t 1) 5,861 45.3% 693... -

Page 99

... focus on key accounts and adidas own-retail activities were the main contributors to growth in Europe. adidas Sales in North America Increase 16% on a Currency-Neutral Basis On a currency-neutral basis, adidas sales in North America increased 16% in 2005, reï¬,ecting double-digit sales increases in... -

Page 100

... three largest sporting goods markets Brazil, Mexico and Argentina, due to increased demand related to a strong product offering, was the primary driver of this positive development. Virtually all other countries also grew by double-digit rates. adidas Own Retail as Important Top-Line Growth Driver... -

Page 101

... This increase mainly reï¬,ects higher marketing expenditures from fourth quarter product launches related to the 2006 FIFA World Cupâ„¢ as well as higher operating overhead costs as a percentage of sales related to increased ownretail activities. adidas Net Sales by Region Latin America 6% Asia 22... -

Page 102

... International Financial Reporting Standards had a small positive impact on the reported operational performance in 2005. On a comparable basis, the operating proï¬t at TaylorMade-adidas Golf increased 4%. TaylorMade-adidas Golf at a Glance â,¬ in millions 2005 Net sales Gross margin Operating... -

Page 103

...commission income for both years, operating proï¬t at TaylorMade-adidas Golf increased 4% while the operating margin decreased 0.6 percentage points in 2005. Highest Growth in North America In Three Years On a regional basis, currency-neutral revenue growth in 2005 was driven by strong performance... -

Page 104

... order management, manufacturing and distribution. We remain committed to making signiï¬cant permanent improvements in both the creation and procurement areas to achieve optimal effects in terms of quality, costs and delivery performance. Independent Manufacturers Produce adidas Group Products... -

Page 105

...at once" sales through team dealers. Retail order lead times of this product are approximately 120 days, requiring purchasing decisions to be made well in advance of actual market need and creating inventory exposure. A replenishment program was designed to address this challenge and reduce order-to... -

Page 106

... Group's research and development activities are located in Herzogenaurach, Germany, Portland/ Oregon, USA, and Carlsbad/California, USA. Product design and development for the Sport Performance categories running, football, tennis and training take place at the development center in Herzogenaurach... -

Page 107

... technology and the BlackMAX® golf ball. TaylorMade-adidas Golf will continue to position itself as the innovation leader in the golf market in 2006 by introducing further new product and technology developments (see Outlook). Active Trademark and Patent Protection Policy To capitalize on the Group... -

Page 108

... and position our brands, our promotion strategy concentrates on partnerships with top athletes, teams, leagues and events. In addition to optimizing our marketing working budget, we strive to reduce operating overhead expenses as a percentage of sales by continuously improving internal processes... -

Page 109

... this annual report (see Outlook). We also publish regular updates on the development of our order book in our quarterly reports. In addition, the development of key performance measures and ï¬nancial ratios can be monitored in the Group's quarterly statements. Key Financial Metrics - 2005 Results... -

Page 110

...strategic direction or resource deployment are regularly reviewed and evaluated on a business case basis incorporating relevant risk components. In a quarterly rhythm, risks and opportunities above a deï¬ned threshold are reported formally to the risk management ofï¬cer and monitored in successive... -

Page 111

... high price points and sustain high margins going forward, we differentiate ourselves by positioning adidas as being the industry's innovation leader and having high credibility among athletes. In some Asian markets and Latin America, the sporting goods industry is still in its development stage... -

Page 112

... hedges. Investment Risks In 2005, the adidas Group signiï¬cantly reduced the amount of cash invested in investment funds in anticipation of the ï¬nancing of the Reebok acquisition. As the remaining investment funds were sold at the beginning of 2006, risks related to a major decline in the value... -

Page 113

...products directly to the consumer (see adidas Business Performance). New stores require considerable investment in leases, furniture and ï¬ttings resulting in a high portion of ï¬xed costs, especially given that our own-retail activities require considerably more personnel in relation to net sales... -

Page 114

... recovery, in the near future our data center will be moved to a separate location meeting highest safety standards. Group Management Report Overall Risk Based on the compilation of risks explained within this report and the current business outlook, no immediate risks have been identiï¬ed... -

Page 115

... Strategic Opportunities Reebok integration Promotion partnerships Product innovations Macro-Economic Opportunities Emerging Markets as Long-Term Growth Drivers One of the most important drivers of medium-term growth will come from growth in the emerging markets. We are targeting signiï¬cant sales... -

Page 116

... the Ofï¬cial Partner of the FIFA World Cupâ„¢ tournaments through to 2014 and of the Beijing 2008 Olympic Games. Partnerships with athletes are also important for positive future development in the basketball and tennis categories. adidas' long-term basketball partnerships with the NBA stars Tracy... -

Page 117

... year for adidas. The Reebok integration and the 2006 FIFA World Cupâ„¢ in our home market Germany will be our main focus. Supported by our strong product pipeline and marketing initiatives, we are conï¬dent that we will again be able to deliver strong top- and bottom-line performance this year... -

Page 118

... 900 million in 2005. Group Management Report 2006 Product Launch Schedule Product 2006 FIFA World Cup™ national team jerseys - away kit +F50 TUNIT™ football boot Stella McCartney's new women's performance line adidas_1 basketball shoe David Beckham +Predator® Absolute football boot ClimaCool... -

Page 119

...-digit rates mainly due to improvements in the football category, also contributed to the positive development of adidas backlogs. As a result of the strong product pipeline outlined above, our excellent order book and vigorous growth expectations for our own-retail activities, we expect high-single... -

Page 120

... 37 35 Group Management Report Europe Footwear Apparel Total 2 4 4 Asia 12 28 22 Total 11 16 15 1) At year-end, change year-over-year Currency-Neutral Development of adidas Order Backlogs by Product Category and Region1) in % North America 15 19 17 Europe to Grow at Mid-Single-Digit Rates On... -

Page 121

...adidas subsidiaries will continue to generate marginal income by selling Salomon products at gross margins lower than the Group average. Further, positive currency effects on the unhedged portion of our sourcing costs, enjoyed in 2005, will not be repeated in 2006. Operating Margin Remains on a High... -

Page 122

... for the adidas Group excluding Reebok are expected to grow in line with the number of newly hired employees. R&D Spending to Remain Focused on Technological Innovations In 2006, the Group will continue to spend around 1% of sales on research and development associated with new products. Areas of... -

Page 123

... as strongly increasing business activities of Reebok in Asia and Europe, which carry high gross margins. The positive gross margin development will be driven by increases at all brands, mainly at Reebok. In the medium term, we expect the Group's operating margin to exceed the Group's 2005 level of... -

Page 124

120 A consummate professional and role model Andre Agassi combines his passion for life and sport with a sense of community...Inspirational -

Page 125

|||||||||||||| |||||||||||||| |||||||||||||| |||||||||||||| |||||||||||||| financial |||||||||||||| analysis 121 -

Page 126

... the economic development and the Group Management Report as well as the other information presented in the annual report. Pursuant to § 315a German Commercial Code (HGB), the consolidated ï¬nancial statements 2005 were prepared in accordance with International Financial Reporting Standards (IFRS... -

Page 127

... by adidas-Salomon AG - comprising the balance sheet, the income statement, statement of changes in equity, cash ï¬,ow statement and the notes to the consolidated ï¬nancial statements - together with the Group Management Report for the business year from January 1, 2005 to December 31, 2005. The... -

Page 128

... Sheet â,¬ in thousands Financial Analysis (Note) Cash and cash equivalents Short-term ï¬nancial assets Accounts receivable Inventories Other current assets Total current assets Property, plant and equipment, net Goodwill, net Other intangible assets, net Long-term ï¬nancial assets Deferred tax... -

Page 129

... Cost of sales Gross proï¬t (% of net sales) Royalty and commission income Selling, general and administrative expenses (% of net sales) Depreciation and amortization (excl. goodwill) Goodwill amortization Operating proï¬t (% of net sales) Financial income Financial expenses Income before taxes... -

Page 130

... Financial Analysis Year ending Dec. 31, 2005 Year ending Dec. 31, 2004 Operating activities: Income before taxes Adjustments for: Depreciation and amortization (incl. goodwill) Unrealized foreign exchange (gains)/losses, net Interest income Interest expense Losses on sale of property, plant... -

Page 131

... Year ending Dec. 31, 2005 Financing activities: Increase/(Decrease) in long-term borrowings Proceeds from issue of share capital Dividend of adidas-Salomon AG Dividends to minority shareholders Exercised share options Other ï¬nancial liabilities (Decrease)/Increase in short-term borrowings... -

Page 132

... gains/losses, net of tax Restated balance at January 1, 2004 Net income recognized directly in equity Net income Total recognized income and expense for the period Dividend payment Exercised share options Acquisition of shares from minority shareholders Exclusion from consolidation Reclassi... -

Page 133

...ï¬ned beneï¬t plans, net of tax Expenses recognized for share option plans, net of tax Currency translation Net income recognized directly in equity Income after taxes Total income and expense recognized in the ï¬nancial statements Attributable to shareholders of adidas-Salomon AG Attributable to... -

Page 134

130 Statement of Movements of Fixed Assets â,¬ in thousands Financial Analysis Goodwill Acquisition cost December 31, 2003 Currency effect Additions Changes in companies consolidated Transfers Disposals December 31, 2004 Netting goodwill amortization Currency effect Additions Changes in companies ... -

Page 135

Consolidated Financial Statements (IFRS) Statement of Movements of Fixed Assets 131 Other equipment, furniture and ï¬ttings Construction in progress Total tangible assets Shares in afï¬liated companies Participations Other ï¬nancial assets Total ï¬nancial assets 305,493 (7,823) 59,988 ... -

Page 136

132 Notes adidas-Salomon AG, a listed German stock corporation, and its subsidiaries design, develop, produce and market a broad range of athletic and sports lifestyle products. The Group's headquarters are located in Herzogenaurach, Germany. The adidas Group has divided its operating activities by ... -

Page 137

...cant to the Group's ï¬nancial position, results of operations and cash ï¬,ows. The shares in these companies were accounted at cost. The ï¬rst-time consolidation of the newly founded companies did not have any material impact in 2005. A schedule of the shareholdings of adidas-Salomon AG is shown... -

Page 138

.... Goodwill arising from the acquisition of a foreign entity and any fair value adjustments to the carrying amounts of assets and liabilities of that foreign entity are treated as assets of the reporting entity and are translated at exchange rates prevailing at the date of the initial consolidation... -

Page 139

... for Salomon was sold in connection with the divestiture of the Salomon business segment. Research and Development Research costs are expensed as incurred. Development costs are also expensed as incurred and are not capitalized due to the short product life cycle of sporting goods. The Group spent... -

Page 140

... tax is recognized in the income statement except to the extent that it relates to items recognized directly in equity, in which case it is recognized in equity. Financial Analysis Equity Compensation Beneï¬ts Stock options have been granted to members of the Executive Board of adidas-Salomon... -

Page 141

...USA). Analysis of the Result of Discontinued Operations â,¬ in millions Dec. 31 2005 Net sales Expenses Income from discontinued operations before taxes Income taxes Income from discontinued operations after taxes Gain/(loss) recognized on the measurement to fair value less cost to sell Income taxes... -

Page 142

... ï¬nance the acquisition of Reebok International Ltd...6...Short-Term Financial Assets Short-term ï¬nancial assets are classiï¬ed "at fair value through proï¬t or loss". They comprise investment funds as well as marketable equity securities. Due to the acquisition of Reebok International Ltd. in... -

Page 143

... use for the development of the adidas Group's international headquarters "World of Sports", and is included under property, plant and equipment. The remaining part, not needed by the adidas Group, has a size of 73 hectares and is to be sold. According to the "Urban Design Contract", signed with the... -

Page 144

... long-term promotional contracts and service contracts (see also notes 31 and 22)...Borrowings and Credit Lines ...15 ...In response to the increased ï¬nancial needs due to the acquisition of Reebok International Ltd., the Group adjusted its ï¬nancing policy. In 2005, the German Commercial Paper... -

Page 145

... borrowings Private placements Convertible bond Total 168 18 0 186 Between 1 and 3 years 4 141 0 145 Between 3 and 5 years 0 239 356 595 After 5 years 0 194 0 194 Total 172 592 356 1,120 As all short-term borrowings were backed by long-term arrangements in 2005, the Group has returned to reporting... -

Page 146

... consolidated Financial Analysis ...Other Current Liabilities 17 ...Other current liabilities consist of the following: Other Current Liabilities â,¬ in thousands Dec. 31 2005 Liabilities due to personnel Tax liabilities other than income taxes Liabilities due to social security Interest rate... -

Page 147

... Financial Statements (IFRS) Notes to the Consolidated Balance Sheet 143 Similar obligations include mainly long-term liabilities under a deferred compensation plan. The funds withheld are invested by the Group on behalf of the employees in certain securities, which are presented under long-term... -

Page 148

... of the exercise of a total of 371,505 stock options and the issuance of 371,505 no-par-value bearer shares associated with the various exercise periods of the Management Share Option Plan (MSOP). Capital reserves thus increased by â,¬ 18,738,977.55 in 2005. Financial Analysis The details of the... -

Page 149

... not more than 430,582 no-par-value bearer shares (Contingent Capital 1999) for the purpose of granting stock options in connection with the Management Share Option Plan to members of the Executive Board of adidas-Salomon AG as well as to managing directors/senior vice presidents of its afï¬liated... -

Page 150

...to meet the Company's obligations arising from the Management Share Option Plan 1999 (MSOP); ...subject to Supervisory Board approval, to withdraw the shares from the market. It is not necessary to obtain any further shareholders' approval. Financial Analysis It is stipulated that the acquisition... -

Page 151

... net present values are as follows: Within 1 year Between 1 and 5 years After 5 years Total Service Arrangements The Group has outsourced certain logistics and information technology functions, for which it has entered into long-term contracts. Financial commitments under these contracts mature as... -

Page 152

... future favorable exchange rate developments in the ï¬nancial markets. In 2005, the Group contracted currency options with premiums paid in a total amount of â,¬ 27 million (2004: â,¬ 22 million), of which â,¬ 11 million were paid for hedges relating to the acquisition of Reebok International Ltd... -

Page 153

...divestiture of the Salomon business segment. In order to determine the fair values of its derivatives that are not publicly traded, the adidas Group uses approved ï¬nance-related economic models based on market conditions prevailing at the balance sheet date. Management of Interest Rate Risk It has... -

Page 154

... the production costs of goods sold. Operating Expenses (Continuing Operations) â,¬ in millions Year ending December 31 2005 2004 Marketing working budget Marketing overhead Sales Logistics Research & development Central ï¬nance & administration Other Total operating expenses Thereof: Depreciation... -

Page 155

... Net foreign exchange loss Other Financial expenses Financial expenses, net 1) Restated due to application of IAS 32 (see note 20). ...Income Taxes 27 ...In general, adidas-Salomon AG and its German subsidiaries are subject to corporate and trade taxes. In general, a corporate tax rate of 25% plus... -

Page 156

... 153,026 Current taxes in the amount of â,¬ 2 million and â,¬ 1 million which relate to net investment hedges have been credited directly to shareholders' equity for the years ending December 31, 2005 and 2004, respectively (see also note 23). The effective tax rate of the adidas Group differs from... -

Page 157

...Notes - Additional Information ...Segmental Information 29 ...The Group operates predominately in one industry segment, the design, wholesale and marketing of athletic and sports lifestyle products. The Group is currently managed by brands and on the basis of a regional structure. Certain functions... -

Page 158

... Segmental Information by Brand â,¬ in millions Financial Analysis 2005 Net sales to third parties Gross proï¬t in % of net sales Operating proï¬t 1) Assets Liabilities Capital expenditure Amortization and depreciation (excl. goodwill amortization) 5,861 2,654 45.3% 693 2,526 704 138 69 adidas... -

Page 159

Consolidated Financial Statements (IFRS) Notes - Additional Information 155 Segmental Information by Region â,¬ in millions Europe 1) 2005 Net sales Intersegment sales Net sales to third parties Gross proï¬t in % of net sales Operating proï¬t 2) Assets Liabilities Capital expenditure ... -

Page 160

... Subsidiaries â,¬ in thousands Dec. 31 2005 Cash Inventories Receivables and other current assets Property, plant and equipment Goodwill and other intangible assets Investments and other long-term assets Accounts payable and other liabilities Short-term borrowings Long-term bank borrowings Total... -

Page 161

... resolution of the Annual General Meeting on May 8, 2002, and on May 13, 2004, the Executive Board was authorized to issue non-transferable stock options for up to 1,373,350 no-par-value bearer shares to members of the Executive Board of adidas-Salomon AG as well as to managing directors/senior vice... -

Page 162

...the stock market price for the adidas-Salomon AG share must have developed by an annual average of 1% more favorably than the stock market prices of a basket of competitors of the adidas Group globally and in absolute terms may not have fallen. The stock options may only be exercised against payment... -

Page 163

... As a result, the Reebok business will be consolidated as a separate brand segment within the adidas Group from February 1, 2006, which will have an impact on the Group's balance sheet and cash ï¬,ow statement. The total purchase price for 100% of the shares of Reebok International Ltd. was US$ 3.85... -

Page 164

...East) adidas Sport GmbH Sarragan AG adidas Austria GmbH adidas Holding S.A. (formerly adidas Salomon France S.A.) adidas Sarragan France S.a.r.l. adidas International B.V. adidas International Trading B.V. adidas Logistic Services B.V. adidas International Marketing B.V. adidas International Finance... -

Page 165

... Financial Statements (IFRS) Shareholdings 161 (Attachment I) Shareholdings of adidas-Salomon AG, Herzogenaurach as of December 31, 2005 Company and Domicile 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 Taylor Made Golf Ltd. 2) (formerly Salomon... -

Page 166

..., 2005 Financial Analysis (Attachment I) Company and Domicile North America adidas North America Inc. (fomerly adidas-Salomon North America Inc.) adidas America Inc. adidas Promotional Retail Operations Inc. adidas Sales Inc. adidas Village Corporation adidas Interactive Inc. adidas International... -

Page 167

...directly directly 100 100 100 99 1 100 100 100 100 100 100 1) Sub-group adidas UK 2) Sub-group Taylor Made UK 3) Sub-group adidas Sourcing 4) Sub-group India 5) Sub-group Mexico 6) Companies with no active business. 7) The number refers to the number of the company which maintains the shareholding... -

Page 168

164 adidas Group Segmental Information: Seven-Year Overview â,¬ in millions Financial Analysis 2005 Brands adidas Net sales Gross proï¬t Operating proï¬t Operating assets TaylorMade-adidas Golf Net sales Gross proï¬t Operating proï¬t Operating assets Salomon Net sales Gross proï¬t Operating ... -

Page 169

... 165 adidas Group Segmental Information: Seven-Year Overview â,¬ in millions 2005 Regions 1) Europe Net sales Gross proï¬t Operating proï¬t Operating assets North America Net sales Gross proï¬t Operating proï¬t Operating assets Asia Net sales Gross proï¬t Operating proï¬t Operating assets... -

Page 170

... Income Statement Ratios Gross margin2) SG&A expenses as a percentage of net sales 2) Operating margin2) Effective tax rate 2) Net income as a percentage of net sales 3) Interest coverage 2) Balance Sheet Data (â,¬ in millions) Total assets 4) Inventories Receivables and other current assets Working... -

Page 171

... 2005 Balance Sheet Ratios Financial leverage 4) Equity ratio 4) Equity-to-ï¬xed-assets ratio 4) Asset Coverage I 4) Asset Coverage II 4) Fixed asset intensity of investments Current asset intensity of investments Liquidity I 4) Liquidity II 4) Liquidity III 4) Working capital turnover 4) Return... -

Page 172

... per share = net income/weighted average number of shares outstanding during the year. Equity Ratio The equity ratio shows the role of shareholders' equity within the ï¬nancing structure of a company. It is calculated by dividing shareholders' equity by total assets. Equity-To-Fixed-Asset Ratio The... -

Page 173

... Market Capitalization The total market value of all outstanding shares. It is calculated by multiplying the number of shares by the current market price. Marketing Overhead Comprises marketing personnel, general and administrative costs. Marketing Working Budget Promotion and communication spending... -

Page 174

... assets. Net borrowings = long-term borrowings + short-term borrowings - cash - short-term ï¬nancial assets. Operating Expenses Costs associated with running a business which are not directly attributable to the products or services sold. This refers to sales and marketing, research and development... -

Page 175

...income before taxes (IBT). Working Capital Working capital is a company's short-term disposable capital used to ï¬nance the day-to-day operations of providing sporting footwear, apparel and hardware to customers. It is calculated as current assets minus current liabilities. Working Capital Turnover... -

Page 176

...external suppliers in order to commercialize, produce and deliver ï¬nal products to our customers. Supply Chain Management The process of developing, producing and transporting products to customers. Top-Value Brand A brand at the upper end of value or budget market. Torque The force which tends to... -

Page 177

... or neutral. Own-Retail Activities Sales directly generated through a store operated by adidas. adidas own retail includes concept stores, concession corners, e-commerce and factory outlets. Predator® Elements adidas' football boot technology that uses strategically placed rubber elements. The... -

Page 178

... reporting Cover, 153 ff., 164 f. Seven-year overview 165 Share price performance 24 ff. Shareholder structure 27 Shareholders' equity 144 ff. Shareholdings 160 ff. Stock key data 24, 27 Stock options see Management Share Option Plan (MSOP) Strategy ...adidas 34 ff...Group 32 f...TaylorMade-adidas... -

Page 179

Financial Calendar 2006 March 2 ...2005 Full Year Results ...Analyst and press conferences ...Press release, conference call and webcast April 11 ...Investor Day - adidas Group Strategy and Brand Positioning ...Conference call and webcast May 9 ...First Quarter 2006 Results ...Press release, ... -

Page 180

...-Group.com/investors adidas is a member of DAI (German Share Institute), DIRK (German Investor Relations Association) and NIRI (National Investor Relations Institute, USA). This report is also available in German. For further adidas publications, please see our corporate website. Concept and Design...