Whirlpool 2001 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2001 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

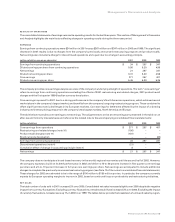

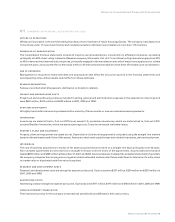

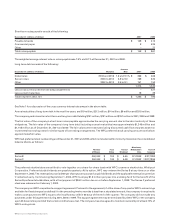

unfavorable exchange rate movement in the company’s portfolio of foreign currency forward contracts would have resulted in an

incremental unrealized loss of $75 million, while a ten percent favorable shift would have resulted in an incremental unrealized gain of

$67 million. Consistent with the use of these contracts to neutralize the effect of exchange rate fluctuations, such unrealized losses or

gains would be offset by corresponding gains or losses, respectively, in the remeasurement of the underlying transactions being hedged.

The company uses commodity futures contracts to hedge the price risk associated with firmly committed and forecasted commodities

purchases that are not hedged by contractual means directly with suppliers. As of December 31, 2001, a ten percent shift in

commodity prices would have resulted in an incremental $1 million gain or loss related to these contracts.

The company utilizes interest rate swaps to hedge its interest rate risk. As of December 31, 2001, a ten percent shift in interest rates

would have resulted in an incremental $1 million gain or loss related to these contracts. Since the company’s debt was primarily fixed

rate at year-end, a ten percent shift in interest rates would have an immaterial effect on operating results.

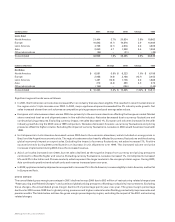

RECENTLY ISSUED ACCOUNTING STANDARDS

On January 1, 2001, the company adopted SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities,” as

amended, resulting in a cumulative effect of an accounting change of $8 million of income, net of tax, in the company’s statement of

earnings and an $11 million decrease, net of tax, in stockholders’ equity. See Notes 1 and 7 of the notes to consolidated financial statements.

In June 2001, the Financial Accounting Standards Board issued SFAS No. 141, “Business Combinations” and No. 142, “Goodwill

and Other Intangible Assets.” SFAS No. 141 requires that the purchase method of accounting be used for all business combinations

initiated after June 30, 2001. SFAS No. 141 also includes guidance on the initial recognition and measurement of goodwill and other

intangible assets arising from business combinations completed after June 30, 2001. Under SFAS No. 142, goodwill and indefinite

lived intangible assets will no longer be amortized but will be reviewed at least annually for impairment. Intangible assets that are

not deemed to have an indefinite life will continue to be amortized. Application of the non-amortization provisions of SFAS No.

142 is expected to result in an increase in net earnings of approximately $23 million in 2002. The company has not yet determined

the financial impact that the impairment provisions of SFAS No. 142 will have on its earnings or its consolidated financial

position. See Note 2 of the notes to consolidated financial statements.

FORWARD-LOOKING STATEMENTS

The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements made by or on behalf of

the company. Management’s Discussion and Analysis and other sections of this report may contain forward-looking statements that

reflect our current views with respect to future events and financial performance.

Certain statements contained in this annual report and other written and oral statements made from time to time by the company do

not relate strictly to historical or current facts. As such, they are considered “forward-looking statements” that provide current

expectations or forecasts of future events. Such statements can be identified by the use of terminology such as “anticipate,”

“believe,” “estimate,” “expect,” “intend,” “may,” “could,” “possible,” “plan,” “project,” “will,” “forecast,” and similar words or

expressions. The company’s forward-looking statements generally relate to its growth strategies, financial results, product development,

and sales efforts. These forward-looking statements should be considered with the understanding that such statements involve a

variety of risks and uncertainties, known and unknown, and may be affected by inaccurate assumptions. Consequently, no forward-

looking statement can be guaranteed and actual results may vary materially.

Many factors could cause actual results to differ materially from the company’s forward-looking statements. Among these factors

are: (1) competitive pressure to reduce prices; (2) the ability to gain or maintain market share in an intensely competitive global

market; (3) the success of our global strategy to develop brand differentiation and brand loyalty; (4) our ability to control operating

and selling costs and to maintain profit margins during industry downturns; (5) continuation of our strong relationship with Sears,

Roebuck and Co. in North America, which accounted for approximately 21% of our consolidated net sales of $10.3 billion in 2001; (6)

currency exchange rate fluctuations in Latin America, Europe, and Asia that could affect our consolidated balance sheet and income

statement; (7) our ability to continue to recognize Befiex credits as described in more detail in the “Other Matters” section within

Management’s Discussion and Analysis; (8) the completion of the company’s microwave-hood combination and dehumidifier recalls

and their impact on consumer preferences; (9) the effectiveness of the series of restructuring actions the company anticipates taking

through 2002; and (10) social, economic, and political volatility, including potential terrorist activity, in the North American, Latin

American, European and Asian economies.

The company undertakes no obligation to update every forward-looking statement, and investors are advised to review disclosures

by the company in our filings with the Securities and Exchange Commission. It is not possible to foresee or identify all factors that

could cause actual results to differ from expected or historic results. Therefore, investors should not consider the foregoing factors

to be an exhaustive statement of all risks, uncertainties, or factors that could potentially cause actual results to differ.

Whirlpool Corporation 2001 Annual Report 35