3M 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.47

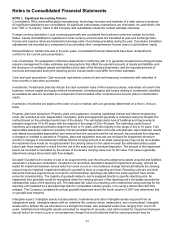

Derivatives and hedging activities: All derivative instruments are recorded on the balance sheet at fair value. The

Company uses interest rate swaps, currency swaps, and forward and option contracts to manage risks generally

associated with foreign exchange rate, interest rate and commodity market volatility. All hedging instruments that qualify

for hedge accounting are designated and effective as hedges, in accordance with U.S. generally accepted accounting

principles. If the underlying hedged transaction ceases to exist, all changes in fair value of the related derivatives that

have not been settled are recognized in current earnings. Instruments that do not qualify for hedge accounting are

marked to market with changes recognized in current earnings. The Company does not hold or issue derivative financial

instruments for trading purposes and is not a party to leveraged derivatives. However, the Company does have

contingently convertible debt that, if conditions for conversion are met, is convertible into shares of 3M common stock

(refer to Note 10 in this document).

New Accounting Pronouncements

As of December 31, 2005, the Company adopted FASB Interpretation No. 47, “Accounting for Conditional Asset

Retirement Obligations” (FIN 47). This accounting standard applies to the fair value of a liability for an asset retirement

obligation associated with the retirement of tangible long-lived assets and where the liability can be reasonably

estimated. Conditional asset retirement obligations exist for certain of the Company’s long-term assets. The fair value

of these obligations is recorded as liabilities on a discounted basis. Over time the liabilities are accreted for the change

in the present value and the initial capitalized costs are depreciated over the useful lives of the related assets. The

adoption of FIN 47 effective December 31, 2005, resulted in the recognition of an asset retirement obligation liability of

$59 million at December 31, 2005, and an after-tax charge of $35 million for 2005, which is reflected as a cumulative

effect of change in accounting principle in the Consolidated Statement of Income. At December 31, 2007, the asset

retirement obligation liability was $59 million.

In February 2006, the FASB issued Statement of Financial Accounting Standards (SFAS) No. 155, “Hybrid

Instruments.” SFAS No. 155 amends SFAS No. 133 and SFAS No. 140, “Accounting for Transfers and Servicing of

Financial Assets and Extinguishments of Liabilities.” SFAS No. 155 also resolves issues addressed in Statement 133

Implementation Issue No. D1, “Application of Statement 133 to Beneficial Interests in Securitized Financial Assets.”

SFAS No. 155: a) permits fair value remeasurement for any hybrid financial instrument that contains an embedded

derivative that otherwise would require bifurcation, b) clarifies which interest-only strips and principal-only strips are

not subject to the requirements of SFAS No. 133, c) establishes a requirement to evaluate interests in securitized

financial assets to identify interests that are freestanding derivatives or that are hybrid financial instruments that

contain an embedded derivative requiring bifurcation, d) clarifies that concentrations of credit risk in the form of

subordination are not embedded derivatives, and e) amends SFAS No. 140 to eliminate the prohibition on a qualifying

special purpose entity from holding a derivative financial instrument that pertains to a beneficial interest other than

another derivative financial instrument. The Company adopted SFAS No. 155 effective January 1, 2007; however,

there was no material impact.

In June 2006, the FASB issued Interpretation No. 48 (FIN 48), “Accounting for Uncertainty in Income Taxes, an

interpretation of FASB Statement No. 109.” This interpretation was effective as of January 1, 2007. Refer to Note 8 for

additional information concerning this standard.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements.” SFAS No. 157 establishes a single

definition of fair value and a framework for measuring fair value, sets out a fair value hierarchy to be used to classify

the source of information used in fair value measurements, and requires new disclosures of assets and liabilities

measured at fair value based on their level in the hierarchy. SFAS No. 157 is effective for all fiscal years beginning

after November 15, 2007 (January 1, 2008 for 3M) and is to be applied prospectively. In February 2008, the FASB

issued Staff Positions No. 157-1 and No. 157-2 which partially defer the effective date of SFAS No. 157 for one year

for certain nonfinancial assets and liabilities and remove certain leasing transactions from its scope. The Company is

currently evaluating the impacts and disclosures of this standard, but would not expect SFAS No. 157 to have a

material impact on 3M’s consolidated results of operations or financial condition.

In September 2006, the Financial Accounting Standards Board (FASB) issued SFAS No. 158, “Employers’ Accounting

for Defined Benefit Pension and Other Postretirement Plans, an amendment of FASB Statements No. 87, 88, 106 and

132(R).” Refer to Note 11 for additional information concerning this standard.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial

Liabilities”. SFAS No. 159 permits an entity to choose, at specified election dates, to measure eligible financial

instruments and certain other items at fair value that are not currently required to be measured at fair value. An entity

shall report unrealized gains and losses on items for which the fair value option has been elected in earnings at each

subsequent reporting date. Upfront costs and fees related to items for which the fair value option is elected shall be

recognized in earnings as incurred and not deferred. SFAS No. 159 also establishes presentation and disclosure

requirements designed to facilitate comparisons between entities that choose different measurement attributes for