Whirlpool 2001 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2001 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

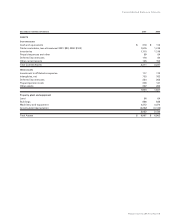

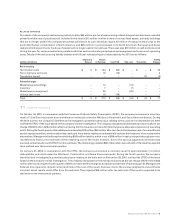

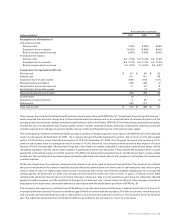

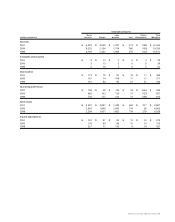

09 STOCK OPTION AND INCENTIVE PLANS

Stock option and incentive plans are accounted for in accordance with Accounting Principles Board Opinion No. 25, “Accounting for

Stock Issued to Employees,” and related interpretations. Generally, no compensation expense is recognized for stock options with

exercise prices equal to the market value of the underlying shares of stock at the date of grant. Stock options generally have 10 year

terms, and vest and become fully exercisable over a two year period after date of grant. Compensation expense related to the

company’s stock and incentive plans is recognized ratably over each plan’s defined vesting period. Expenses under these incentive

plans were $26 million, $1 million and $8 million in 2001, 2000 and 1999.

The company’s stock option and incentive plans permit the grant of stock options and other stock awards covering up to 14.2 million

shares to key employees of the company and its subsidiaries, of which 3.7 million shares are available for grant at December 31,

2001. Outstanding restricted and phantom shares totaled 1,060,000 with a weighted-average grant-date fair value of $55.35 per share

at December 31, 2001 and 770,000 with a weighted-average grant-date fair value of $50.35 per share at December 31, 2000.

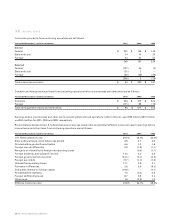

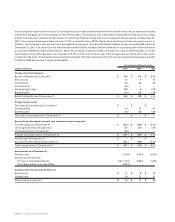

Under the Nonemployee Director Stock Ownership Plan, each nonemployee director is automatically granted 400 shares of common

stock annually and is eligible for a stock option grant of 600 shares if the company’s earnings meet a prescribed earnings formula. In

addition, each nonemployee director is awarded annually deferred compensation in the form of 400 shares of phantom stock, which

is converted into common stock on a one-for-one basis and paid when the director leaves the Board. This plan provides for the grant

of up to 300,000 shares as either stock or stock options, of which 169,000 shares were available for grant at December 31, 2001. The

stock options vest and become exercisable six months after date of grant. There were no significant expenses under this plan for

2001, 2000 or 1999.

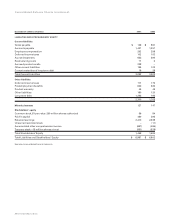

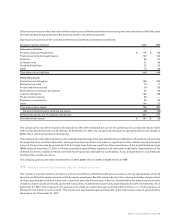

Had the company elected to adopt the recognition provisions of SFAS No. 123, “Accounting for Stock-Based Compensation,” under which

stock options are accounted for at estimated fair value, proforma net earnings and diluted net earnings per share would be as follows:

December 31 (millions of dollars, except per share data) 2001 2000 1999

Net earnings

As reported $ 21 $ 367 $ 347

Proforma 8 355 338

Diluted net earnings per share

As reported $ 0.31 $ 5.20 $ 4.56

Proforma 0.12 5.03 4.44

Whirlpool Corporation 2001 Annual Report 47