XM Radio 2000 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2000 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RADiO TO THE POWER OF X

XM SATELLiTE RADiO 2000 Annual Report

28

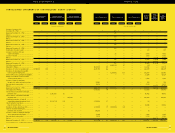

CONSOLiDATED BALANCE SHEETS

(In thousands, except share data)

ASSETS

Current assets:

Cash and cash equivalents ....................................................................................................$ 50,698 $ 224,903

Short-term investments ........................................................................................................ 69,472 —

Restricted investments .......................................................................................................... — 95,277

Prepaid and other current assets .......................................................................................... 1,077 8,815

Total current assets .......................................................................................................... 121,247 328,995

Other assets:

Restricted investments, net of current portion ........................................................................ —65,889

System under construction .................................................................................................... 362,358 805,563

Property and equipment, net of accumulated depreciation and amortization of $347 and $2,337 .... 2,551 59,505

Goodwill and intangibles, net of accumulated amortization of $1,220 and $2,599 ...................... 25,380 24,001

Other assets, net of accumulated amortization of $0 and $672 .............................................. 3,653 9,265

Total assets......................................................................................................................$ 515,189 $ 1,293,218

LiABiLiTiES AND STOCKHOLDERS’ EQUiTY

Current liabilities:

Accounts payable..................................................................................................................$ 23,338 $ 47,159

Accrued expenses ................................................................................................................ 1,514 4,645

Due to related party.............................................................................................................. 62 63

Accrued interest on senior secured notes .............................................................................. —13,397

Royalty payable .................................................................................................................... 1,646 2,565

Total current liabilities........................................................................................................ 26,560 67,829

Senior secured notes, net of discount amortization of $0 and $2,044 ........................................ —261,298

Royalty payable, net of current portion ...................................................................................... 3,400 2,600

Capital lease, net of current portion .......................................................................................... 212 1,367

Other non-current liabilities ........................................................................................................ —4,172

Total liabilities .................................................................................................................. 30,172 337,266

Stockholders’ equity:

Series A convertible preferred stock, par value $0.01 (liquidation preference

of $102,688,000); 15,000,000 shares authorized, 10,786,504 shares issued

and outstanding at December 31, 1999 and 2000 ............................................................ 108 108

Series B convertible redeemable preferred stock, par value $0.01 (liquidation preference of

$43,364,000); 3,000,000 shares authorized, no shares and 867,289 shares issued and

outstanding at December 31, 1999 and 2000, respectively ................................................ — 9

Series C convertible redeemable preferred stock, par value $0.01 (liquidation preference

of $244,277,000); 250,000 shares authorized, no shares and 235,000 shares issued

and outstanding at December 31, 1999 and 2000, respectively.......................................... — 2

Class A common stock, par value $0.01; 180,000,000 shares authorized,

26,465,333 and 34,073,994 shares issued and outstanding at

December 31, 1999 and 2000, respectively ...................................................................... 265 341

Class B common stock, par value $0.01; 30,000,000 shares authorized,

17,872,176 and 16,557,262 shares issued and outstanding at

December 31, 1999 and 2000, respectively ...................................................................... 179 166

Class C common stock, par value $0.01; 30,000,000 shares authorized,

no shares issued and outstanding at December 31, 1999 and 2000 .................................. ——

Additional paid-in capital ........................................................................................................ 539,187 1,061,921

Deficit accumulated during development stage ...................................................................... (54,722) (106,595)

Total stockholders’ equity .................................................................................................. 485,017 955,952

Commitments and contingencies (notes 3, 10 and 11)

Total liabilities and stockholders’ equity ..............................................................................$ 515,189 $ 1,293,218

See accompanying notes to consolidated financial statements.

20001999

December 31,