XM Radio 2000 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2000 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RADiO TO THE POWER OF X

XM SATELLiTE RADiO 2000 Annual Report

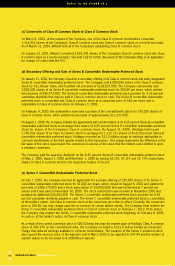

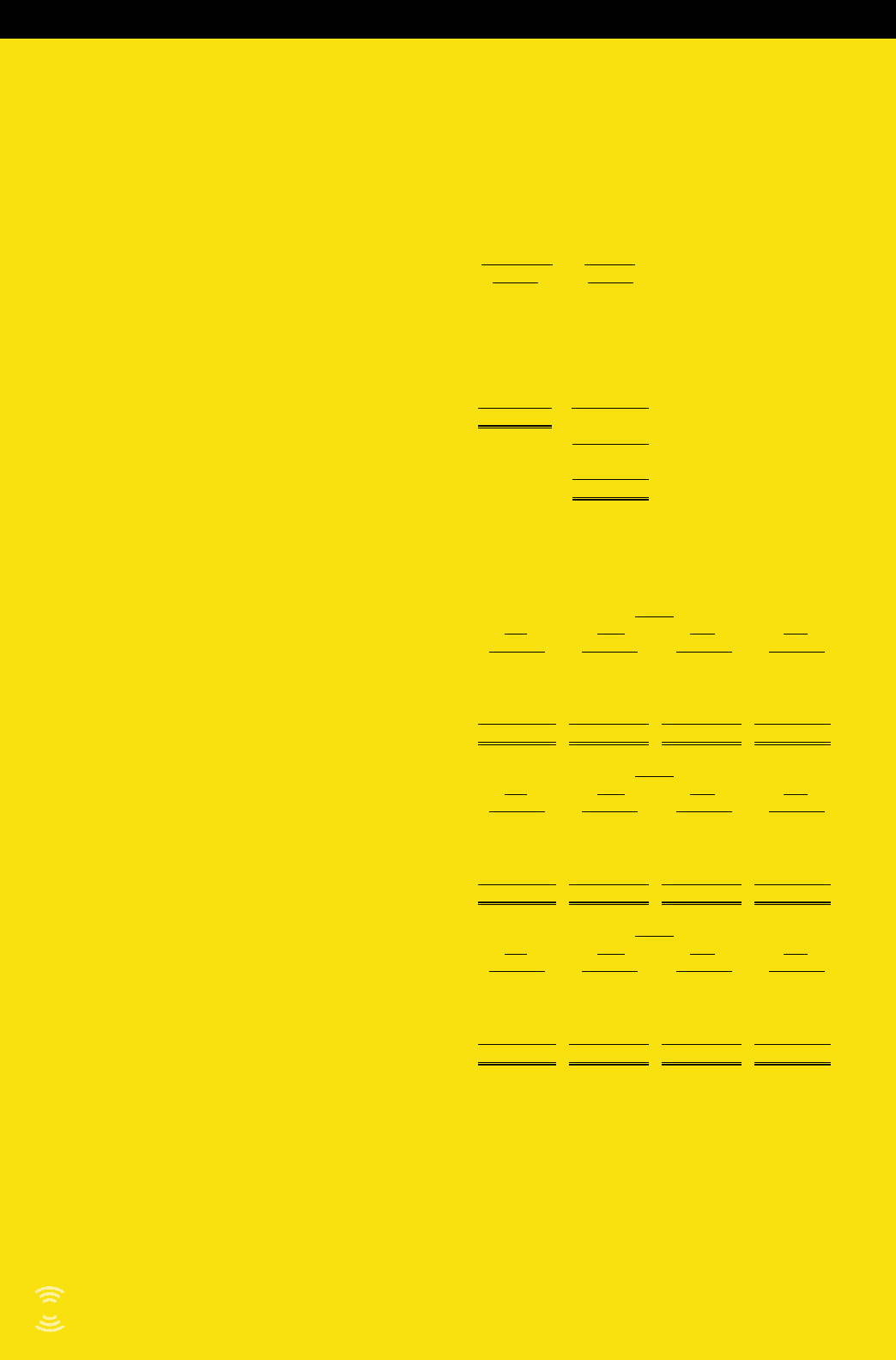

(l) Leases

The Company has noncancelable operating leases for office space and terrestrial repeater sites and noncancelable

capital leases for equipment that expire over the next ten years. The future minimum lease payments under

noncancelable leases as of December 31, 2000 are (in thousands):

Operating Capital

leases leases

Year ending December 31:

2001 ........................................................ $ 13,261 $ 847

2002 ........................................................ 13,665 761

2003 ........................................................ 13,986 474

2004 ........................................................ 14,230 —

2005 ........................................................ 11,041 —

Thereafter ................................................ 22,513 —

Total ...................................................... $ 88,696 2,082

Less amount representing interest ............................ (159)

Present value of net minimum lease payments .......... 1,923

Less current maturities ............................................ (556)

Long-term obligations .............................................. $ 1,367

Rent expense for 1998, 1999 and 2000 was $231,000, $649,000 and $6,082,000 respectively.

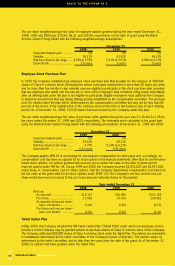

(12) Quarterly Data (Unaudited)

1998

1st 2nd 3rd4th

Quarter Quarter Quarter Quarter

Revenues................................................................. $ — $ — $ — $ —

Operating loss.......................................................... 3,100 5,032 3,865 4,196

Loss before income taxes......................................... 3,100 5,032 3,857 4,178

Net loss attributable to common stockholders............ 3,100 5,032 3,857 4,178

Net loss per share—basic and diluted........................ $ (0.46) $ (0.75) $ (0.58) $ (0.62)

1999

1st 2nd 3rd4th

Quarter Quarter Quarter Quarter

Revenues................................................................. $ — $ —$ — $ —

Operating loss.......................................................... 4,421 4,020 9,374 12,876

Loss before income taxes......................................... 4,367 3,999 17,402 11,128

Net loss attributable to common stockholders............ 4,367 3,999 17,402 11,128

Net loss per share—basic and diluted....................... $ (0.65) $ (0.60) $ (2.60) $ (0.27)

2000

1st 2nd 3rd4th

Quarter Quarter Quarter Quarter

Revenues................................................................. $ —$ —$ — $ —

Operating loss.......................................................... 16,888 13,937 28,109 20,544

Loss before income taxes......................................... 12,740 5,088 20,060 13,985

Net loss attributable to common stockholders............ 14,212 7,259 160,095 19,773

Net loss per share—basic and diluted........................$ (0.30) $ (0.15) $ (3.26) $ (0.40)

The sum of quarterly per share net losses do not necessarily agree to the net loss per share for the year due to

the timing of stock issuances.

(13) Subsequent Financing (unaudited)

In March 2001, the Company completed a follow-on offering of 7,500,000 shares of Class A common stock,

which yielded net proceeds of $72.0 million, and a concurrent offering of 7.75% convertible subordinated notes

due 2006, convertible into shares of Class A common stock at a conversion price of $12.23 per share, which

yielded net proceeds of $120.7 million.

48