3M 2007 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2007 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

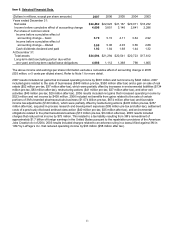

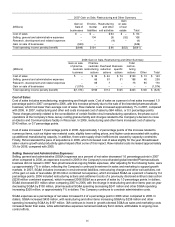

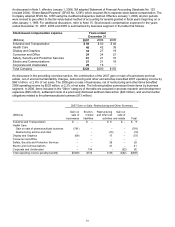

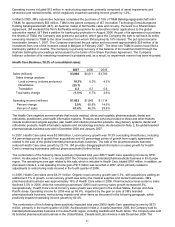

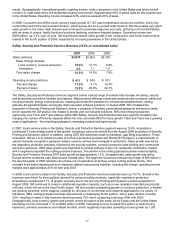

2007 Gain on Sale, Restructuring and Other Summary

Gain on Environ- Restructuring

Gain

on sale

(Millions) Sale of mental and other of real

businesses liabilities exit activities estate Total

Cost of sales $ – $ – $ 64 $ – $ 64

Selling, general and administrative expenses – 134 26 (52) 108

Research, development and related expenses – – (4) – (4)

Gain on sale of businesses (849) – – (849)

Total operating income penalty (benefit) $(849) $134 $ 86 $(52) $(681)

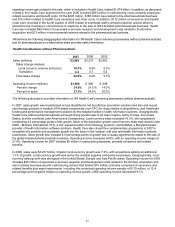

2006 Gain on Sale, Restructuring and Other Summary

Gain on sale

of pharma-

Pharma-

ceuticals Overhead Business

Total

restruc-

(Millions) ceuticals restructuring reduction specific turing

business actions actions actions actions Other Total

Cost of sales $ – $ 32 $ 24 $ 74 $130 $ 13 $ 143

Selling, general and administrative expenses – 66 81 51 198 40 238

Research, development and related expenses – 68 7 – 75 95 170

Gain on sale of businesses (1,074) – – – – – (1,074)

Total operating income penalty (benefit) $(1,074) $166 $112 $125 $403 $148 $ (523)

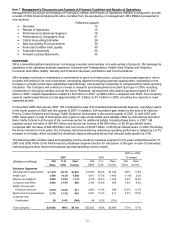

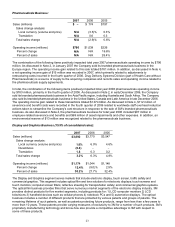

Cost of Sales:

Cost of sales includes manufacturing, engineering and freight costs. Cost of sales as a percent of net sales increased 1.0

percentage point in 2007 compared to 2006, with this increase primarily due to the sale of the branded pharmaceuticals

business, which had lower than average cost of sales. Raw material costs increased approximately 1% in 2007, compared

with 2006. In 2007, restructuring and other exit costs increased cost of sales by $64 million, or 0.3 percentage points.

These charges primarily related to the consolidation of certain flexible circuit manufacturing operations, the phase-out of

operations at the Company’s New Jersey roofing granule facility and charges related to the Company’s decision to close

an Electro and Communications facility in Wisconsin. In 2006, restructuring and other items increased cost of sales by

$143 million, or 0.7 percentage points.

Cost of sales increased 1.9 percentage points in 2006. Approximately 1.2 percentage points of this increase related to

numerous items, such as higher raw material costs, slightly lower selling prices, and higher costs associated with scaling

up additional manufacturing capacity. In addition, there were supply chain inefficiencies caused by capacity-constraints.

Finally, 3M accelerated the pace of acquisitions in 2006, which increased cost of sales slightly for the year. Broad-based

sales volume growth and productivity gains helped offset some of this impact. Raw material costs increased approximately

3% for 2006, compared with 2005.

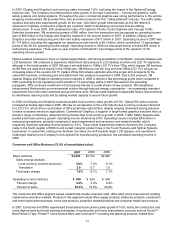

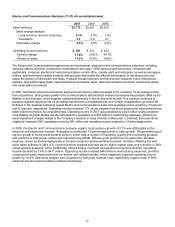

Selling, General and Administrative Expenses:

Selling, general and administrative (SG&A) expenses as a percent of net sales decreased 1.6 percentage points in 2007

when compared to 2006, as expenses incurred in 2006 in the Company’s now-divested global branded Pharmaceuticals

business did not repeat in 2007. Non-pharmaceutical ongoing SG&A expenses, after adjusting for the following items, were

up approximately 7% in dollars, reflecting the Company’s continued investment in sales and marketing to support growth

markets. In 2007, SG&A includes increases in environmental liabilities, restructuring charges and other exit activities, net

of the gain on sale of real estate ($108 million combined net expense), which increased SG&A as a percent of sales by 0.4

percentage points. 2006 included restructuring actions and settlement costs of a previously disclosed antitrust class action

($238 million combined expense), which increased 2006 SG&A as a percent of sales by 1.0 percentage points. In dollars,

SG&A decreased $51 million when comparing 2007 to 2006, with the change in restructuring and other items year-on-year

decreasing SG&A by $130 million, pharmaceutical SG&A spending decreasing $241 million and other SG&A spending

increasing $320 million, or approximately 7% in dollars. The Company continues to constrain administrative costs.

SG&A expenses as a percentage of net sales increased 0.2 of a percentage point in 2006 when compared to 2005. In

dollars, SG&A increased $435 million, with restructuring and other items increasing SG&A by $238 million and other

spending increasing SG&A by $197 million. 3M continues to invest in growth-oriented SG&A as sales and marketing costs

increased faster than sales, while administrative expenses remained relatively flat in dollars, attributable to ongoing cost-

control efforts.