3M 2007 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2007 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

FINANCIAL INSTRUMENTS

The Company enters into contractual derivative arrangements in the ordinary course of business to manage foreign

currency exposure, interest rate risks and commodity price risks. A financial risk management committee, composed of

senior management, provides oversight for risk management and derivative activities. This committee determines the

Company’s financial risk policies and objectives, and provides guidelines for derivative instrument utilization. This

committee also establishes procedures for control and valuation, risk analysis, counterparty credit approval, and ongoing

monitoring and reporting.

The Company enters into foreign exchange forward contracts, options and swaps to hedge against the effect of

exchange rate fluctuations on cash flows denominated in foreign currencies and certain intercompany financing

transactions. The Company manages interest rate risks using a mix of fixed and floating rate debt. To help manage

borrowing costs, the Company may enter into interest rate swaps. Under these arrangements, the Company agrees to

exchange, at specified intervals, the difference between fixed and floating interest amounts calculated by reference to an

agreed-upon notional principal amount. The Company manages commodity price risks through negotiated supply

contracts, price protection agreements and forward physical contracts.

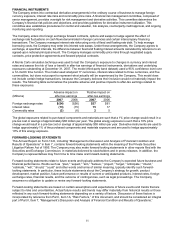

A Monte Carlo simulation technique was used to test the Company’s exposure to changes in currency and interest

rates and assess the risk of loss or benefit in after-tax earnings of financial instruments, derivatives and underlying

exposures outstanding at December 31, 2007. The model (third-party bank dataset) used a 95% confidence level over

a 12-month time horizon. The model used analyzed 17 currencies, interest rates related to three currencies, and five

commodities, but does not purport to represent what actually will be experienced by the Company. This model does

not include certain hedge transactions, because the Company believes their inclusion would not materially impact the

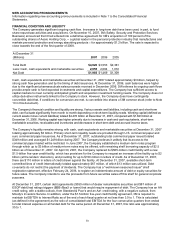

results. The following table summarizes the possible adverse and positive impacts to after-tax earnings related to

these exposures.

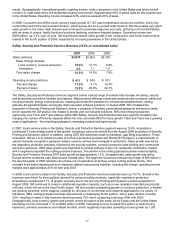

Adverse impact on Positive impact on

(Millions) after-tax earnings after-tax earnings

2007

2006 2007 2006

Foreign exchange rates $(54) $(56) $57 $61

Interest rates (13) (15) 15 17

Commodity rates (3) (6) 2 5

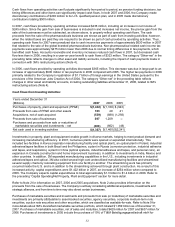

The global exposures related to purchased components and materials are such that a 1% price change would result in a

pre-tax cost or savings of approximately $60 million per year. The global energy exposure is such that a 10% price

change would result in a pre-tax cost or savings of approximately $38 million per year. Derivative instruments are used to

hedge approximately 1% of the purchased components and materials exposure and are used to hedge approximately

10% of this energy exposure.

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, including “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” in Item 7, contains forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. The Company may also make forward-looking statements in other reports filed with the

Securities and Exchange Commission, in materials delivered to stockholders and in press releases. In addition, the

Company’s representatives may from time to time make oral forward-looking statements.

Forward-looking statements relate to future events and typically address the Company’s expected future business and

financial performance. Words such as “plan,” “expect,” “aim,” “believe,” “project,” “target,” “anticipate,” “intend,”

“estimate,” “will,” “should,” “could” and other words and terms of similar meaning, typically identify such forward-

looking statements. In particular, these include statements about the Company’s strategy for growth, product

development, market position, future performance or results of current or anticipated products, interest rates, foreign

exchange rates, financial results, and the outcome of contingencies, such as legal proceedings. The Company

assumes no obligation to update or revise any forward-looking statements.

Forward-looking statements are based on certain assumptions and expectations of future events and trends that are

subject to risks and uncertainties. Actual future results and trends may differ materially from historical results or those

reflected in any such forward-looking statements depending on a variety of factors. Discussion of these factors is

incorporated by reference from Part I, Item 1A, “Risk Factors,” of this document, and should be considered an integral

part of Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”