eTrade 2002 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2002 eTrade annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

Delinquent, Non-performing and Other Problem Assets

General. We continually monitor our loan portfolio so that we will be able to anticipate and address potential and actual delinquencies. Based

on the length of the delinquency period, we reclassify these assets as non-performing and, if necessary, take possession of the underlying

collateral. Once the Bank takes possession of the underlying collateral, the property is classified on our balance sheet as other assets.

Non-performing Assets .Loans for which payment of principal or interest is 90 days past due, as well as other loans considered uncollectible,

are placed on non-accrual status. All non-accrual loans are considered non-performing. Interest income is not accrued for loans classified as

non-performing and any income accrued through the initial 90-day delinquency is reversed. Accretion of deferred loan fees is discontinued for

non-accrual loans. The Company’ s method of accounting for payments received on non-accrual loans is to recognize payments as interest

income when the loan is considered collectible and to apply payments to principal when it is doubtful that principal and interest will be fully

recovered.

Real Estate Owned and Repossessed Assets. At acquisition, we record Real Estate Owned (“REO”) and repossessed assets at estimated fair

value less estimated selling costs. Fair value is determined by appraisal or other appropriate valuation method. Losses estimated at the time of

acquisition are charged to the allowance for loan losses. Management performs periodic valuations and establishes a valuation allowance for

REO and repossessed assets through a charge to income if the carrying value of a property exceeds its estimated fair value less estimated selling

costs.

As of December 31, 2002, our REO and repossessed assets consisted of $1.6 million of one to four-family real estate loans, $1.4 million of

automobile loans and $3.7 million of RV loans.

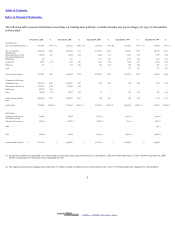

The following table presents information about our non-accrual loans and other repossessed assets at the dates indicated (in thousands):

December31, 2002 December31, 2001 September30, 2000 September30, 1999 September30, 1998

Real estate loans:

One- to four-family $ 22,497 $ 20,595 $ 11,391 $ 7,595 $ 7,727

Home equity lines of credit and second

mortgage loans

81 — — 21 255

Commercial — — 657 664 372

Land — — — — 316

Automobiles loans 2,277 91 — — —

Marine loans 94 — — — —

Recreational vehicles loans 1,486 — — — —

Other 53 — — 60 205

Total non-performing loans, net 26,488 20,686 12,048 8,340 8,875

Total REO and other repossessed assets, net 6,723 3,328 850 539 1,460

Total non-performing assets, net $ 33,211 $ 24,014 $ 12,898 $ 8,879 $ 10,335

Total non-performing assets, net, as a

percentage of total bank assets

0.19 %

0.18 %

0.14 %

0.21 %

0.45 %

Total loss allowance as a percentage of total

non-performing loans, net

104.45 %

96.07 %

90.72 %

85.86 %

53.70 %

During fiscal 2002, our non-performing assets increased by $9.2 million, or 38%, to $33.2 million at December 31, 2002 from $24.0 million at

December 31, 2001. This increase was attributable primarily to the

8

2003. EDGAR Online, Inc.