XM Radio 2000 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2000 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

XM SATELLiTE RADiO 2000 Annual Report

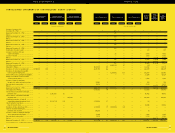

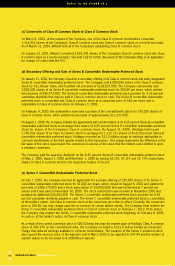

System under construction consists of the following (in thousands):

December 31,

1999 2000

License .................................................. $132,418 $ 140,220

Satellite system ...................................... 214,471 533,154

Terrestrial system .................................. 11,396 84,715

Spacecraft control facilities .................... 2,000 13,046

Broadcast facilities.................................. 2,073 27,970

System development .............................. —6,458

$362,358 $ 805,563

The balances at December 31, 1999 and 2000 include capitalized interest of $29,068,000 and $68,120,000, respectively.

The Company’s policy is to review its long-lived assets and certain identifiable intangibles for impairment whenever

events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable.

Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to

future undiscounted net cash flows expected to be generated by the asset. If such assets are considered to be

impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the

assets exceed the fair value of the assets. Assets to be disposed of are reported at the lower of the carrying

amount or fair value less costs to sell.

The Company had scheduled the launch of its satellite, “XM Roll”, on January 8, 2001. This launch was halted

just before lift-off. As a result, the Company has determined that it will launch its other satellite, “XM Rock”, first,

which is scheduled for March 18, 2001. The Company anticipates that XM Roll will be launched in early May

2001 and will commence commercial operations in the summer of 2001.

(h) Goodwill and Intangible Assets

Goodwill and intangible assets, which represents the excess of purchase price over fair value of net assets

acquired, is amortized on a straight-line basis over the expected periods to be benefited, generally 15 years.

The Company assesses the recoverability of its intangible assets by determining whether the amortization of the

goodwill and intangible assets balance over its remaining life can be recovered through undiscounted future

operating cash flows. The amount of goodwill and intangible assets impairment, if any, is measured by the

amount by which the carrying amount of the assets exceed the fair value of the assets. The assessment of the

recoverability of goodwill will be impacted if estimated future operating cash flows are not achieved.

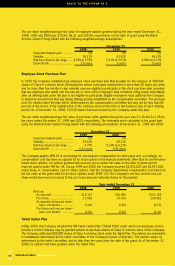

(i) Stock-Based Compensation

The Company accounts for stock-based compensation arrangements in accordance with the provisions of

Accounting Principle Board (‘‘APB’’) Opinion No. 25, Accounting for Stock Issued to Employees (‘‘APB 25’’), and

related interpretations including FASB Interpretation (‘‘FIN’’) No. 44, Accounting for Certain Transactions Involving

Stock Compensation, an interpretation of APB opinion No. 25 issued in March 2000, and complies with the disclosure

provisions of SFAS No. 123, Accounting for Stock-Based Compensation. Under APB 25, compensation expense

is based upon the difference, if any, on the date of grant, between the fair value of the Company’s stock and

the exercise price. All stock-based awards to non-employees are accounted for at their fair value in accordance

with SFAS No. 123.

The Company adopted FIN No. 44 in July 2000 to account for stock options that had been repriced during the

period covered by FIN No. 44. The application resulted in additional compensation of $1,213,000 during the

year ended December 31, 2000. Additional compensation charges may result depending upon the market value

of the common stock at each balance sheet date.

FiNANCiALS 2000

35

$ 362,358

$ 132,418

214,471