XM Radio 2000 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2000 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RADiO TO THE POWER OF X

XM SATELLiTE RADiO 2000 Annual Report

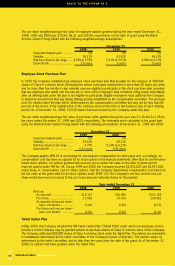

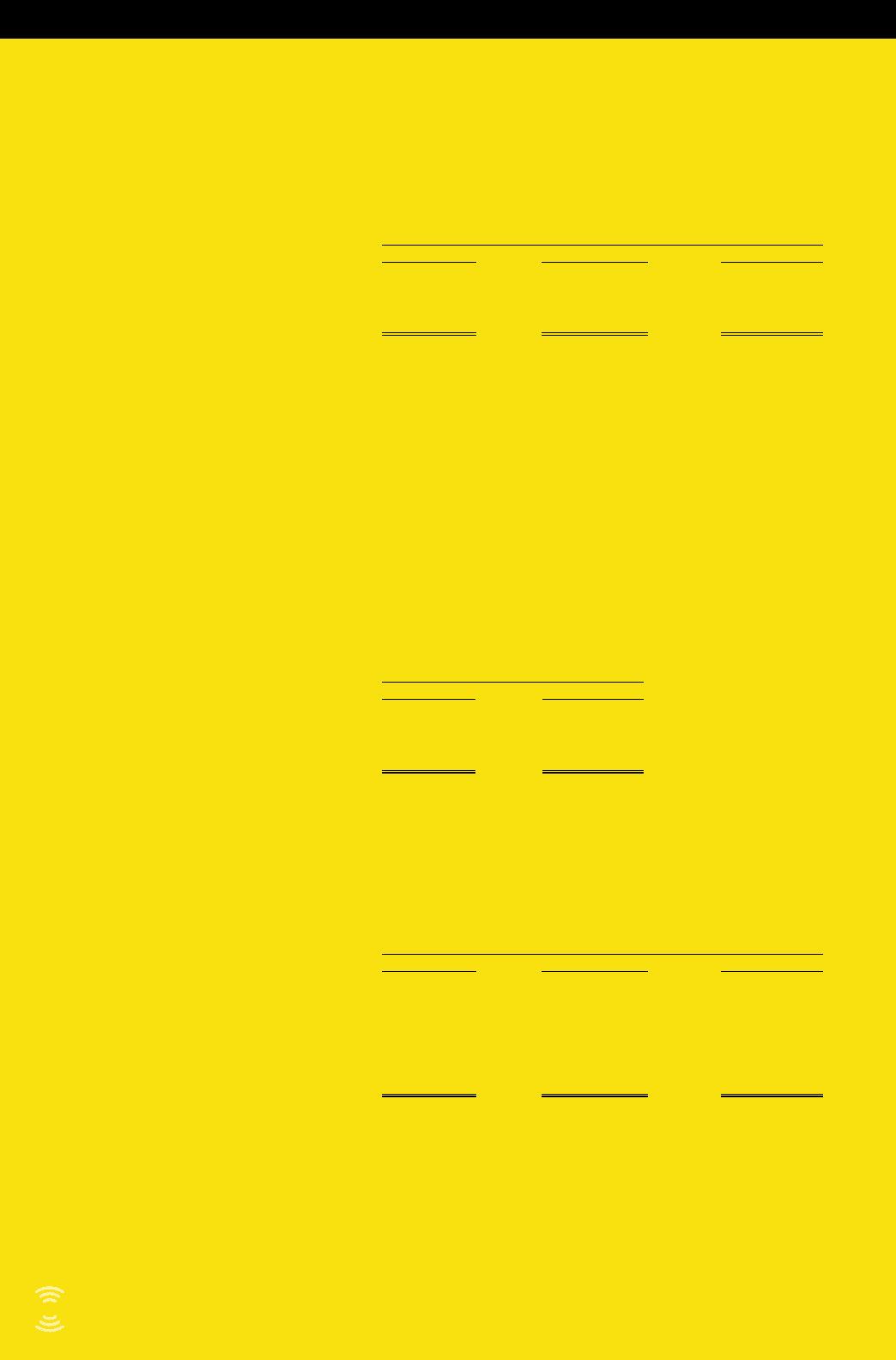

The per share weighted-average fair value of employee options granted during the year ended December 31,

1998, 1999 and 2000 was $10.54, $6.21 and $22.06, respectively, on the date of grant using the Black-

Scholes Option Pricing Model with the following weighted-average assumptions:

December 31,

1998 1999 2000

Expected dividend yield ............ 0% 0% 0%

Volatility.................................... 56.23% 63.92% 68.21%

Risk-free interest rate range ...... 4.53% to 5.57% 5.47% to 5.97% 4.99% to 6.71%

Expected life ............................ 7.5 years 5 years 5 years

Employee Stock Purchase Plan

In 1999, the Company established an employee stock purchase plan that provides for the issuance of 300,000

shares of Class A common stock. All employees whose customary employment is more than 20 hours per week

and for more than five months in any calendar year are eligible to participate in the stock purchase plan, provided

that any employee who would own five percent or more of the Company’s total combined voting power immediately

after an offering date under the plan is not eligible to participate. Eligible employees must authorize the Company

to deduct an amount from their pay during offering periods established by the compensation committee. The purchase

price for shares under the plan will be determined by the compensation committee but may not be less than 85

percent of the lesser of the market price of the common stock on the first or last business day of each offering

period. As of December 31, 2000, 53,539 shares had been issued by the Company under this plan.

The per share weighted-average fair value of purchase rights granted during the year was $3.30 and $11.28 for

the years ended December 31, 1999 and 2000, respectively. The estimates were calculated at the grant date

using the Black-Scholes Option Pricing Model with the following assumptions at December 31, 1999 and 2000:

December 31,

1999 2000

Expected dividend yield ............ 0% 0%

Volatility.................................... 62.92% 68.21%

Risk-free interest rate range ...... 4.73% 5.33% to 6.23%

Expected life ............................ 0.23 years 0.24 years

The Company applies APB 25 in accounting for stock-based compensation for both plans and, accordingly, no

compensation cost has been recognized for its stock options in the financial statements other than for performance

based stock options, for options granted with exercise prices below fair value on the date of grant and for

repriced options under FIN No. 44. During 1999 and 2000, the Company incurred $4,070,000 and $2,557,000,

respectively, in compensation cost for these options. Had the Company determined compensation cost based on

the fair value at the grant date for its stock options under SFAS 123, the Company’s net loss and net loss per

share would have been increased to the pro forma amounts indicated below (in thousands):

Year ended December 31,

1998 1999 2000

Net loss:

As reported .......................... $16,167 $36,896 $201,338

Pro forma ............................ 17,508 37,706 209,582

As reported–net loss per share–

basic and diluted................ (2.42) (2.40) (4.15)

Pro forma–net loss per share–

basic and diluted .............. (2.62) (2.62) (4.32)

Talent Option Plan

In May 2000, the Company adopted the XM Talent Option Plan (‘‘Talent Plan’’) under which non-employee service

providers to the Company may be granted options to purchase shares of Class A common stock of the Company.

The Company authorized 500,000 shares of Class A common stock under the Talent Plan. The options are exercisable

in installments determined by the talent committee of the Company’s board of directors. The options expire as

determined by the talent committee, but no later than ten years from the date of the grant. As of December 31,

2000, no options had been granted under the Talent Plan.

42