Whirlpool 2001 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2001 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

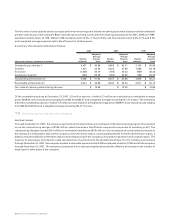

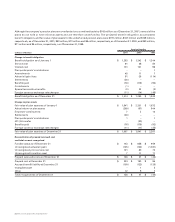

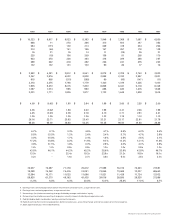

The medical cost trend significantly affects the reported postretirement benefit cost and benefit obligations. A one-percentage-point

change in the assumed health care cost trend rate would have the following effects:

One One

Percentage Percentage

Point Point

(millions of dollars) Increase Decrease

Effect on total service cost and interest cost components $ 4 $ (4)

Effect on postretirement benefit obligation 37 (37)

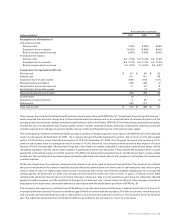

The U.S. pension plans provide that in the event of a plan termination within five years following a change in control of the company,

any assets held by the plans in excess of the amounts needed to fund accrued benefits would be used to provide additional benefits

to plan participants. A change in control generally means either a change in the majority of the incumbent board of directors or

an acquisition of 25% or more of the voting power of the company’s outstanding stock, without the approval of a majority of the

incumbent board.

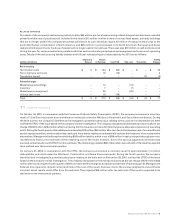

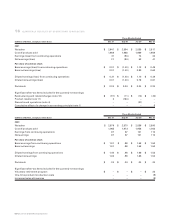

The company maintains a 401(k) defined contribution plan covering substantially all U.S. employees. Company matching contributions

for domestic hourly and certain other employees under the plan, based on the company’s annual operating results and the level of

individual participant’s contributions, amounted to $12 million, $12 million and $9 million in 2001, 2000 and 1999.

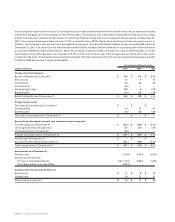

14 CONTINGENCIES

The company is involved in various legal actions arising in the normal course of business. Management, after taking into consideration

legal counsel’s evaluation of such actions, is of the opinion that the outcome of these matters will not have a material adverse effect

on the company’s financial position.

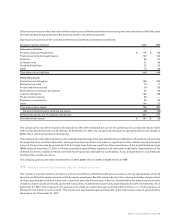

The company is a party to certain financial guarantees and standby letters of credit with risk not reflected on the balance sheet.

The only significant arrangement in place at year-end is in its Brazilian subsidiary. As a standard business practice the subsidiary

guarantees customer lines of credit at commercial banks following its normal credit policies. As of December 31, 2001 and 2000,

these amounts totaled $124 million and $106 million, respectively. The company currently believes the risk of loss to be minimal.

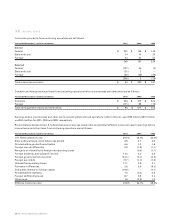

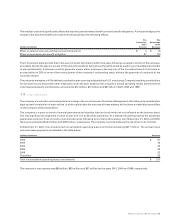

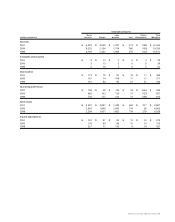

At December 31, 2001, the company had noncancelable operating lease commitments totaling $217 million. The annual future

minimum lease payments are detailed in the table below.

(millions of dollars) Amounts

2002 $ 57

2003 45

2004 32

2005 28

2006 23

Thereafter 32

Total noncancelable operating lease commitments $ 217

The company’s rent expense was $98 million, $93 million and $87 million for the years 2001, 2000 and 1999, respectively.

Whirlpool Corporation 2001 Annual Report 55