United Technologies 2011 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2011 United Technologies annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32011 ANNUAL REPORT

Our focus on operating performance in 2011 drove organic

growth across UTC, with all business segments achieving

double-digit operating margins. Most notable, Carrier

achieved its 12 percent margin goal in 2011, one year

ahead of our target. This success was the result of strong

operational focus, cost containment eorts and execution

of its business transformation strategy.

Along with strong operating performance came strong

cash generation, with cash flow from operations less

capital expenditures again exceeding net income. Strong

cash performance during the year enabled us to raise

our dividend by 12.9 percent. This year also marked the

75th consecutive year that United Technologies has paid

a dividend. Through dividend payments and share

repurchase, United Technologies returned 67 percent

of its cash flow to our shareowners.*

UTC’s long-term total shareowner return continued to

exceed that of peers and key market indices. For the period

from December 31, 2001, through December 31, 2011, UTC

delivered total shareowner return of 175 percent, more

than three times the Dow Jones industrials and more

than five times the S&P 500.

While the near-term global economic outlook remains

challenging, we look to the future with confidence. We

believe our announced agreement to acquire Goodrich,

the largest acquisition in United Technologies’ history,

marks the start of a bright new chapter for UTC and will

significantly strengthen our position in the fast-growing

commercial aerospace market. Goodrich, a leading global

supplier of systems and services to the aerospace and

defense industry, will be an excellent strategic fit with

UTC’s existing aerospace portfolio. Goodrich has a well-

established presence in areas where we do not, such

as aircraft landing gear, braking systems and nacelles.

Together, Goodrich and United Technologies will be well

positioned to provide greater value to our customers

with better, more integrated products and services for

the next-generation aircraft at a more competitive price.

Since the agreement was announced, customer feedback

has been overwhelmingly positive, and integration plan-

ning is progressing very smoothly. We anticipate closing

the transaction in mid-2012 and are excited to welcome

the Goodrich employees to United Technologies. We are

also excited about the opportunity to bring together the

complementary capabilities of our two great companies

to provide additional value to our customers.

Further strengthening our position in the commercial

aerospace market was the agreement to purchase

Rolls-Royce’s share of IAE, which produces the V2500

engine for the A320 family of aircraft. Upon closing, which

is expected in mid-2012, UTC will become the majority

shareholder of IAE. This new ownership structure positions

Pratt & Whitney for strong growth in the important single-

aisle aircraft segment, as IAE has more than 4,500 V2500

engines in service today and nearly 2,000 engines on

order. The new structure will also allow customers to

transition smoothly from the current V2500 engine to

Pratt & Whitney’s new Geared Turbofan engine for the

Airbus A320neo aircraft family.

In 2011, we also positioned UTC for long-term growth with

the announcement of significant organizational changes

that will group a number of UTC business units into new

aerospace and commercial building organizations. This new

structure will allow United Technologies to more eciently

serve our global customer base through greater integra-

tion across product lines and drive growth by taking full

advantage of technology investments and the company’s

footprint in emerging markets.

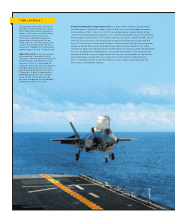

On the aerospace side, we created UTC Propulsion &

Aerospace Systems, which brings the Pratt & Whitney and

Hamilton Sundstrand businesses under a new leadership

structure. As we position ourselves for a growth phase in

the aerospace cycle, this new organizational structure will

allow us to leverage the long-term investments we have

made in aerospace systems, including systems developed

for the Boeing 787 and in the Geared Turbofan technol-

ogy. Closer coordination by Pratt & Whitney and Hamilton

Sundstrand, two world-class franchises, will also position

UTC to win increased content on next-generation aircraft

Chairman & Chief Executive Ocer Louis R. Chênevert visits

Pratt & Whitney’s manufacturing facility in Middletown, Conn.

Background at left, downtown Shanghai.

* This represents funds returned to shareowners as a percentage of a cash

flow measure we call free cash flow. We define free cash flow as cash flow

from operations less capital expenditures. In 2011, UTC generated cash flow

from operations of $6.6 billion, and capital expenditures were $983 million,

resulting in free cash flow of $5.6 billion. We returned approximately

57 percent of cash flow from operations to shareowners through dividends

and share repurchases.