XM Radio 2000 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2000 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

XM SATELLiTE RADiO 2000 Annual Report

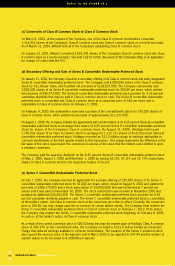

(6) WSI Options

In 1997, the Company issued WSI three options in accordance with the terms of loans issued to WSI. Under the

first option, WSI could have purchased 5,202,748 shares of common stock at $4.52 per share to acquire common

stock. The option could have been exercised in whole or in incremental amounts between April 16, 1998 and

October 16, 2002. Under certain circumstances, Motient could have required WSI to exercise the option in

whole. The Company allocated $1,250,000 to the option. Under the second option, WSI could have purchased

6,897,291 shares at $8.91 per share. The option could have been exercised between October 16, 1997 and

October 16, 2003. The Company allocated $170,000 to the option. Under the third option, WSI could have purchased

187,893 shares of common stock at $5.32 per share. The option could have been exercised between October

16, 1997 and October 17, 2002. The Company allocated $80,000 to the option.

The options were acquired by Motient and exchanged for the $81,676,000 note to Motient as part of the

WorldSpace Transaction (see note 3(a)).

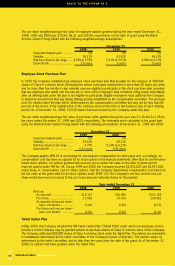

(7) Profit Sharing and Employee Savings Plan

On July 1, 1998, the Company adopted a profit sharing and employee savings plan under Section 401(k) of the

Internal Revenue Code. This plan allows eligible employees to defer up to 15 percent of their compensation on a

pre-tax basis through contributions to the savings plan. The Company contributed $0.50 in 1998, 1999 and

2000 for every dollar the employees contributed up to 6 percent of compensation, which amounted to $14,000,

$164,000 and $229,000, respectively.

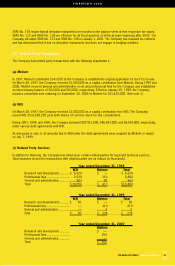

(8) Interest Cost

The Company capitalizes a portion of interest cost as a component of the cost of the FCC license and satellite

system under construction. The following is a summary of interest cost incurred during December 31, 1998,

1999 and 2000, and for the period from December 15, 1992 (date of inception) to December 31, 1999 (in

thousands):

December 15, 1992

(date of inception)

to December 31,

1998 1999 2000 2000

Interest cost capitalized................................ $ 11,824 $ 15,343 $ 39,052 $ 68,120

Interest cost charged to expense.................. —9,120 —9,669

Total interest cost incurred ...................... $ 11,824 $ 24,463 $ 39,052 $ 77,789

Interest costs incurred prior to the award of the license were expensed in 1998. During 1999, the Company

exceeded its capitalization threshold by $3,600,000 and incurred a charge to interest of $5,520,000 for the

beneficial conversion feature of a related party note.

(9) Income Taxes

For the period from December 15, 1992 (date of inception) to October 8, 1999, the Company filed consolidated

federal and state tax returns with its majority stockholder Motient. The Company generated net operating losses

and other deferred tax benefits that were not utilized by Motient. As no formal tax sharing agreement has been

finalized, the Company was not compensated for the net operating losses. Had the Company filed on a stand-

alone basis for the three-year period ending December 31, 2000, the Company’s tax provision would be as follows:

FiNANCiALS 2000

43