3M 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

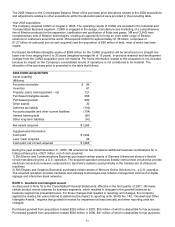

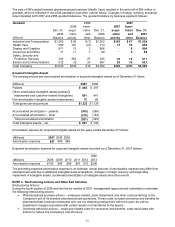

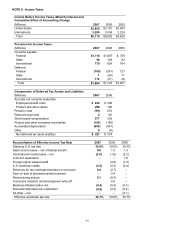

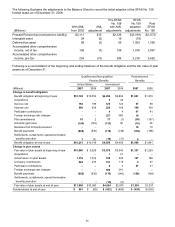

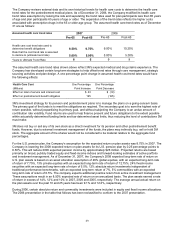

NOTE 8. Income Taxes

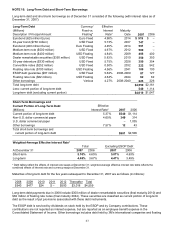

Income Before Income Taxes, Minority Interest and

Cumulative Effect of Accounting Change

(Millions) 2007 2006 2005

United States $2,820 $3,191 $2,604

International 3,295 2,434 2,224

Total $6,115 $5,625 $4,828

Provision for Income Taxes

(Millions) 2007 2006 2005

Currently payable

Federal $1,116 $1,087 $ 709

State 58 128 82

International 779 824 704

Deferred

Federal (105) (261) 127

State 1 (24) 11

International 115 (31) (6)

Total $1,964 $1,723 $1,627

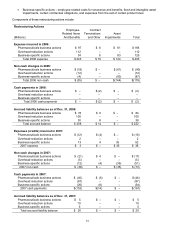

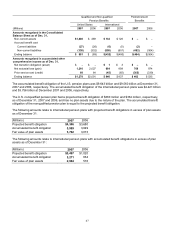

Components of Deferred Tax Assets and Liabilities

(Millions) 2007 2006

Accruals not currently deductible

Employee benefit costs $ 240 $ 206

Product and other claims 258 190

Pension costs (99)

478

Restructuring costs 2 66

Stock-based compensation 377 335

Product and other insurance receivables (154) (156)

Accelerated depreciation (403) (541)

Other 6 (4)

Net deferred tax asset (liability) $ 227 $ 574

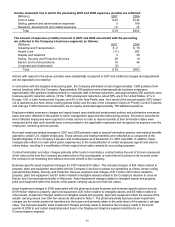

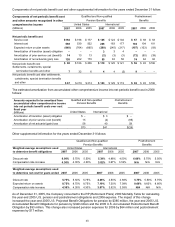

Reconciliation of Effective Income Tax Rate 2007 2006 2005

Statutory U.S. tax rate 35.0% 35.0% 35.0%

State income taxes – net of federal benefit 0.9 1.0 1.3

International income taxes – net (2.8) (1.5) (2.2)

Jobs Act repatriation – –1.6

Foreign export sales benefit – (0.9) (1.0)

U.S. business credits (0.3) (0.3) (0.4)

Reserves for tax contingencies/return to provision 0.4 (2.7) –

Gain on sale of pharmaceuticals business – 0.4 –

Restructuring actions 0.1 (0.3) –

In-process research and development write-off – 0.6 –

Medicare Modernization Act (0.4) (0.4) (0.3)

Domestic Manufacturer’s deduction (0.8) (0.3) (0.2)

All other – net – – (0.1)

Effective worldwide tax rate 32.1% 30.6% 33.7%