XM Radio 2000 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2000 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

XM SATELLiTE RADiO 2000 Annual Report

(10) Accumulated Deficit

The Company is devoting its efforts to develop, construct and expand a digital audio radio network. This effort

involves substantial risk and future operating results will be subject to significant business, economic, regulatory,

technical, and competitive uncertainties and contingencies. These factors individually or in the aggregate could

have an adverse effect on the Company’s financial condition and future operating results and create an uncertainty

as to the Company’s ability to continue as a going concern. The financial statements do not include any adjustments

that might be necessary should the Company be unable to continue as a going concern.

At the Company’s current stage of development, economic uncertainties exist regarding the successful acquisition

of additional debt or equity financings and the attainment of positive cash flows from the Company’s proposed

service. The Company is currently constructing its satellite and terrestrial systems and will require substantial

additional financing to market and distribute the satellite-based radio service. Failure to obtain the required long-term

financing will prevent the Company from realizing its objective of providing satellite-based radio programming.

Management’s plan to fund operations and capital expansion includes the additional sale of debt and equity securities

through public and private sources. There are no assurances, however, that such financing will be obtained.

(11) Commitments and Contingencies

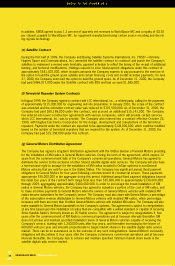

(a) FCC License

The FCC has established certain system development milestones that must be met for the Company to maintain

its license to operate the system. The Company believes that it is proceeding into the system development as

planned and in accordance with the FCC milestones.

(b) Application for Review of FCC License

One of the losing bidders for the DARS licenses filed an Application for Review by the full FCC of the Licensing

Order which granted the Company its FCC license. The Application for Review alleges that WSI had effectively

taken control of the Company without FCC approval. The FCC or the U.S. Court of Appeals has the authority to

overturn the award of the FCC license should they rule in favor of the losing bidder. Although the Company

believes that its right to the FCC license will withstand the challenge as WSI is no longer a stockholder in the

Company, no prediction of the outcome of this challenge can be made with any certainty.

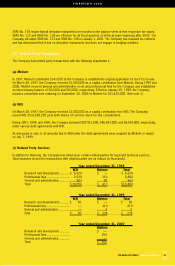

(c) Technical Services

Effective January 1, 1998, the Company entered into agreements with Motient and WorldSpace Management

Corporation (“WorldSpace MC”), an affiliate of WSI, in which Motient and WorldSpace MC would provide technical

support in areas related to the development of a DARS system. Payments for services provided under these

agreements are made based on negotiated hourly rates. These agreements may be terminated by the parties on

or after the date of the commencement of commercial operation following the launch of the Holdings’ first satellite.

There are no minimum services purchase requirements. The Company incurred costs of $413,000, $224,000

and $252,000 under its agreement with Motient and $4,357,000, $0 and $0 costs were incurred under its

agreement with WorldSpace MC during the years ended December 31, 1998, 1999 and 2000, respectively. The

Company incurred costs of $1,039,000 under its agreement with Motient and $5,317,000 in costs were incurred

under its agreement with WorldSpace MC from December 15, 1992 (date of inception) through December 31, 2000.

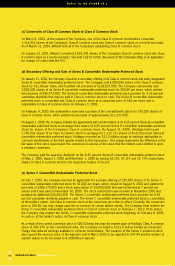

(d) Technology Licenses

Effective January 1, 1998, XMSR entered into a technology licensing agreement with Motient and WorldSpace

MC by which as compensation for certain licensed technology then under development to be used in the XM

Radio system, XMSR will pay up to $14,300,000 to WorldSpace MC over a ten-year period. As of December 31,

2000 XMSR incurred costs of $6,696,000 payable to WorldSpace MC. Any additional amounts to be incurred

under this agreement are dependent upon further development of the technology, which is at XMSR’s option. No

liability exists to Motient or WorldSpace MC should such developments prove unsuccessful. XMSR maintains an

accrual of $5,165,000 payable to WorldSpace MC, for quarterly royalty payments to be made.

FiNANCiALS 2000

45