3M 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

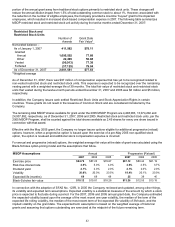

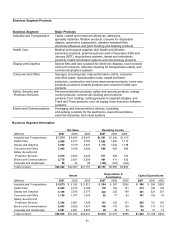

Segment assets for the operating business segments (excluding Corporate and Unallocated) primarily include accounts

receivable; inventory; property, plant and equipment – net; goodwill and intangible assets; and other miscellaneous

assets. Assets included in Corporate and Unallocated principally are cash, cash equivalents and marketable securities;

insurance receivables; deferred income taxes; certain investments and other assets, including prepaid pension assets;

and certain unallocated property, plant and equipment. Corporate and unallocated assets can change from year to year

due to changes in cash, cash equivalents and marketable securities, changes in prepaid pension and postretirement

benefits, and changes in other unallocated asset categories. For management reporting purposes, corporate goodwill

(which at December 31, 2007, totaled approximately $400 million) is not allocated to the six operating business segments.

In Note 3, corporate goodwill has been allocated to the respective market segments as required by SFAS No. 142 for

impairment testing.

Corporate and Unallocated operating income principally includes corporate investment gains and losses, certain

derivative gains and losses, insurance-related gains and losses, certain litigation expenses, corporate restructuring

program charges and other miscellaneous items. Because this category includes a variety of miscellaneous items, it is

subject to fluctuation on a quarterly and annual basis.

Refer to Note 2 and Note 4 for discussion of items that significantly impact business segment reported results. The most

significant items impacting both 2007 and 2006 results are the net gain on sale of the pharmaceuticals business (within

the Health Care segment) and restructuring and other actions.

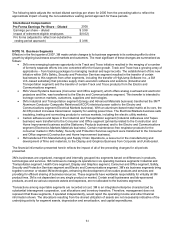

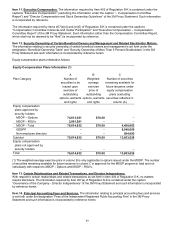

NOTE 17. Geographic Areas

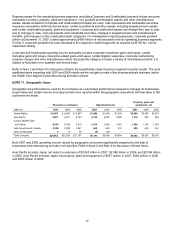

Geographic area information is used by the Company as a secondary performance measure to manage its businesses.

Export sales and certain income and expense items are reported within the geographic area where the final sales to 3M

customers are made.

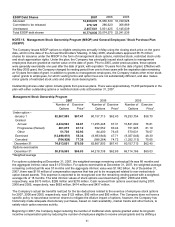

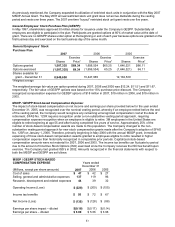

Net sales to customers

Operating Income

Property, plant and

equipment, net

(Millions)

2007 2006 2005

2007 2006 2005

2007 2006 2005

United States $ 8,987 $ 8,853 $ 8,267 $1,692 $1,908 $1,200

$3,668 $3,382 $3,291

Asia Pacific 6,601 6,251 5,744

2,136 2,097 2,085 1,116 959 865

Europe, Middle East

and Africa 6,503 5,726 5,219

1,705 1,092 1,057 1,308 1,162 1,076

Latin America and Canada 2,365 2,080 1,881 665 629 512 490 404 361

Other Unallocated 6 13 56

(5) (30) – – – –

Total Company $24,462 $22,923 $21,167 $6,193 $5,696 $4,854

$6,582 $5,907 $5,593

Both 2007 and 2006 operating income results by geographic area were significantly impacted by the sale of

businesses and restructuring and other exit activities. Refer to Note 2 and Note 4 for discussion of these items.

Asia Pacific includes Japan net sales to customers of $2.063 billion in 2007, $2.048 billion in 2006, and $2.094 billion

in 2005. Asia Pacific includes Japan net property, plant and equipment of $357 million in 2007, $345 million in 2006,

and $350 million in 2005.