Whirlpool 2001 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2001 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

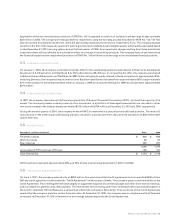

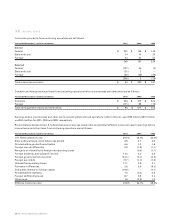

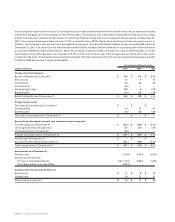

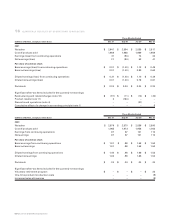

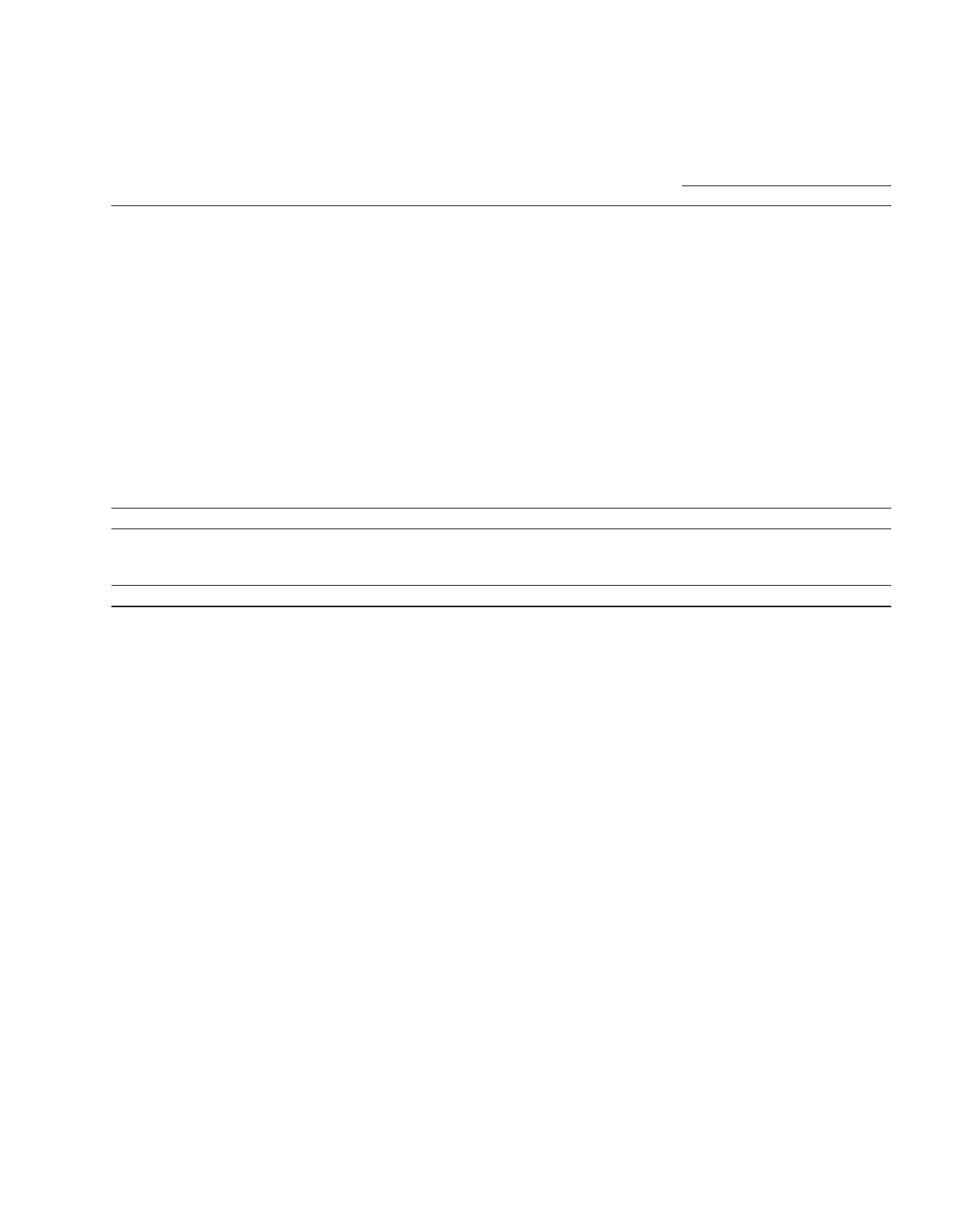

Pension Benefits (continued)

(millions of dollars) 2001 2000 1999

Assumptions as of December 31

U.S. pension plans:

Discount rate 7.50% 8.00% 8.00%

Expected return on assets 10.00% 10.50% 9.00%

Rate of compensation increase 5.00% 5.00% 5.00%

Foreign pension plans:

Discount rate 5.0 -11.3% 5.0 -11.3% 5.0 -11.3%

Expected return on assets 6.0 -11.3% 6.0 -11.3% 6.0 -11.3%

Rate of compensation increase 2.5 - 8.2% 1.0 - 8.0% 2.5 - 8.0%

Components of net periodic benefit cost

Service cost $ 61 $ 48 $ 50

Interest cost 101 101 98

Expected return on plan assets (189) (178) (127)

Recognized actuarial (gain) (36) (39) (7)

Amortization of prior service cost 11 10 9

Amortization of transition asset – (1) (1)

Net periodic benefit cost (credit) (52) (59) 22

Curtailments (1) ––

Special termination benefits 3 32 (1)

Settlements (20) (71) –

Total cost (credit) $ (70) $ (98) $ 21

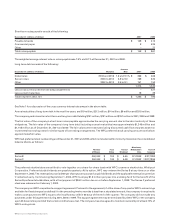

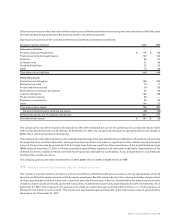

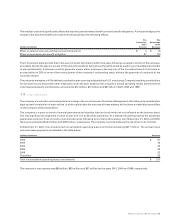

The company accounts for its defined benefit pension plans in accordance with SFAS No. 87, “Employers’ Accounting for Pensions,”

which requires that amounts recognized in financial statements be determined on an actuarial basis. A substantial portion of the

company’s pension amounts relate to its defined benefit plans in the United States. SFAS No. 87 and the policies used by the company,

notably the use of a calculated value of plan assets (which is further described below), generally reduced the volatility of pension

(credits) expense from changes in pension liability discount rates and the performance of the pension plan assets.

The most significant element in determining the company’s pension (credits) expense in accordance with SFAS No. 87 is the expected

return on plan assets. At December 31, 2001, the company assumed that the expected long-term rate of return on U.S. plan assets

will be 10.0% which is down from the assumption of 10.5% at December 31, 2000. Over the past ten years, the company’s U.S.

pension plan assets have on average earned in excess of 10.0%; therefore, the company believes that its assumption of future

returns of 10.0% is reasonable. The assumed long-term rate of return on assets is applied to a calculated value of plan assets, which

recognizes changes in the fair value of plan assets in a systematic manner over five years. This produces the expected return on plan

assets that is included in pension (credits) expense. The difference between this expected return and the actual return on plan assets

is deferred. The net deferral of past asset gains and losses affects the calculated value of plan assets and, ultimately, future pension

(credits) expense.

At the end of each year, the company determines the discount rate to be used to discount plan liabilities. The discount rate reflects

the current rate at which the pension liabilities could be effectively settled at the end of the year. In estimating this rate, the company

looks to rates of return on high quality, fixed-income investments that receive one of the two highest ratings given by a recognized

ratings agency. At December 31, 2001, the company determined this rate to be 7.5% for the U.S. plans, a reduction from 2000

reflecting the declining interest rate environment. Changes in discount rates over the past three years have not materially affected

pension (credits) expense, and the net effect of changes in the discount rate, as well as the net effect of other changes in actuarial

assumptions and experience, have been deferred in accordance with the amortization provision of SFAS No. 87.

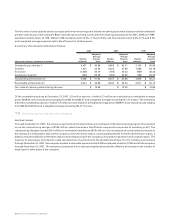

The company also sponsors a defined benefit healthcare plan that provides postretirement medical benefits to full time U.S.

employees who have worked 10 years and attained age 55 while in service with the company. The Plan is currently noncontributory

and includes cost-sharing features such as deductibles, coinsurance and a lifetime maximum. The company does not fund the

plan. No significant postretirement medical benefits are provided by the company to non-U.S. employees.

Whirlpool Corporation 2001 Annual Report 53