Whirlpool 2001 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2001 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis30

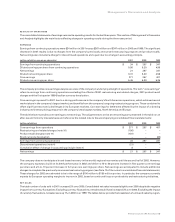

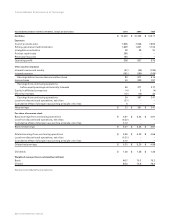

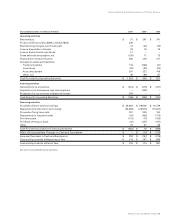

(in thousands) 2001 Change 2000 Change 1999

Units Sold

North America 21,404 3.7% 20,634 3.9% 19,862

Europe 10,803 (0.7) 10,876 3.9 10,469

Latin America 4,738 (3.7) 4,918 2.3 4,809

Asia 2,050 4.7 1,958 5.4 1,858

Other/eliminations (36) –(31) –(49)

Consolidated 38,959 1.6% 38,355 3.8% 36,949

(millions of dollars) 2001 Change 2000 Change 1999

Net Sales

North America $ 6,581 5.8% $ 6,223 1.0% $ 6,159

Europe 2,058 (4.5) 2,156 (12.1) 2,452

Latin America 1,487 (12.8) 1,706 2.3 1,668

Asia 373 (4.4) 390 4.0 375

Other/eliminations (156) –(150) –(143)

Consolidated $ 10,343 0.2% $ 10,325 (1.8)% $ 10,511

Significant regional trends were as follows:

In 2001, North American unit volumes increased 4% in an industry that was down slightly. This resulted in record market share in

the region and a 1.4 pts increase over 2000. In 2000, major appliance shipments exceeded the 2% industry-wide growth. Net

sales increased slower than unit volumes as competitive pricing pressures reduced average sales values.

European unit volumes were down versus 2000 due primarily to the economic downturn affecting the European market. Market

share remained level as unit shipments were in line with the industry. Net sales decreased due to currency fluctuations and

continued pricing pressures. Excluding currency impact, net sales decreased 1%. European unit volumes increased in line with

industry growth during the 2000 versus 1999 comparison. Net sales decreased, however, as currency fluctuations and pricing

pressures offset the higher volume. Excluding the impact of currency fluctuations, net sales in 2000 would have been level with

1999.

Unit shipments in Latin America decreased versus 2000 due to the economic slowdown, which included an energy crisis in

Brazil and the Argentine economic crisis. The region’s sales were also heavily affected by currency fluctuations and the slowing

global economy’s impact on export sales. Excluding the impact of currency fluctuations, net sales increased 1%. Positive

economic trends during 2000 contributed to an increase in unit shipments over 1999. The increased volume and price

increases implemented during 2000 drove the increased revenue.

Asia’s unit sales increased over 2000, but net sales declined as the negative impact from currency and pricing pressures

combined to offset the higher unit volume. Excluding currency fluctuations, net sales increased 1%. Unit shipments increased

5% and 43% in the Indian and Chinese markets, which represent the larger markets in the company’s Asian region. During 2000,

Asia continued a positive trend as both units and revenue increased year-over-year.

In 2002, appliance industry shipments are expected to increase 2% in North America, increase slightly in Latin America, and be flat

in Europe and Asia.

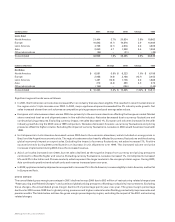

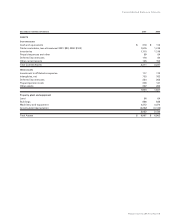

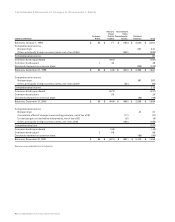

GROSS MARGIN

The consolidated gross margin percentage in 2001 declined versus 2000 due to $53 million of restructuring related charges (see

“Restructuring and Related Charges”) and continued global pricing pressures offsetting productivity improvements. Excluding

these charges, the consolidated gross margin declined 0.2 percentage points year-over-year. The gross margin percentage

declined in 2000 versus 1999 due to global pricing pressures and higher material costs offsetting productivity improvements and

pension credits. The table below outlines the gross margin percentages by region, excluding the impact of the 2001 restructuring

related charges.