eTrade 2002 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2002 eTrade annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216

|

|

Table of Contents

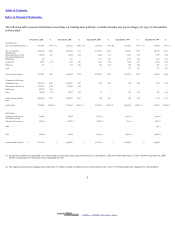

Index to Financial Statements

Bank’ s decision to shift a portion of its assets into consumer loans which are higher-yielding asset classes that have higher risk characteristics.

If our non-accruing loans as of December 31, 2002 had been performing in accordance with their terms, we would have recorded additional

interest income of approximately $1.4 million in fiscal 2002. In fiscal 2002, $0.6million of interest was recognized on non-accrual loans.

Special Mention Loans .In certain situations, a borrower’ s past credit history may cast doubt on the borrower’ s ability to repay under the loan’ s

contractual terms, whether or not the loan is delinquent. Such loans, classified as “special mention” loans, continue to accrue interest and

remain as a component of the loans receivable balance. These loans represented $31.0 million of the total loan portfolio at December 31, 2002,

and are actively monitored.

Allowance for Loan Losses. As an investor in mortgage and consumer loans, we recognize that we will experience credit losses. We believe the

risk of credit loss varies based on a variety of factors including the following:

•

type of loan;

•

creditworthiness of the borrower over the term of the loan;

•

general economic conditions; and

•

in the case of a secured loan, the type and quality of the loan’ s security and the loan-to-value ratio.

Our policy is to maintain an adequate allowance for loan losses based on a variety of factors including the following:

•

our historical loan loss experience;

•

regular reviews of delinquencies and loan portfolio quality;

•

the industry’ s historical loan loss experience for similar asset types; and

•

evaluation of economic conditions.

We increase our allowance for loan losses when we estimate that losses have been incurred by charging provisions for probable loan losses

against income. Charge-offs reduce the allowance when losses are recognized.

In establishing the allowance for loan losses, we record specific allowances for probable losses that we have identified for commercial and

certain large dollar real estate and consumer loans specifically reviewed for impairment. We provide a general allowance for estimated

expected losses for real estate and consumer loans not specifically reviewed. The allowances established by management are subject to review

2003. EDGAR Online, Inc.